Table of contents

- FY 2019-20 & FY 2018-19 for both individual and corporate taxpayers

- To calculate and generate the Advance Tax Challan, please follow the steps provided below:

Any person having an estimated tax liability of Rs. 10,000 or more in a year is required to pay tax in advance. Advance tax applies to all the taxpayers, salaried, freelancers, and businesses. Senior citizens, who are 60 years or older, and do not run a business, are exempt from paying advance tax.

This payment of tax in advance and in instalments is known as advance tax payment

FY 2019-20 & FY 2018-19 for both individual and corporate taxpayers

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th June | 15% of advance tax |

| On or before 15th September | 45% of advance tax less advance tax already paid |

| On or before 15th December | 75% of advance tax less advance tax already paid |

| On or before 15th March | 100% of advance tax less advance tax already paid |

For taxpayers who have opted for Presumptive Taxation Scheme under section 44AD & 44ADA – Business Income

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th March | 100% of advance tax |

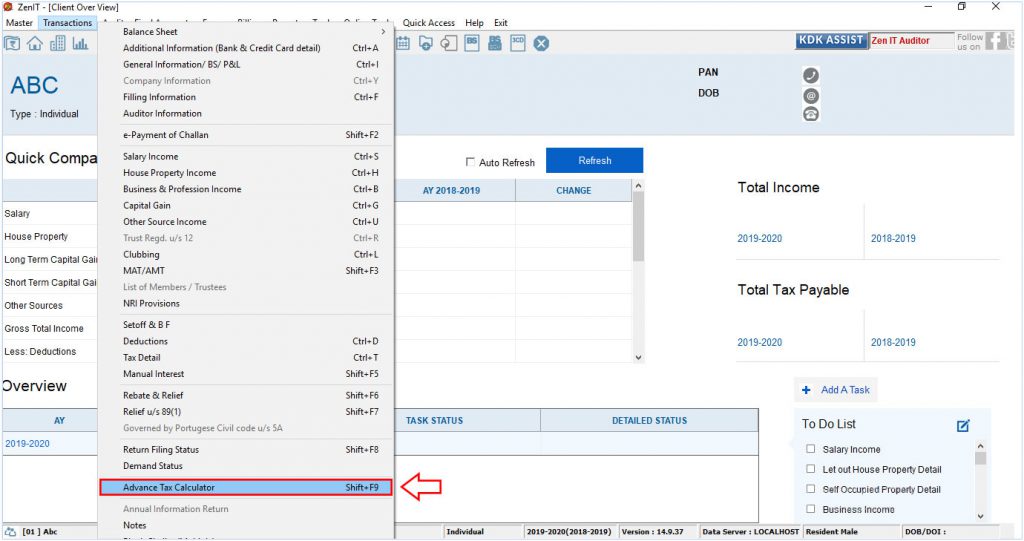

To calculate and generate the Advance Tax Challan, please follow the steps provided below:

Step 1:

Open the Income Tax software – Go to Transactions → Advance Tax Calculator option given in the menu bar

Please check whether correct assessment year is selected on the main window of the software.

For AY-2020-21 Advance Tax Calculation:

1. Salary income has to be entered after standard deduction.

2. Long term capital gain u/s 112A has to be entered in LTCG Proviso after 1 Lac Rs.Exemption.

Step 2:

Select Assessment Year

- Put Income detail

- Click on calculate Tax

Step 3:

Now Click on Challan Button to prepare Advance Tax Challan.

Step 4:

- Select Instalment

- Select Payment Mode

- Click on Save and Print Challan