As per NSDL, TDS Return guideline and RPU Return flow, it is not possible to adjust multiple challan with one dedcutee entry.

Possible solution is user can bifurcate deductee entry in two parts and adjust the same with each challan.

Example

If there are two challans amounting Rs 9000 and 1000 and the user wishes to adjust them with TDS 10000 deduction entry, then in that case follow the steps suggested below:

Step 1

- ADD challan entry

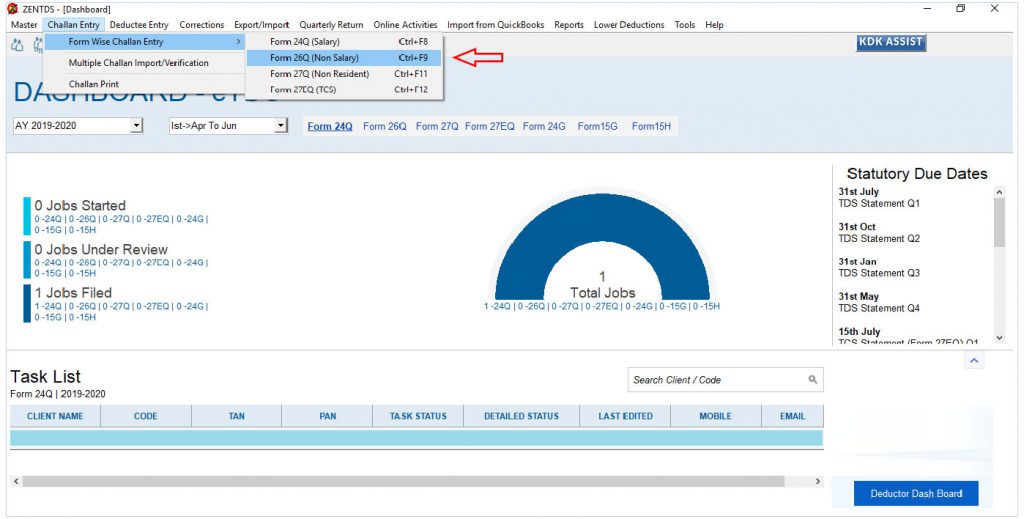

Go to Challan Entry → Form Wise Challan Entry → Select receptive form type

Add the two challans:

Step 2

Now, bifurcate the deductee entry in two parts viz amount paid and tds deduction amount with respect to challan payment and adjust with each challan.

For example, if there is one payment made, amounting to Rs 1,00,000 and TDS deduction is Rs 10,000, then in this case the user has to create the entry in two parts,

- First amount paid Rs 90000 and TDS deduction Rs 9000

- And second amount paid Rs 10000 and TDS deduction 1000

- Date of Payment/ Credit and Date of deduction should remain same in both the entries.

Now, go to Deductee entry → Form wise entry → Select receptive form type