The new income tax return forms (All ITR’s except ITR 1 ,4 and 6) for the assessment year 2019-20 come with a set of changes where more detailed disclosures have been asked by the taxpayer. If you have held unlisted equity shares during the

previous year then you have to report the same in the Income tax return .

As per the new changes introduced, an assesse is required to fill details in the following path.

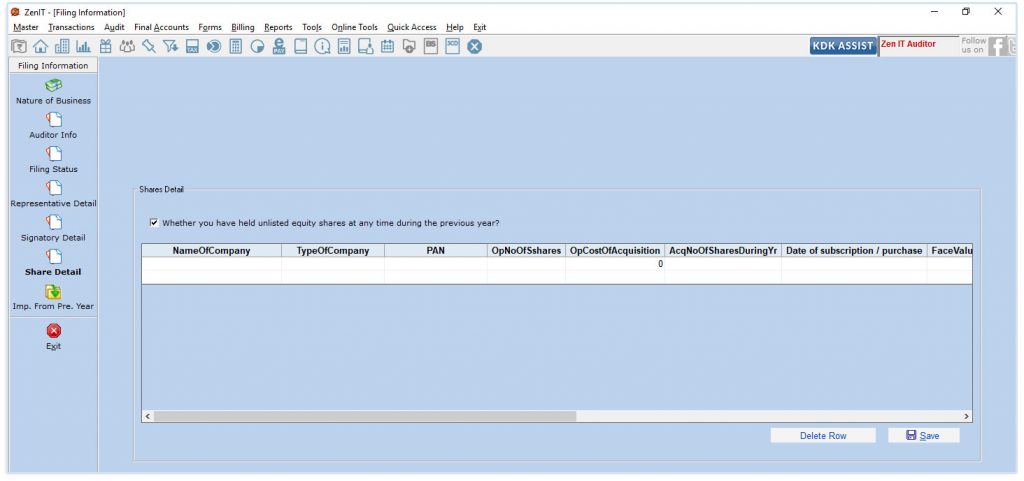

Go into transactions → Filing information → Share details → Check mark the same and fill the information in below fields

In the above table following fields are mandatory:

- Name of company

- Type of company

- Opening balance number of shares- ‘ OpNoOfShares ‘

- Opening balance cost of acquisition- ‘ OpCostOfAcquisition ‘

- Closing balance number of shares- ‘ Closing No of shares ‘

Click on ‘save‘ once you have entered the required details and continue with filing your ITR.