What to do when the Income Tax Software does not suggest any ITR form in the case of an Individual?

Income Tax Software has a feature that suggests which ITR has to be submitted depending upon the details entered under specific income heads such as Salary, House Property, Business, Capital gain, etc. Sometimes it happens where the software does not suggest any ITR due to unavailability of properly punched data. One such case where user would face this type of issue is where there are Brought forward losses or Set-off.

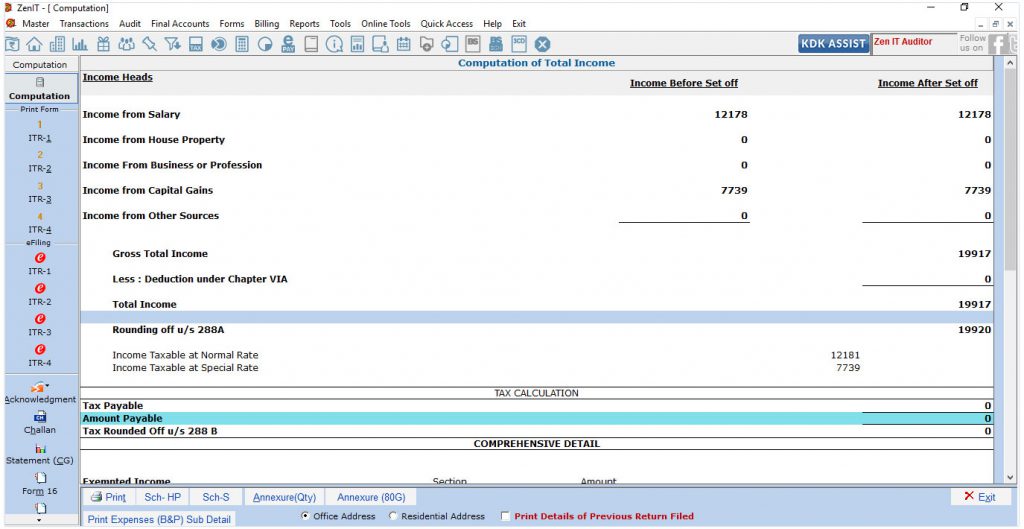

As per the below Screen, the data has been entered for Salary head and Other source Income, but the software is not suggesting neither ITR-1 nor ITR-2.

Solution to the above:

Step 1

Go to Forms → Computation → Click on e-ITR-2

Reason why ITR- 1 or ITR 2 are not being selected would be suggested by the software.

Step 2

To check the same, Go to → Transactions → Set off & B F

Step 3

In case if the Business Brought Forward losses are available, the ITR to be generated is ITR-3 So proceed below to enter the data for Nature of business.

Go To Transaction → Filing Information → Nature of business.

Once the details for Nature of Business are and and saved, the Computation then generated would indicate ITR- 3 in Green Color for XML file generation and Submission.