Table of contents

- How to prepare notes of accounts and significant accounting policies for non-company cases?

- For Notes of Accounts

How to prepare notes of accounts and significant accounting policies for non-company cases?

The disclosure of accounting policies is particularly important in situations where an organisation chooses to follow policies that are generally being used within its industry. By pursuing these policies, the investment community gets a better understanding about the ways in which the accounting policies are used when could alter the reported financial results and financial position of an entity. The policy summary can include policies from a broad range of operational and financial areas, including cash, receivables, intangible assets, asset impairment, inventory valuation, types of liabilities, revenue recognition, and capitalized costs.

To prepare “Significant Accounting Policies” please follow the steps provided below:

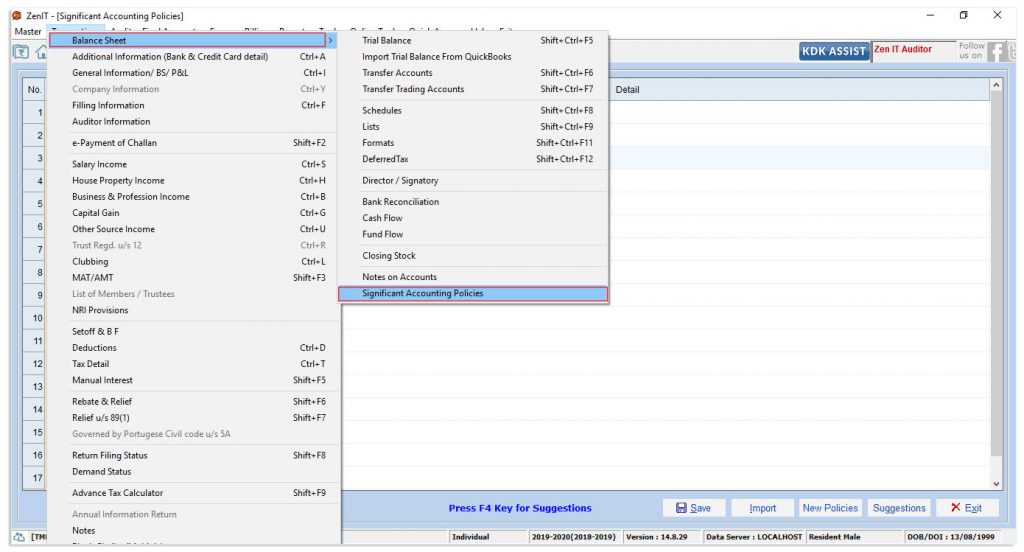

Step 1 :– Open the Income Tax Software, Go to Transactions → Balance sheet →Significant Accounting Policies option given in menu bar.

Step 2: Here, User is required to enter details for Significant Accounting Policies

Step 3:

- If the user is required to add any other suggestion then he has to Click on Suggestions→New → type your suggestion and then save it.

– To select the suggestion click F4 and then select the suggestion

Step 6: – To Generate Significant Accounting Policies Report, Go to Reports → Balance Sheet Report→Significant Accounting Policies

For Notes of Accounts

Step 1: Open the Income Tax Software ,Go to Transactions → Balance sheet → Notes of Accounts option given in menu bar.

Note: The line items highlighted in grey are notes of accounts applicable only in case of a Company.

Step 8: If Required to enter detail, double click on notes of account in the given list.

Step 8: To Generate Notes of Accounts Report, Go to Reports → Balance Sheet Report → Notes of Accounts