Tips for Successful GSTR-1 Annual Reconciliation with Books: Expert Advice

GSTR-1 Reco is the regular comparison of the data of our GSTR-1 return (uploaded data on portal) and the books of account (sales register) to verify whether the books of accounts are same as GSTR-1 filed. GSTR-1 reconciliation is the process of matching two sets of data; data available in the GSTR-1 form and data available in books of accounts. Ideally, both GSTR-1 and Books data must match exactly; however, in the real world, for plenty of reasons, differences can occur. GSTR-1 reconciliation is a regular process that ensures your returns are in sync with your books. Before filing the annual return, every taxpayer must ensure the correctness and validity of their data. Regular reconciliation of GSTR-1 with the books of accounts makes it an easy task. In addition, all GST-registered businesses are mandated to preserve books of accounts, including invoices and other documents. As a result, the returns should be the reflection of our books, and any difference would lead to non-compliance.

1) How to do Reconciliation with ExpressGST

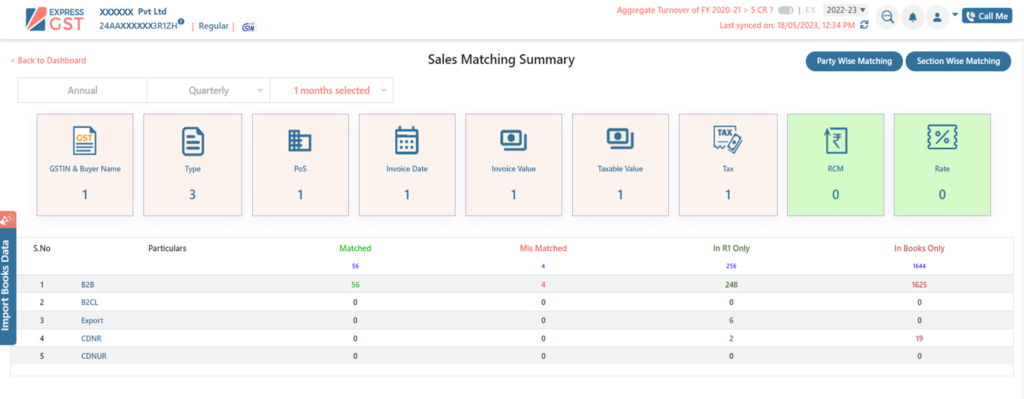

Express GST provides Annual/ Monthly/ Quarterly comparison option available for GSTR-1 and books to check on match and mismatch invoices and invoices available in R1 but not in books and vice versa.

It also includes:

- Party wise matching and Section wise matching.

- Check mismatch fields such as, GST and buyer mismatch, POS, Rate, Type, Date, Values (Invoice /Taxable), Tax, RCM.

- Identification of E invoices/ E Waybill transactions.

The manual process of GSTR-1 reconciliation is time-consuming as one needs to download the data from portal and accounts and need to go through every transaction, calculate, and then rectify when mismatches occur between the two sets of data. Express GST GSTR-1 Reco is the fastest automated way to perform reconciliation. As GSTR-1 reconciliation is a regular process, using ExpressGST does this in a smart & quick way while ensuring zero errors.

- Express GST helps automate GSTR-1 reconciliation as it fetches the bulk data from GST portal.

- Import the books data, and ExpressGST will automatically compare filed GSTR-1 data.

- The software highlights the mismatches in shortest time, thereby saving hours and efforts.

- With this it becomes easier for users to identify mismatches as per books and GSTR-1 and if required can correct the books to avoid any discrepancy in future while preparing annual returns and audit of books of accounts

- Users will get information of E-Invoices/ E-Way Bill generated within ExpressGST and actual sales invoices yet to be generated via E-invoicing or to be uploaded on GST portal.

2) 2A & 2B Reconciliation with Purchase Register (Annual/Quarter/Monthly)

In this reconciliation GSTR2A/ 2B of a tax period is compared with the purchase register data. This is done to claim 100% Accurate in-time ITC, so that excess and undue tax payment is avoided. It happens when the purchase invoice is not considered by the supplier while filing GSTR-1 or it is missed to capture in the accounts purchase register.

