Table of contents

What is Form 26QB?

TDS applies to the sale of immovable property, where the cost of sale is equal to or greater than Rs. 50,00,000 .On this transaction tax at 1% shall be deducted by the buyer while making the payment for the property and the buyer has to obtain Form 26QB.

TDS has to be deposited along with the duly-filled Form 26QB within 30 days from the month end in which TDS was deducted.

For paying TDS, the seller has to obtain Form 16B, while the buyer has to obtain Form 26QB.

PAN card is mandatory for the seller. If the seller is not able to provide the PAN card, then 20% TDS is applicable.

To make the payment of Challan 26QB from TDS Software these steps are to be followed.

- Go into Online Activities →26QB E–payment

- Here first you have to create Transferor Master by entering the required details and click on SAVE/ Update button.Multiple Transferor Master can be created using NEW button.

- In case there are more than one Transferor Master , all transferor masters will get displayed.

- To do the entry for transferee Go into→ Online Activitie →26 QB e-Payment→Transferee, Property and Payment Detail

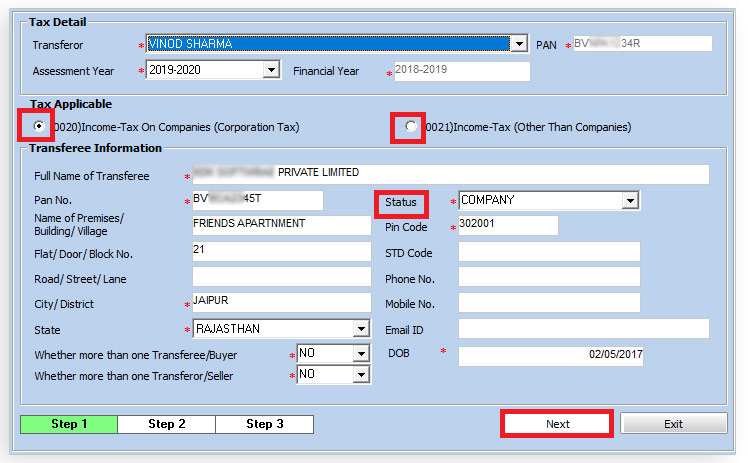

- Click on Add button to make the entries and below screen would appear.

There is three step process:

Step 1 : Select the Transferor from the drop down list ,select the category of Tax Applicability and Transferee information and fill other information’s according to the selected category , then click on “Next”

Note: Red star fields are mandatory

Step 2 Button you required to provide Property Detail and Agreement Details

For this first you need to select Type of property and fill information related to property and then enter Agreement Details and click on Next

Note: Red star fields are mandatory

Step 3: you required to feed Tax Deposit Detail, Payment Detail and Challan Detail then click on “Save /Update” button

Note: Red star fields are mandatory

Now under “Payment Detail” if Mode of Payment is E-Tax Payment immediately (Through Net banking facility ), then proceed by clicking on E-Payment Option. Click on Save / Update and Exit.

Now you required to go to E-Payment button and check the details

Software will redirect you on OLTAS website and there you need to check all the details of all pages and then you can proceed for payment on Page 4 (Payment info)

Now under “Payment Detail” if Mode of Payment is E-tax payment on Subsequent date, then proceed by clicking on Print 26QB. Click on Save / Update and Exit.

You required to click on Print 26QB

Form 26QB Challan –cum – statement will get generate.

To Request for Form 16B certificate, Online Activity option can be used.

Go into → Online Activity→ New Request→Proceed

Provide the User ID and Password then Click on Login

Software will redirect you on Traces Website.