Table of contents

Important Notes in case of Presumptive Income (44AD / 44AE / 44ADA) who cannot file ITR-4

- Income from more than one house property; or

- Income from winning of lottery or income from Race horses; or

- Income taxable under section 115BBDA; or

- Income of the nature referred to in section 115BBE; or

- Income under the head “Capital Gains”, e.g. Short-term capital gains or long-term capital gains from sale of house, plot, shares etc.; or

- Agricultural income in excess of 5,000; or

- Income from Speculative Business and other special incomes; or

- Income from an agency business or income in the nature of commission or brokerage; or

- Person claiming relief under section 90, 90A or 91; or

- Any resident having any asset (including financial interest in any entity) located outside India or signing authority in any account located outside India; or

- Any resident having income from any source outside India.

If any of the condition specified above is fulfilled than you can’t generate ITR-4.

Now, If the Software is suggesting e-ITR-3 instead of e-ITR-4, Please follow the below solution:

Solution :

Step 1:

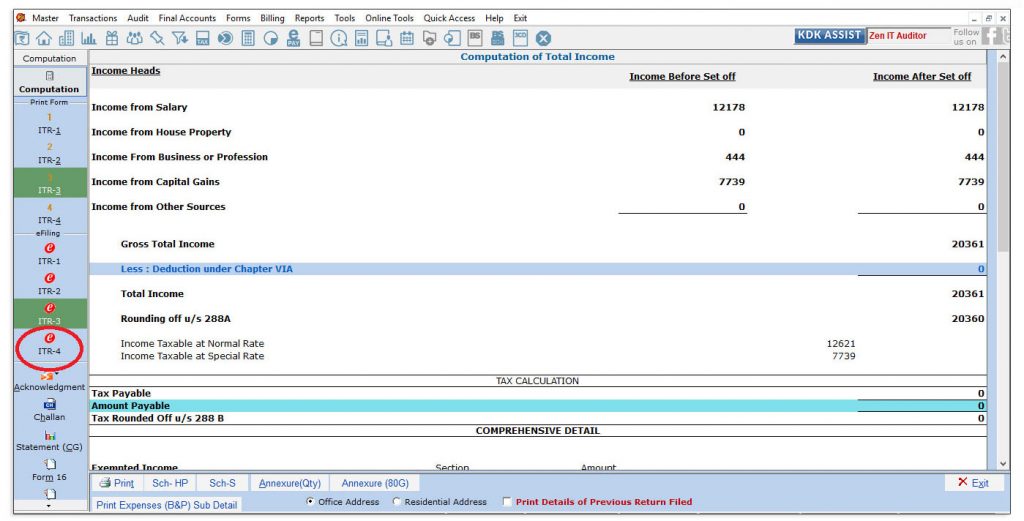

Go to Forms → Computation → and click on e-ITR-4 → software will guide you why you cannot file e-ITR-4.

Depending upon the Validation, if any data is entered mistakenly in software for above conditions than you can delete the same.

for example: If you enter capital gain income and try to generate ITR-4 then software will show the below massage.

Please correct the same to generate e-ITR – 4.

If all the conditions as mentioned above are fulfilled and yet the e-ITR-4 is not getting highlighted for XML file generation, then follow step 2.

Step 2:

Go to Transaction → Additional Information (Bank & Credit Card detail) → remove check mark on “Whether Audit is Required?” and Save the details.