Discover The Quickest Route For Your E-Way Bill Generation

Do you transport goods within your state or across different states in India? To comply with the GST law, you will need a new electronic document in order to transport your goods – The E-Way Bill.

What is an E-Way bill?

An E-Way bill is an electronic document which contains details of the supplier and the transporter for a shipment. This document should be generated for any supply, as well as under certain other conditions.

“Why do I have to create an E-Way bill when I already have an invoice for all the goods being transported?” you might ask. The E-Way bill was introduced mainly to track the proper movement of goods being transported across India, and also to reduce tax evasion. As per the GST law, an E-Way bill is required to be carried for the movement of goods exceeding Rs 50000 in value (the limit differs state to state).

Whenever you want to ship items, you will have to create both your regular document (such as an invoice) and also an E-Way bill for the items to be shipped.

The E-Way bill is divided into two parts:

- Part A – Details of the recipient, the required document and the transporter

- Part B – Details of the transport vehicle

The Process

Normally, to transport goods that require an E-Way bill, you will need to:

- Create an invoice for the items you’re going to ship

- Convert the invoice into JSON File

- Upload the JSON File to the EWB portal

- Enter EWB details

- Generate an E-Way bill for the items

How can the Express Way Bill Software help you with the E-Way bill generation?

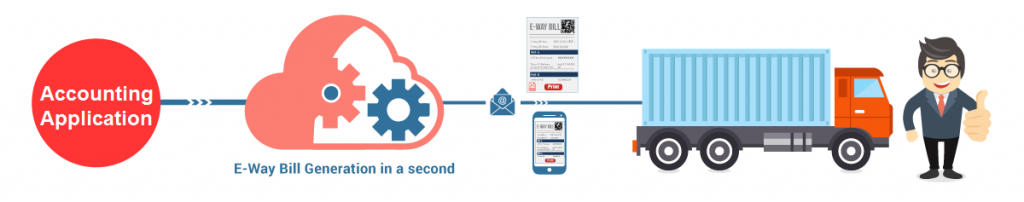

With Express Way Bill Software, you can compress all of the steps required for generating an E-way bill into one single step: generating your E-Way bill directly from your Accounting Application in just “1 Second“

Every time you create an invoice in your Accounting Application for goods to be shipped, you can add the E-Way bill details and generate the corresponding E-Way bill. These details will then get directly synced with the EWB portal.

To ship goods requiring an E-Way bill through Tally, you will simply have to register Alankit Limited as your GST Suvidha Provider in GST Software and create an invoice in Tally for the items to be shipped. Then you can add your E-Way bill details and generate your E-Way bill.

And Voila!

Your E-Way bill details will automatically be synced with the EWB portal. Want to know the detailed process of generating E-Way Bill through Express Way Bill Software?

Stay Tuned to know more about it!!

Quick Summary of the above blog

- What is an E-Way Bill?

- Why one has to create an E-Way Bill?

- The E-Way Bill parts?

- What is the Traditional process of generating an E-Way bill?

- How can the Express Way Bill Software help in the e-way bill generation?

Quickest Route For Your E-Way Bill Generation

Generate E-Way Bill In Just 1 Second

Start Free Express Way Bill Trial

( No Hidden charges)