Table of contents

This feature allows the user to view transactions related to above in DETAIL in the computation report.

1. Process to view and print details in computation report:

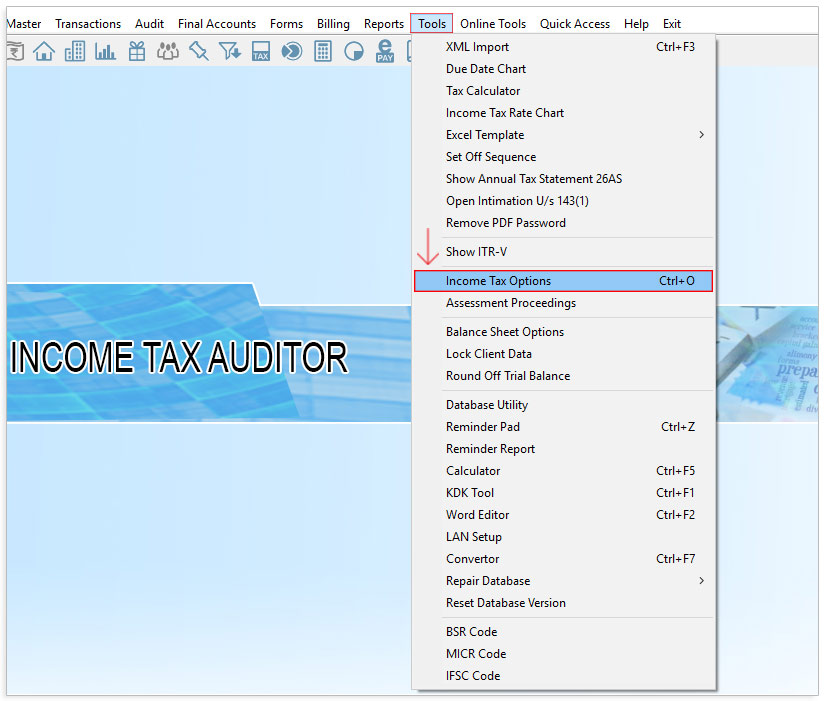

- Open the Income Tax Auditor Software – Go to Tools → Income tax Options given in the menu bar

- Now check mark on Point number 1 “Show Bank details in computation“

2. Process to view Capital Gain Statement in the computation report

- Check mark on Point number 2 “Show Statement of Capital gain in computation“

3. Similarly to view NSC/KVP Detail in the computation report

- Check mark on Point number 3 “Show NSC/KVP Detail in computation“

4. To view TDS detail in the computation report

- Check mark on Point number 4 “Show TDS details in computation“

This option helps to print detailed information related to the option on which check mark is done like Address details, Footer, Header, GST No., Mobile number, e-Mail ID, etc. in the computation report.