What is UDIN?

Unique Document Identification Number (UDIN) is a unique number generated on the UDIN Portal for every certificate and other such documents that have been attested by a Chartered Accountant who’ve registered themselves on the portal.

The Institute of Chartered Accountants of India (ICAI), has developed a method of securing the documents issued by a Chartered Accountant by issuing a Unique Document Identification Number (UDIN).

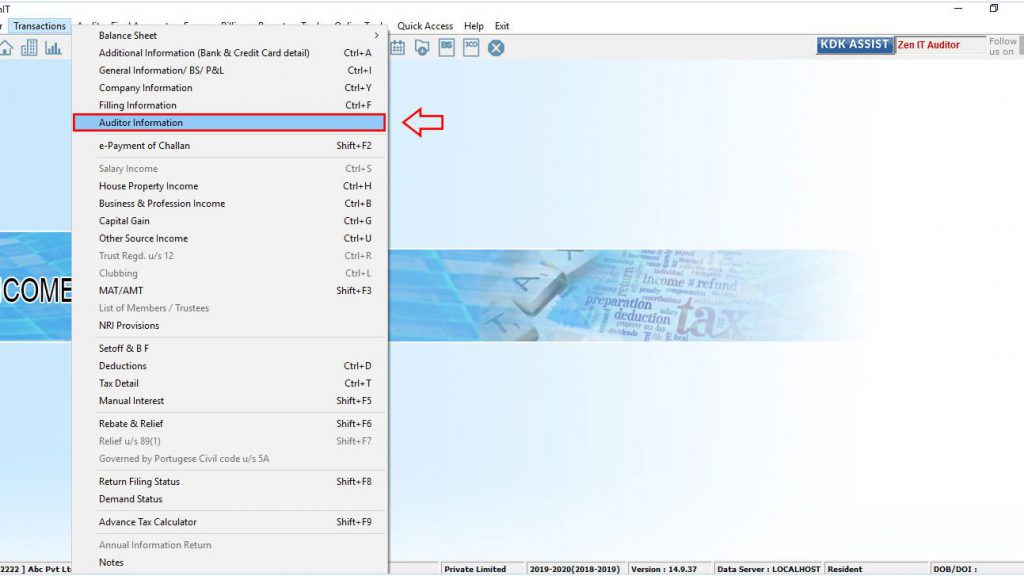

To Feed UDIN Number, please follow the steps provided below.

Step 1:

Open the Income Tax Software – Go to Transactions → Auditor Information option given in the menu bar

Step 2:

Now mention UDIN Number – for Tax audit

Company Audit Information: For Company Audit Case and CARO.

UDIN Reference:

Step 3:

To check with UDIN , check the Tax Audit report details for the respective Form Type (3CA/3CB).

Go to Audit → Tax Audit → New 3CD W.E F 20/08/2018

For Company Case

Audit → Company Audit→Caro.

Note – UDIN Number will not reflect in XML as presently NO PLACE / OPTION available IN Department UTILITY (FY 2018-19) FOR UDIN Number.