Table of contents

What is Schedule Asset and Liabilities and when it is applicable?

Income Tax Department has section AL from A.Y. 2016-17 called Asset and Liability ,Schedule AL ,in ITRs which is applicable in cases where the total income exceeds Rs 50 lakhs.

This article talks about Schedule AL or Asset and Liability In the ITR.

For an individual ,Schedule AL, is available in the forms such as ITR-2 and ITR-3

Where to enter Schedule AL in the Income Tax Software?

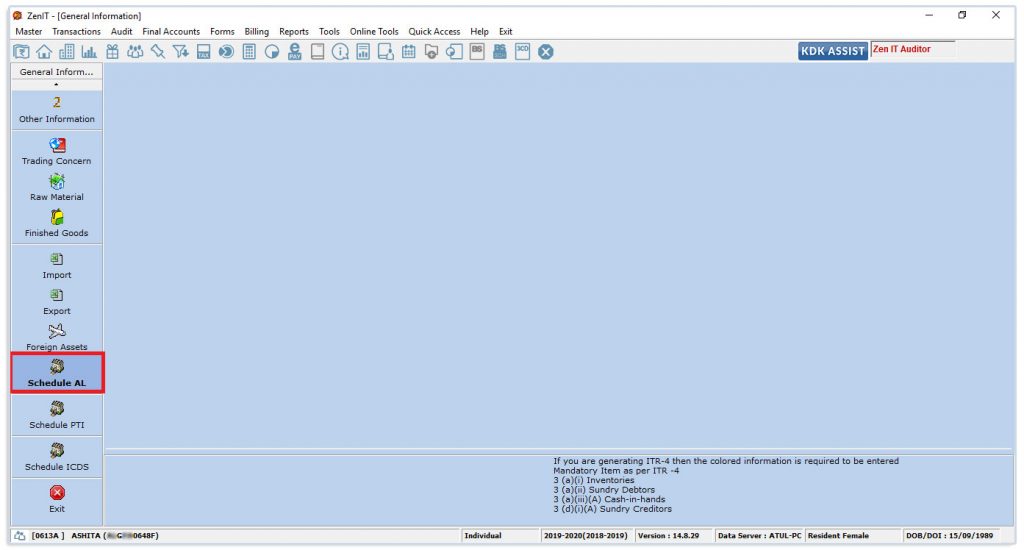

Step 1 : Go into Transactions → General Information /BS/P&L → Schedule AL

Step 2: Click on the given tab to enter the data.

Note: ITR-1 can not be filed in the case where the total income exceeds Rs 50 lakhs. Hence ITR 2/3 will be applicable.