Demystifying 26AS: Your Ultimate Guide to Financial Knowledge

The Income Tax Return (ITR) is a form used by taxpayers to file information about their income and tax with the tax authorities. It is a document that taxpayers need to submit annually, declaring their earnings, deductions, and exemptions. The purpose of filing an ITR is to calculate the tax liability, if any, and to provide a summary of one’s financial transactions throughout the year.

What is AIS?

The Income Tax Department has introduced the Annual Information Statement (AIS) as a significant and improved method, serving as a tool for taxpayers to provide comprehensive information about their financial activities. It is a consolidated document that lists various financial transactions of a taxpayer, such as TDS (Tax Deducted at Source) details, TCS (Tax Collected at Source) information, any advances in taxes, and other relevant details.

The primary objective of AIS is to supersede the detailed breakdown of a taxpayer’s income and transactions, enabling them to view it conveniently and in a consolidated manner. It provides taxpayers with a means to furnish information to the government securely and transparently, ensuring compliance with tax regulations. AIS plays a crucial role in offering a holistic overview of a taxpayer’s financial engagements, allowing them to navigate through their economic activities efficiently.

This initiative by the Income Tax Department is aimed at simplifying the process for taxpayers, replacing the need for multiple documents with a single, comprehensive statement. By presenting various financial details in one place, AIS facilitates a clearer understanding of an individual’s financial landscape. Moreover, it serves as a valuable resource for taxpayers to ensure accurate reporting and compliance with tax laws.

In summary, AIS is a transformative approach by the Income Tax Department, streamlining the provision of financial information for taxpayers and promoting a more accessible and consolidated view of their economic activities.

How is the information in AIS structured?

The information in the AIS (Annual Information Statement) is structured through various processes to ensure the consolidation and presentation of diverse financial transactions and tax-related details in a unified and straightforward document. The structure of the information included in AIS can be outlined as follows:

Source of Income

The AIS incorporates primary sources of income such as salary, interest, dividends, and other sources. This section assists in presenting a clear overview of the taxpayer’s total income.

Details of Tax Deductions

This section may include details of Tax Deducted at Source (TDS), Tax Collected at Source (TCS), advance tax payments, or any other tax deductions associated with the taxpayer’s liabilities.

Income from Various Sources

This section provides a breakdown of income from diverse sources, such as interest earned, gains from various investments, dividends, and other income sources.

Tax-Related Information

Here, tax-related information such as tax savings, advance tax payments, and other relevant details may be included. This section is crucial for understanding the taxpayer’s tax liabilities and payments.

General Information

This section may contain general information about the taxpayer, including name, address, and PAN (Permanent Account Number). This information helps in uniquely identifying the taxpayer.

The structure of AIS is designed to present a comprehensive summary of a taxpayer’s financial situation. By categorizing information into these sections, AIS offers a consolidated view that aids taxpayers in understanding their financial position. This streamlined structure is essential for both taxpayers and tax authorities, ensuring that the information is presented in a standardised and accessible format.

In conclusion, the structure of AIS involves systematically organising information about various financial aspects, income sources, tax deductions, and general details of the taxpayer. This structured approach enhances clarity and simplifies the understanding of a taxpayer’s financial status, making it a valuable tool in the tax reporting process.

How to download AIS?

