Table of contents

- Introduction to Section 112A – Income Tax on Long Term Capital Gain

- Impact with the amendment in Section 112 A

- Steps to import the Capital Gain template from software.

Introduction to Section 112A – Income Tax on Long Term Capital Gain

Vide Finance Bill 2018, the Government has come up with an insertion to section 112A under the Income Tax Act, 1961. The new section 112A has been inserted in order to levy long-term capital gain tax on the transfer of equity share, units of equity oriented funds and units of the business trust.

Impact with the amendment in Section 112 A

With effect from 1st April, 2018, provisions of section 10 (38) will not be applicable to any income arising from transfer of equity share, units of equity oriented funds and units of business trust.

From 1st April, 2018, provisions of section 112A shall be applicable to tax income arising from transfer of equity shares, units of equity oriented funds and units of business trust.

To enter the details for Capital Gain income on equity share, units of equity oriented mutual funds and units of the business trust follow the below given path:

Go into transactions → Capital Gain Head → select Type of asset equity/ preference share or equity oriented mutual funds or units of the business trust.

There is no requirement to enter ISIN code if you add a single consolidate entry for all the transactions made during the year.

For enter a single consolidated entry a user required to check mark the path as highlighted in the image below.

Tools → Income tax options → Others do check mark on Point 43 ( Do not generate 112A schedule in XML file )

IF you want to do separate entries and number of capital gain entries are huge in numbers then you can export the CG excel Template given in the software and feed the data in that Template.

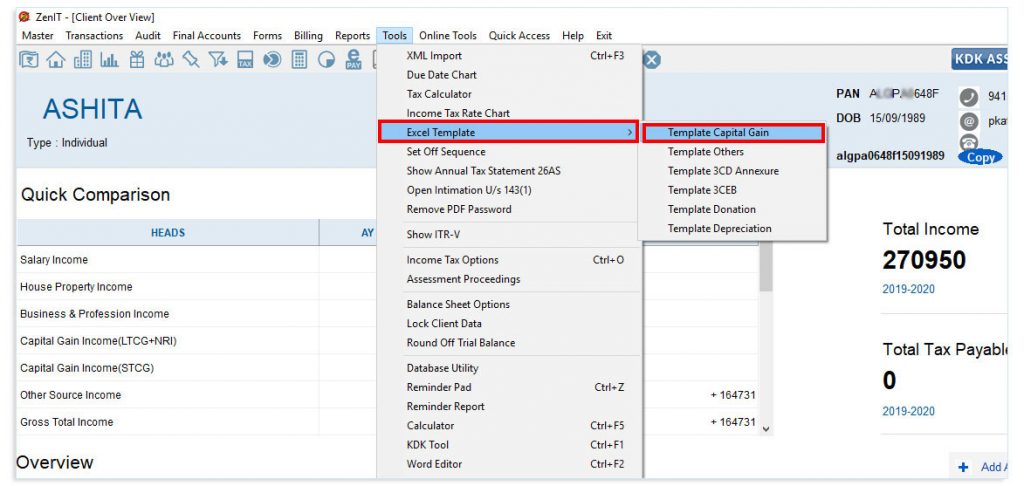

To export the Template Go into → Tools → Excel Template → Template capital Gain

Steps to import the Capital Gain template from software.

Go into transactions → Capital Gain head → Select Type of Asset as equity / preference share or equity oriented mutual funds→ Import from Excel

option will get enabled. It is mandatory to mention transaction type before importing the excel sheet and transaction type.Also the excel sheet should be match with transaction type.

Click on “Yes” and browse the saved excel template.

You can recheck your entries from “View summary” option on the bottom of the screen.

Note: Mandatory fields for excel import in case of separate entries :

- Description

- Date of Sale

- Date of Purchase

- Sale Consideration

- Purchase cost

- STT Paid

- Listed/Unlisted

- Indexation Required

- STT Purchase

- Sale Consideration from buyer

- no of shares

- Sale price per share

- ISIN Code

- FMV per share