At KDK Software, we are constantly striving to make GST compliance as seamless and efficient as possible for our users. In line with this commitment, we are excited to announce a new powerful feature in ExpressGST. These updates are designed to provide you with more comprehensive data access and streamlined processes, ensuring you stay ahead in your GST compliance journey.

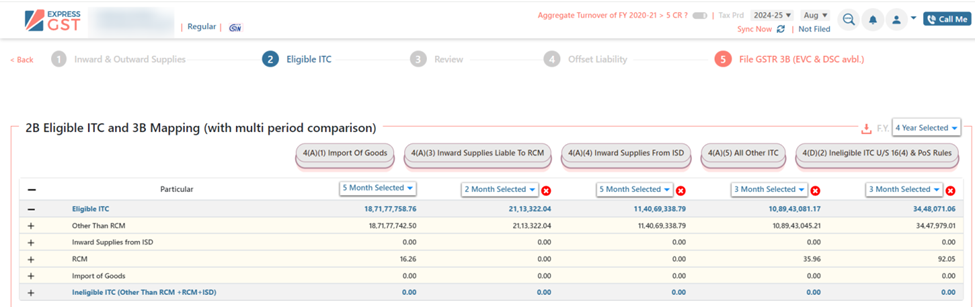

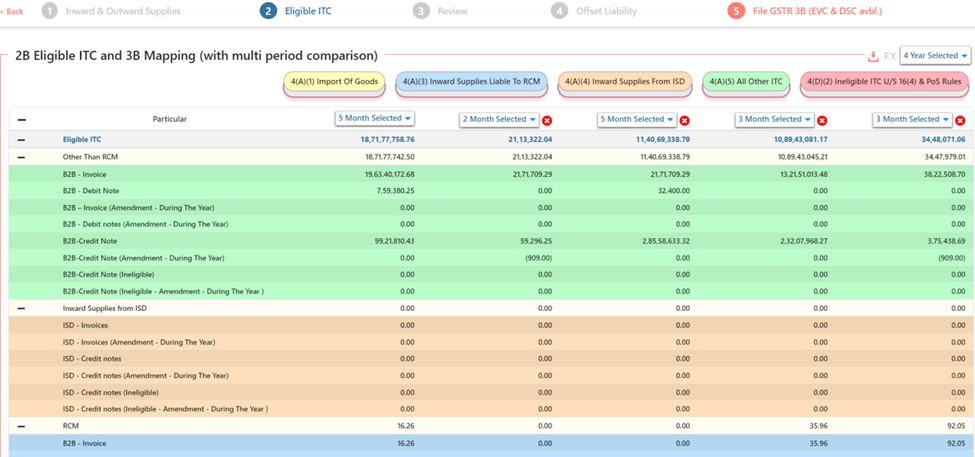

One of the key aspects of GST compliance is managing Input Tax Credit (ITC) accurately. With our latest feature update, you can now download the complete transactional data of 2B eligible ITC, including 2B itemised ITC Transactional Details.

How to Access:

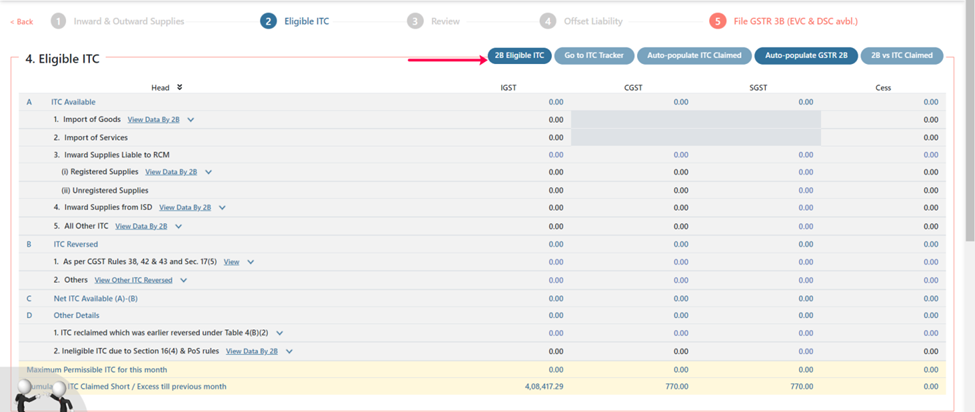

- Navigate to: 3B >> Eligible ITC >> 2B Eligible ITC

- Download the detailed ITC transactional data in a user-friendly format

Step 1: Navigate to: 3B

Step 2 – Navigate to: >> Eligible ITC

compact view

Step 3 – Navigate to: >> 2B Eligible ITC

Detailed view, multi-month and multi-year

This enhancement ensures you have all the necessary information at your fingertips, making it easier to verify and reconcile your ITC claims. Whether you need to conduct detailed audits or generate reports, this feature will save you significant time and effort.