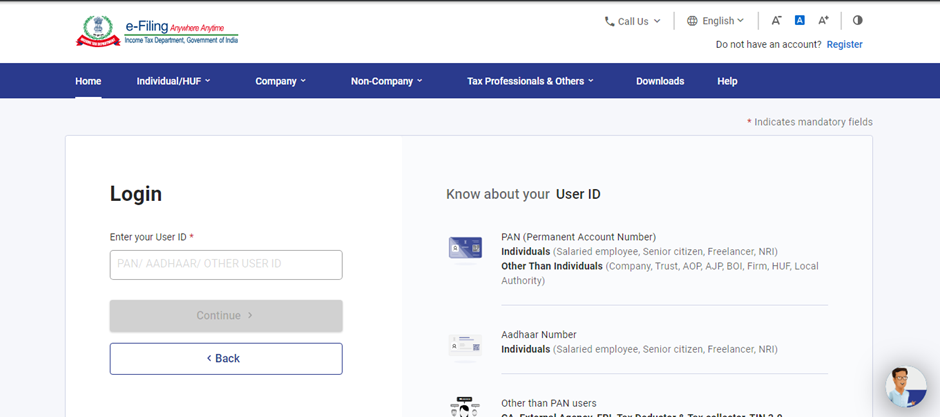

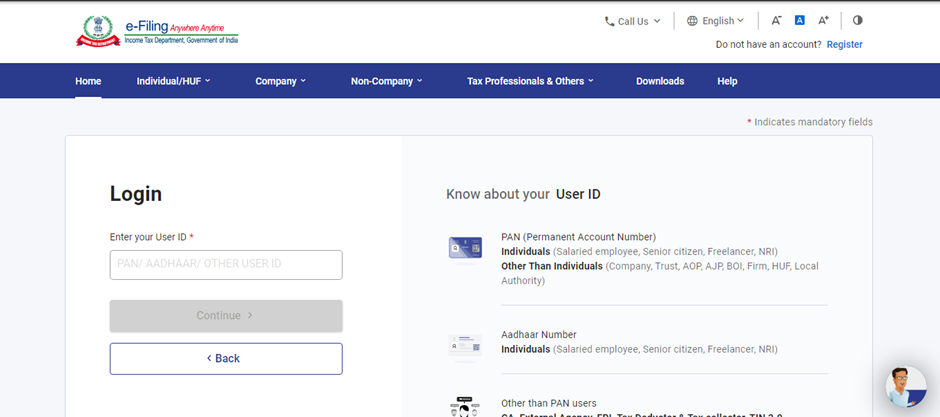

First, go to the Income Tax website and log in.

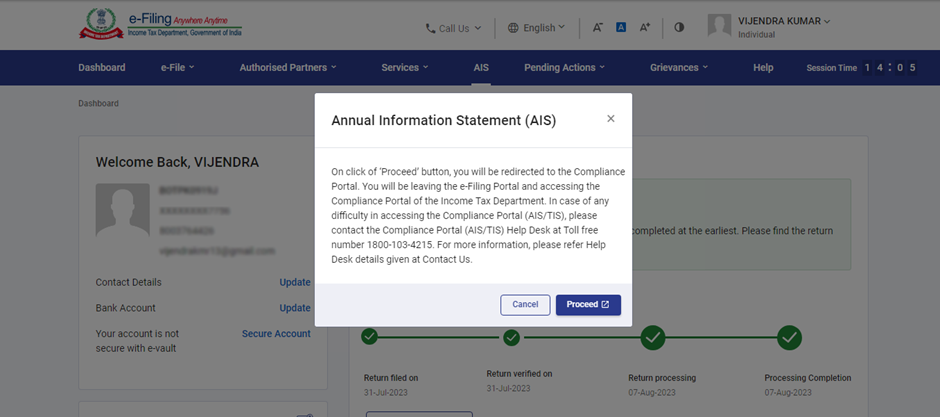

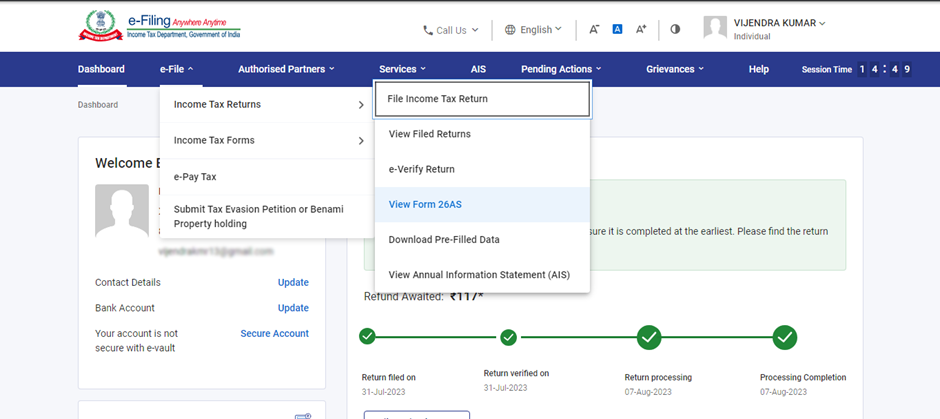

After logging in, click on the AIS tab and proceed.