Reconciliation is done to ensure that the ITC claimed by the tax payer matches with the ITC available on portal as declared by their suppliers in their GSTR-1 returns. In simple words, client will only be able to claim ITC if the related purchase invoice is present in GTR2B. Here are a few reasons why GSTR2A/2B reconciliation is important for Businesses:

- To avoid ITC loss.

- Claiming excess credit or incorrect values.

- Notice from GST department.

- Avoid duplicate or ineligible ITC.

- Identify habitual default suppliers.

How ExpressGST helps is GSTR2A/2B Reconciliation.

Express GST provides the following features in Reconciliation of ITC

- Actionable emails to all suppliers with default: User can send actionable mails to all default suppliers indicating them to file their GSTR-1 as soon as possible so that he can claim his input credits on time, if already uploaded then supplier can check if any mismatch in the amount uploaded as result of which client fails to claim correct ITC. This mail consists of 6 reports:

- Invoices not found in 2A/2B statement.

- Invoices with mismatch in taxable and tax amount

- Invoices in 2A but not in 2B

- ITC eligibility conflict

- RCM Conflict

- POS conflict

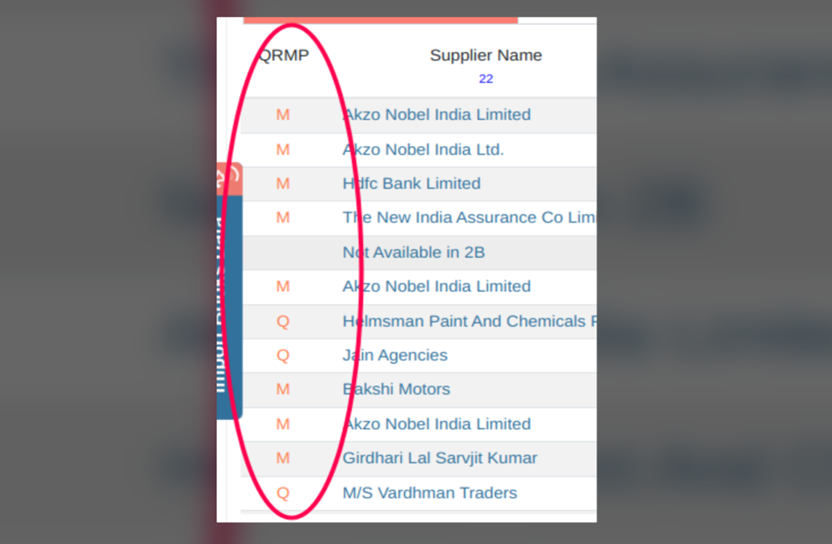

- 2A/2B reconciled report provides return filling status of all suppliersof all months for GSTR-1 and GSTR3Bin one single sheet. User not only get the filling frequency but also he gets detail status of each invoice uploaded by his supplier and he can claim ITC accordingly

- The amount of data/ no of invoices does not impact the speed of reconciliation. ExpressGST does the fastest reconciliation.

- Additional column to show QRMP (Filing Frequency) details for the FY. Click on the text, to get quarter wise details.

Reconciliation from Express GST have its unique benefit and user must ensure that he performs reconciliation at regular interval as he gets following features:

- Avoid duplication and correct declaration of books.

- No ITC loss on any invoices and in-time claim in 3B returns.

- Maximising input credits

- Claiming correct ITC and avoiding ITC which are ineligible.

- Helps to find invoices that have errors.

- Helps to ensure the GST payment is done timely and accurately, preventing overpayment or underpayment of GST.

- The reconciliation also ensures you claim ITC once, preventing you from paying penalties due to incorrect practices.

- Identify probable matches.

- Use the intuitive design of reconciliation report easily.

- View reconciliation status summary and its download into excel.

