Deadline for FY19 Non-Fraud GST Notices Ends December 31

Under the Goods and Service Tax (GST), the authorities communicate to the taxpayers via GST notices and orders. There are various reasons for the issue of the different types of notice under GST, which every taxpayer should know. GST notices under the Goods and Service Tax (GST) are issued by the tax authorities to individuals or companies when there is a perceived violation of the GST law or a discrepancy in the returns filed. The purpose of these notices is to bring the matter to the attention of the individual or company and to give them an opportunity to respond and rectify the situation. GST notices are usually sent as a word of caution for any defaults noticed by authorities, specifically in GST compliance, or to collect more information from taxpayers.

GST authorities mainly send out notices when taxpayers operate suspiciously and when there is any supply of goods or services which does not occur under the tax lens. Upon verification of the taxpayer’s GST returns, authorities act according to the hints collected by them, received from another governmental department, or a third party.

The common reason for receiving a notice from the GST department is defaults committed on the taxpayer’s part, including no GST registration made even when the law requires, delayed or no GST returns filed, excess claim of Input Tax Credit (ITC), unpaid GST, short GST payment, etc.

Common Reasons for issue of GST Notice & orders

- Difference in amounts of ITC claimed in GSTR 3B as compared to GSTR 2A.

- Delay in filing GSTR-1 and GSTR-3B consecutively for more than six months.

- The Input Tax Credit is wrongly availed or utilized.

- For furnishing any information related to records to be maintained by a taxpayer.

- When tax authorities have to conduct an audit.

- When any additional information is required by authorities related to the records maintained by the taxpayer.

- When any additional information is required by authorities related to the records maintained by the taxpayer.

- Where information return was required to be furnished before tax authorities, but not submitted within the time limit stipulated.

To Be Continued…

Types Of Notices & Orders

| Name Of Notice and forms | Description | Time Limit for Response |

| STR 3A | Default notice for taxpayers who have not filed GST returns in GSTR-1, GSTR-3B, GSTR-4, or GSTR-8 | 15 Days from the date of Receiving the Notice |

| CMP-05 | Show Cause Notice (SCN) questioning the taxpayer’s eligibility to be a composition dealer.. | 15 days from the date of receiving the notice |

| REG-23 | SCN asked for justification as to why the cancellation of taxpayers’ GST registration should be revoked for the reasons mentioned in the notice. | 7 working days from the date of receiving the notice |

| PCT-03 | SCN for the GST practitioner’s misconduct. | Within the time prescribed in the SCN |

| RFD-08 | SCN asks why GST should not be refunded to the taxpayer. | 15 days from the date of receiving the notice |

| DRC-01 | SCN was issued for demanding unpaid or shortly paid tax with or without fraudulent intention. Served along with a detailed statement in DRC-02. | 30 days from the date of receiving the notice |

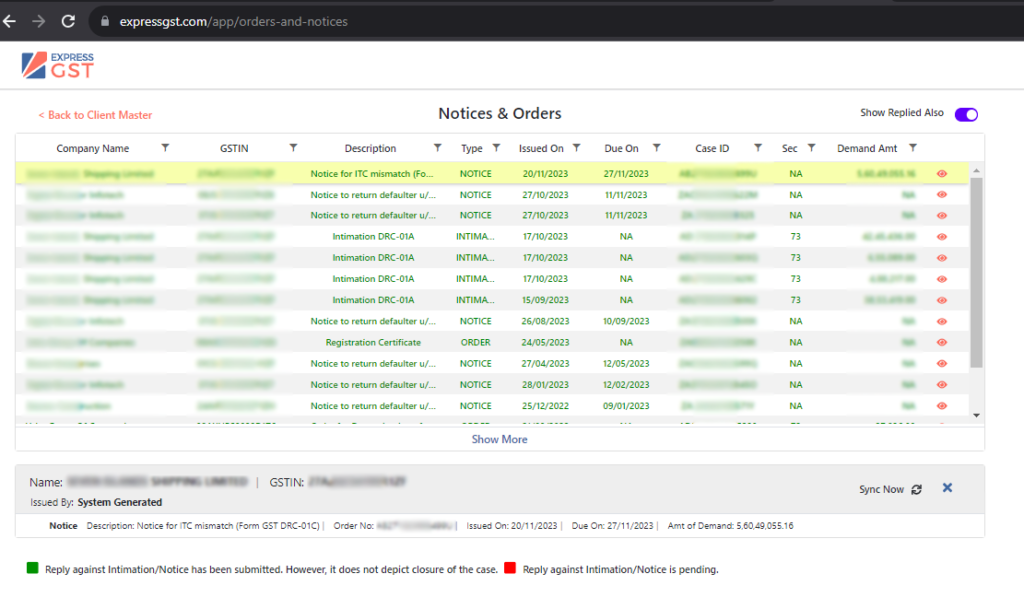

Notice & Orders by Express GST

ExpressGST gives you a bird’s-eye view of all Notice / Orders & Replies of all GSTINS. All GSTINs added by you in the ExpressGST, it will show you in the notice and order dashboard.

Along with this, you can download and see all notice(s), you can also download and see the reply made to it. You will get to know that you replied against particular notice & orders.

Benefits to ExpressGST Users

- There is no chance to miss any notice or order: ExpressGST gives you a bird’s-eye and a detailed view of all the notices and orders in GST.

- Easily download and view the notices: Through this feature, the user can easily download the notices and orders.

- View all the replies and download: Through this feature the user can see & download replies given against particular notices and orders.

- Replied and Non-replied Notice status in different colors: Through this, the user easily gets to know which notice’s reply is given and which notice’s reply is pending.

Discover the features that make GST compliance seamless:

✅ Instant access to your entire GST notice history.

✅ Effortless reconciliation of GSTR1/3B with your accounting records.

✅ Generate detailed 3B reports in Excel format.

✅ Automated update emails for 2A and 2B to keep clients informed.

✅ Easily segregate personal expenses from ITC.

✅ Flexibility to shift ITC inputs to the following month.