This feature is a newly introduced feature in the Income Tax Auditor which helps the user to send Reports, Computation and ITR-V to the client. This feature also allows the user to get the copy of the aforesaid reports saved in the local system.

Process to activate this feature

Note: Computation, 3CD, 3CB, ITR-V, 56F, 56G (PDF Format) are sent to the client & are auto saved in the folder – KDK Data.

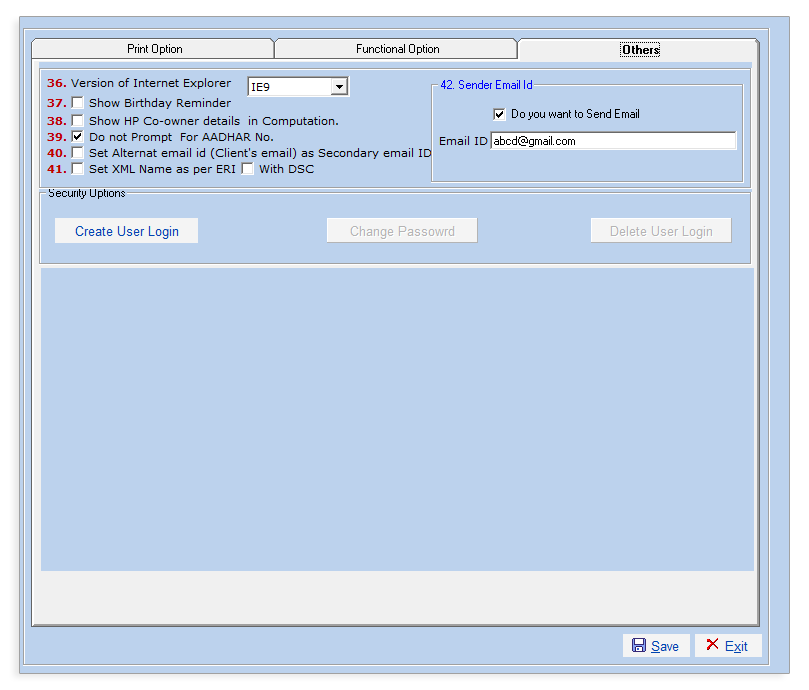

- Go to Income Tax Auditor → Tools → Income tax options → Others → point 42. Sender email ID.

- Enter the Email ID from which emails are required to be sent.

When this option is saved and the very next time a Computation is generated, an option would be made available wherein an email could be sent to the customer.

If PDF is to be sent to the client directly:

- Generate the computation ( PATH :- IT Auditor → Forms → Computation ) of the client and then click on Email Computation option available on the left-hand side panel.

- Once clicked on “Email” a message would appear. Click on “YES” to send the mail from Sender’s mail ID entered at Income tax option to the Client’s mail id entered in the Client Master and then automatically the Computation PDF gets saved at “C:\KDK Data\Zen IT ” folder“.

- In case you do not want to send the email to the client, you may click on “NO” option so that the computation gets saved at “C:\KDK Data\Zen IT” folder.

- Generate the 3CB report ( PATH :- IT Auditor → Audit → Tax Audit → New 3CD W.E.F 20/08/2018 ) of the client and then click on “E-mail Report” option available at the bottom of the screen.

- Generate the 3CD report ( PATH :- IT Auditor >> Audit >> Tax Audit >> New 3CD W.E.F 20/08/2018 ) of the client and then click on “Yes” option.

- Generate the ITR V (PATH :- Income Tax Auditor → Online Activity→ Upload XML ITR → My Return ) of the client and then click on “Email ITR V” option available on the bottom left part of the screen.

- Generate the 56 F report (PATH:- Audit → Tax Audit → Form 56F ( FTZ, FPZ, EPZ ) of the client and then click on “Email Report” option available on the bottom area of the screen.

- Generate the 56G (PATH:- Audit → Tax Audit → Form 56G(100% EOU) report of the client and then click on “email Report” option available at the bottom of the screen.

NOTE:- the default email ID used to send the mail is “falconadmin@kdksoftware.com“