Table of contents

A flow is being suggested for entering the information under section 44AD, AE, ADA Business in case of ITR 4 filing

Information is required to be filled under the following sections:

- Balance sheet

- Profit & loss account

- Business & profession head

- Nature of business

1. Steps to be followed: For Balance sheet

In case of 44 AD / AE OR ADA following columns as highlighted in the screen shot below are required to be filled in the Balance Sheet.

Note : Mandatory fields for filing ITR-4

2. Steps to be followed: For Profit & Loss account

Note: There is no option provided to enter details in the P&L by the department in ITR 4. Hence, there is no requirement to feed the P&L in the software.

3. Steps to be followed: For Business and profession head

Go into Transactions → Business and Profession Head → select point 6 /7 /8 according to your Business .

Note: Do not enter any data in point 1 (Add/ Modify) tab

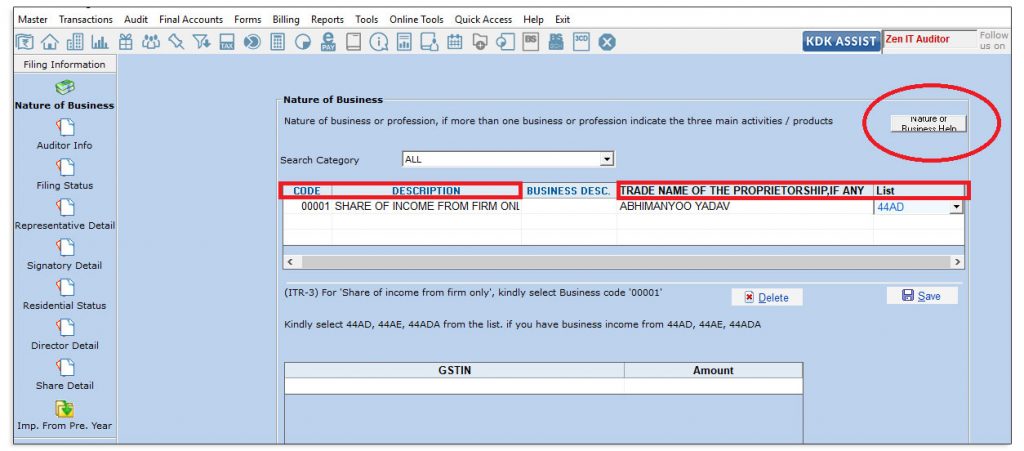

4. Steps to be followed: For Nature of business

Go into transactions → Filling information → Nature of business

Here, the nature of business has to be selected according to your presumptive section, either falling under 44 AD /AE or ADA

In the Nature of business table, following mandatory points are required to be entered:

- Code

- Description

- Trade Name

- List

Note: If you are facing any difficulties to select the nature of business then you can access the

help file given above for the nature of business table in the name of “Nature of business help”.