Now, select the financial year and click on AIS information, after which you can download the AIS form.

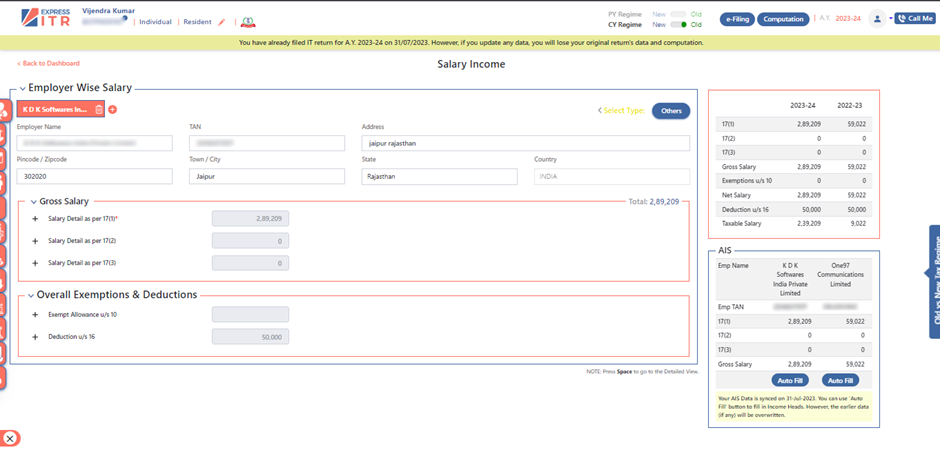

With ExpressITR, no need to download, as it will get AIS details automatically.

If you are using ExpressITR, you don’t need to manually import or download AIS. Express ITR automatically fetches AIS data into the software. For example, if your salary data is in AIS, you will get an auto-fill option with the Salary Head. When you click on autofill, the data is instantly filled in that head of income.

When you go to any head of income, you will find the AIS option there. If the data for that head of income is in AIS, clicking on AIS will give you an auto-fill option. Upon clicking auto-fill, the data for that head of income will be filled automatically.

For the same process, if you are using the portal, first you need to log in, then manually download AIS. But if you use Express ITR, there is no need to do all this because here, all the data is auto fetched, saving you a lot of time. This is the biggest benefit of using ExpressITR.

What is 26AS?

Form 26AS, which is the Annual Tax Statement, is an important document that provides Indian individuals and businesses with a summary of their fiscal transactions. This document reflects a comprehensive overview of business events that occurred during a fiscal year, which individuals use to file their Income Tax Returns (ITR). It is unique to each individual based on their Permanent Account Number (PAN) and is maintained by the Income Tax Department.

Significance of Form 26AS

TDS (Tax Deducted at Source) Information

The most crucial section of Form 26AS is dedicated to TDS transactions. It shows how much tax has been deducted from an individual’s income. Every transaction made by employers, banks, and other deductors is consolidated in this record.

TCS (Tax Collected at Source) Details

TCS transactions are also displayed in this document. If an individual has engaged in a high-value transaction for goods or services that attract TCS, these details will be included.

Advance Tax and Self-Assessment Tax Payment Information

It indicates how much tax an individual has paid in advance or during self-assessment. This helps individuals understand how much refund they may receive or how much more they need to pay.

Refund Status

Form 26AS includes the individual’s income tax refund status, providing information on the progress of the refund process.

Details of High-Value Transactions

If an individual has undertaken high-value transactions during a fiscal year, such as property transactions, these details are also included.

AIR (Annual Information Return) Transactions

AIR transactions, which include cash deposits, credit card payments, mutual fund investments, etc., are also part of Form 26AS.

Details of Tax Credits

Form 26AS shows the tax credits available in the individual’s account. This information helps individuals reduce their taxable income by utilizing their tax credits.

