Table of contents

- How to calculate interest on late deduction and deposit in e-TDS Software

- To Calculate interest on challan payment where detail/transaction is not entered in software,

How to calculate interest on late deduction and deposit in e-TDS Software

Interest on late deduction and late deposit of TDS/TCS is applicable at the rate of 1% and 1.5 % per month respectively.

- Here, 1% rate is applicable from the date on which tax was deductible to the date of actual deduction,

- 1.5% rate is applicable from the due date of deposit to the date of actual deposit.

To Generate Interest on late deduction report,

Please follow the steps provided below: –

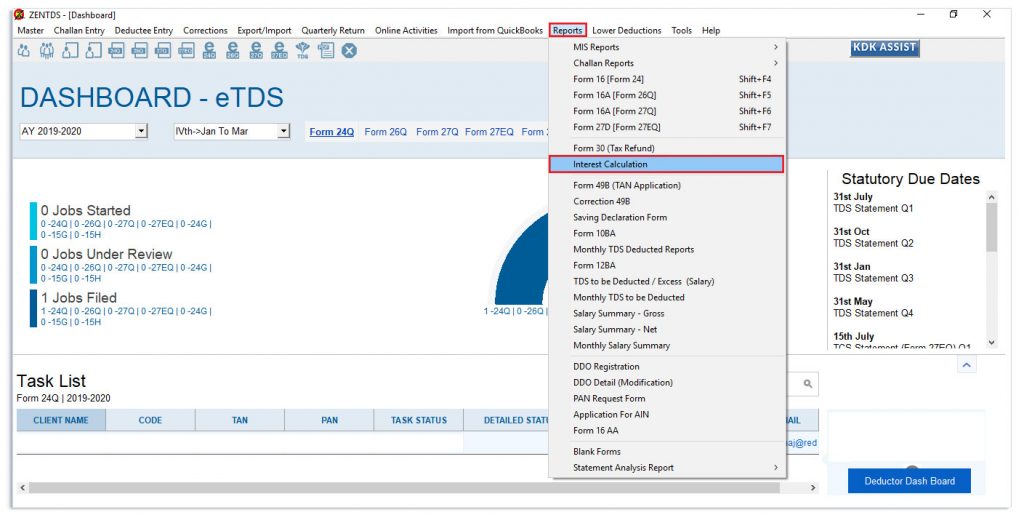

Step 1: Open the e-TDS software Go to Reports → Interest Calculation option given in menu bar

Step 2: Now select form type (Form 24, Form 26, Form 27 and Form 27EQ) and click on calculate button

Step 3: Now, check the Interest calculation detail for the respective Form Type

Step 4: User can also download and take print of this report by clicking on ‘Print‘ Button to generate Interest Calculation Report in word format

Note – The interest report generated is based on existing details in salary and other than salary entered in software.

To Calculate interest on challan payment where detail/transaction is not entered in software,

please follow the steps provided below: –

Step 1 : Open the e-TDS software, Go to Tools→Challan Interest Calculator option given in menu bar

Step 2 : Now select section, Month, TDS amount, and click on calculate

Once you click on calculate, the amount of interest on challan payment will be shown under ‘Interest amount‘.