3) ITC Tracker:

Every taxpayer must furnish the GST returns in Form GSTR-3B. Where the goods are received in lots or instalments, ITC will be allowed to be availed when the last lot or instalment is received. The buyer must pay towards the supply of goods and/or services within 180 days from the invoice date. Input Tax Credit means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business. The input tax credit avoids double taxation. In addition, the ITC eliminates the cascading effects of taxes. If the supplier has not filed their GSTR-3B return, the details of their tax paid on supplies made will not be available to the recipient, and hence the recipient will not be able to claim ITC on such supplies.

Many conditions are there to claim ITC before the last date passes. An Indian enterprise must verify the ITC details before claiming it in Form GSTR-3B for a tax period. It involves regular reconciliation of GSTR-2B with books of accounts. Further, it requires frequent follow-ups with suppliers who have not reported tax invoices or debit notes. All these require a robust and smart solution that requires the least manual effort.

Express GST ensures that your GSTR-2B data is fetched without manual intervention. The advanced reconciliation engine matches data between books and GSTR-2B to identify gaps, with the option to define custom matching logic and claim 100% ITC in GSTR-3B.

Express GST also allows users to annually reconcile ITC across financial years for accurate preparation of GSTR-9 and GSTR-9C.

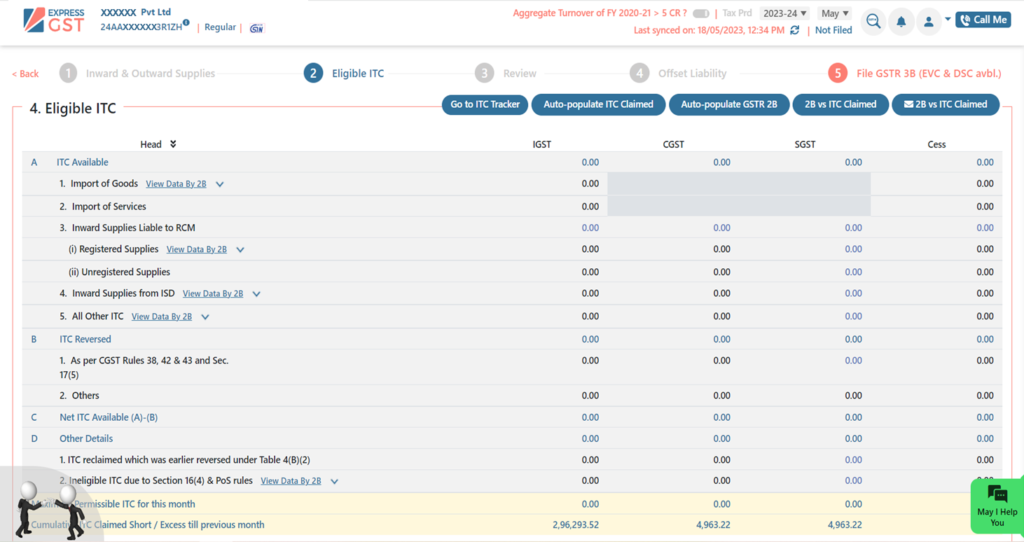

In respect to above, GSTR 3B comes with ITC tracker to keep a track on all such ITC. ITC tracker is an end-to-end enterprise solution for maximising the claims of the input tax credit. ITC tracker has exclusive features to improve your input tax credit claims with value additions as it provides,

- Set auto ITC button to set the actual ITC available from Books and 2B on invoice level

- It gives 6 options while claiming ITC: Accepted books, Accepted 2B, Pending, Rejected, New value and Action required.

- Email functionality to download the ITC claimed report in excel

- Party wise ITC claimed as well.

Express GST Benefit:

ITC tracker tool in Express GST helps client to claim correct and actual ITC rather than claiming maximum and incorrect ITC. User can decide upon whether he need to claim entire ITC available as per his 2B statement or to check with his books and then claim such ITC which is relevant and pertaining to his business only, the tools gives different check points to users helping him in his 3B ITC claim amount

- Steps to check any ITC which is ineligible due to delay in filling GSTR-1 or incorrect POS mentioned in returns by suppliers.

- RCM whether available or not can also be checked.

- Acceptance of any ITC related to PY years and also attaching valuable remarks for future reference.

- Rejecting ITC at the initial stage to avoid any duplicacy.