How to View Form 26AS

Individuals can view their Form 26AS by visiting the official website of the Income Tax Department and logging in with their PAN number.

After logging in, clicking on “View 26AS” will redirect you to the TRACES website, where you can download your Form 26AS in either PDF or text format.

Here, one important thing to note is the amount of time consumed when downloading AIS or 26AS from the portal or any other utility. If the number of clients is substantial, your entire day could be spent just downloading these documents.

Keeping in mind the value of your precious time, ExpressITR helps you with this. With ExpressITR without wasting any time, you can instantly and accurately obtain AIS and 26AS in the software, without any additional processes..

Just like the way AIS is auto-fetched in the software, similarly, the data for 26AS is also automatically fetched in the software. There is no need for you to manually download or import it.

When you go to the Tax details section, you will automatically see the data for 26AS, or you can click on AIS/26AS-Tax Paid to append or overwrite the data. This is quite beneficial for you because there is no need for manual work, and the time that was being spent on downloading 26AS and then manually filling in the data will be saved here.

In addition to 26AS and AIS, Express ITR has several other features that will prove to be quite beneficial for you:

Complete Cloud base Solution:

In Express ITR, you can file all types of income tax returns, from ITR-1 to ITR-7, making it a comprehensive cloud-based solution.

Simplifying Client Creation:

You can easily create single or multiple clients in multiple ways with Express ITR. Whether you want to create a single client or add multiple clients at once, it’s extremely easy. Whether you prefer bulk import using Excel or creating multiple clients through the Auto Scan feature, all of this can be done with just a few clicks.

Automatic Data Fetching:

Express ITR automatically fetches relevant financial data, including AIS and 26AS, reducing the need for manual input and saving valuable time.

User-Friendly Interface:

The software offers a user-friendly interface, making it easy for individuals to navigate and complete the tax filing process efficiently.

Real-time Data Validation:

Express ITR performs real-time data validation, minimizing errors and ensuring that the entered information aligns with the latest tax regulations.

Auto-Fill Options:

The software provides auto-fill options for various heads of income, making it convenient for users to populate their details accurately.

PAN Insights:

In PAN Insights, you get to see all the details about your client that are necessary for the working of the return. You don’t need to ask your client or go to the portal to see these details one by one. The software displays all the essential information on a single page, streamlining the working process.

Integration with GST portal:

In the income tax return, you are required to show the turnover from GST, which you usually check by logging into the GST portal.

However, ExpressITR is integrated with the GST portal, & it will automatically fetch your turnover from the GSTN portal, displaying it for you in the software.

Json import facility without download:

If you need to prepare a computation from JSON, you typically have to log in to the portal, download the JSON, and then import it to prepare the computation. This process of downloading and importing the JSON can be lengthy and time-consuming.

In Express ITR, you get a single-click option to upload the JSON, eliminating the need to download the JSON separately. With just one click, you can import the JSON and prepare the computation in a matter of seconds.

Some graphical view with comparison data:

In the software, you get a graphical comparison not only of income vs. tax but also of head-wise income and tax breakup. This feature can be quite helpful for analysing and interpreting the data effectively.

Integrating 10IE filing with ITR:

In the new tax regime, opting for Form 10-IE upload is required. However, if you are using Express ITR, there is no need to manually upload Form 10-IE. The software automatically uploads Form 10-IE during the return filing process.

Comparison between the New Regime and Old Regime:

After preparing the return, the software will show you a comparison between the new tax regime and the old tax regime. You can see the benefits for yourself and make decisions accordingly.

ExpressITR helps you with 26AS & AIS Data fetching automatically and work on ITR Returns.

Related Posts

How to calculate and generate the Advance Tax Challan

Meet your client’s expectation with #KDKGST

Go for #KDKGST a complete cloud based #Invoice to #GST #ComplianceSolution for #Tax #Professionals & #SMBs

About The Author

KDK Software

KDK is one of the Oldest name in Tax Compliance be it Income Tax, TDS or GST Software. KDK software is the preferred choice of Tax Practitioners and Corporates for their Tax Filing requirements. KDK Softwares founded in the year 2006, has become a Prominent Brand name in the Taxation / Tax Filing Industry.