ITR-6 Form is exclusively used by companies which are not claiming exemption under section 11 (Income from property held for charitable or religious purposes) while filing their Income Tax Returns with the Income Tax Department of India.

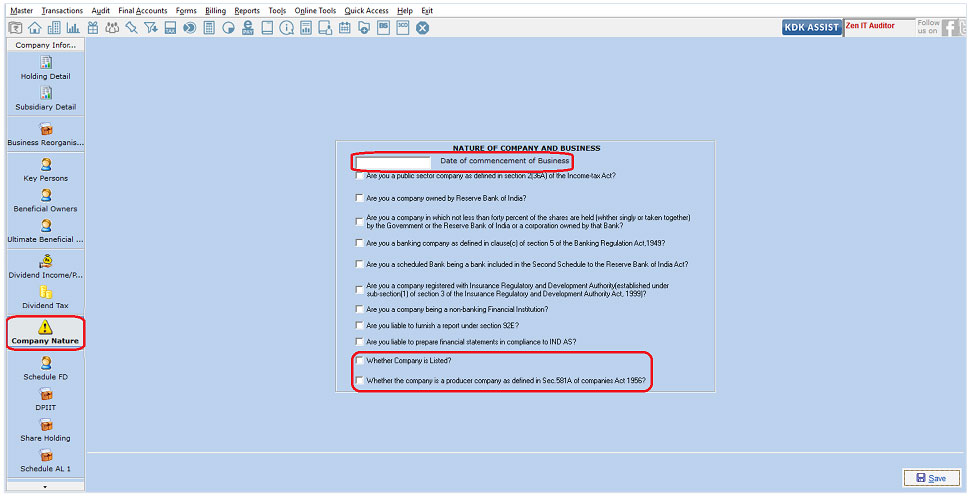

The Nature of Company and Business has to be specified as per applicability for

- Date of Commencement of Business

- Whether the Company is Listed

- Whether the Company is a Producer Company as defined in Sec.581A of companies act 1956

To provide the above details, Go to → Transactions → Company Information → Company Nature

Few Major changes have been made for Assessment Year 2019-2020 in the ITR 6:-

- Schedule SH-1 – Shareholding of Unlisted Company

If you are an unlisted company, please furnish the following details in respective columns of this Schedule:

- The details of shareholding as on 31st March, 2019.

- The details of share application money pending allotment as on 31st March, 2019

- The details of shareholder who did not have a shareholding as on 31st March, 2019 but have had a shareholding during the financial year 2018-19.

Following path is required to be followed for Schedule SH-1

Go to → Transactions → Company Information → Share Holding

- Schedule AL-1 Assets and liabilities as at the end of the year:

If you are an unlisted company, please furnish the details of assets and liabilities of the company in the respective items of this Schedule (AL1_A, AL1_B, AL1_C, AL1_D… and so on to AL1_J)

Following path is required to be followed for Schedule AL 1

Go to →Transactions → Company Information → Schedule AL 1

- DPIIT:- In case you are a start-up, please indicate whether you have been recognised as a start-up by the Department for Promotion of Industry and Internal Trade (DPIIT). Under this the Schedule, SH-2 and Schedule AL 2 are applicable.

Path to DPIIT: –

Go to →Transactions→ Company Information → DPIIT

NOTE: – The Share Holding for Start-Up (Schedule SH-2 ) Assets and Liabilities for Start up (Schedule AL 2) would be applicable only if there is a check mark on “Whether declaration in Form-2 in accordance with para 5 of DPIIT notification dated 19/02/2019 has been filed before filing the return?” option.

- Schedule SH-2 – Shareholding of Start-ups (who have filed declaration in Form-2 with DPIIT)

In case you are a start-up and you have filed declaration in Form-2 with the Department for Promotion of Industry and Internal Trade (DPIIT), for seeking exemption from the provisions of section 56(2)(viib) of the Income-tax Act, before filing of the return of income, please furnish the following details of shareholding of the company in the respective columns of this Schedule:

- The details of shareholding as on 31st March, 2019

- The details of share application money pending allotment as on 31st Instructions to Form ITR-6 (A.Y. 2019-20) Page 44 of 66 March, 2019.

- The details of shareholders who did not have a shareholding as on 31st March, 2019 but had a shareholding during the financial year 2018-19.

Following path is required to be followed for Schedule SH-2

Go to → Transactions → Company Information → Share Holding

- Schedule AL-2 – Assets and liabilities as at the end of the year (for start-up which has filed declaration in Form-2 with DPIIT only)

In case you are a start-up and you have filed declaration in Form-2 with the Department for Promotion of Industry and Internal Trade (DPIIT), for seeking exemption from the provisions of section 56(2)(viib) of the Income-tax Act, before filing of the return of income, please furnish the details of assets and liabilities of the company in the respective items of this Schedule (AL2_A, AL2_B, AL2_C, AL2_D… and so on to AL2_I)

Following path is required to be followed for Schedule AL 2

Go to→Transactions → Company Information → Schedule AL 2

NR Case (NON-RESIDENCE)

In case of an NR Company (Foreign Company), below details are to be furnished:

In case you are a foreign company, please provide following particulars in respect of your immediate parent company and the ultimate parent company as suggested below: –

- Name

- Address

- Country of residence

- PAN (if allotted)

- Taxpayer‟s registration number or any unique identification number allotted in the country of residence.

Path: Go to → Transactions → Company Information → Parent Company Immediate

Go to → Transaction → Company Information → Parent Company Ultimate