COMPARISON OF GSTR1 V/S BOOK

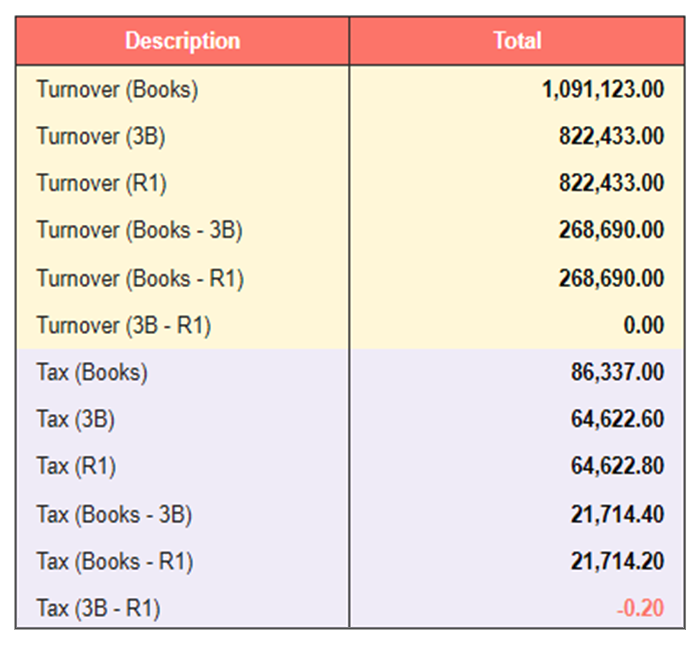

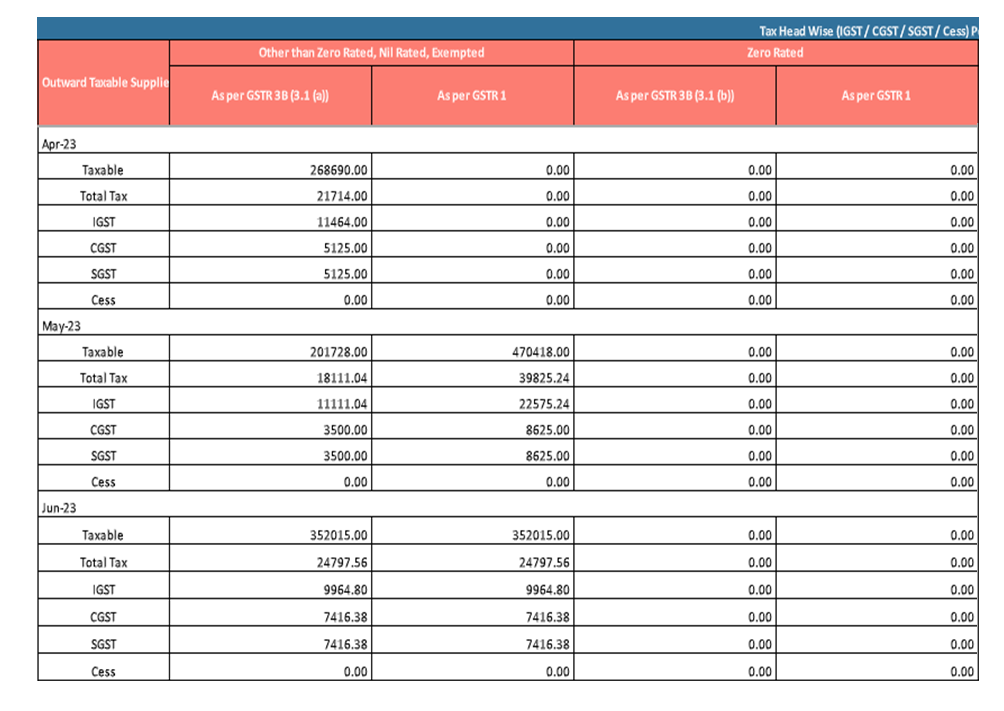

#EXPRESSGST gives detailed comparison of GSTR 1 v/s Book in simplest manner. Along with difference summary it also gives details tax head wise comparison report of GSTR 1 v/s Books v/s 3B. It helps us to find the difference in particular tax head viz, IGST, CGST, SGST.

#EXPRESSGST provides comparison of section wise data, with the help of such comparison taxpayer can find error or discrepancy.

GSTR-1 and books of accounts are compared to ensure that the data reported in the GST returns is accurate and consistent with the data recorded in the books of accounts. Once difference is found, it is required to know the reasons of mismatches. #EXPRESSGST comparison report helps to check detail tax head wise report, i.e., tax liability as per IGST, CGST & SGST on portal and GSTR-1 filed by taxpayer along with the taxable values for every specific month.

Importance of Reconciliation

The importance of comparing GSTR-1 with books of accounts is to ensure that there is no mismatch or discrepancy in the data taxpayers to:

- Avoid any penalty or interest for under-reporting or over-reporting of tax liability or ITC.

- Claim the correct amount of ITC as per the eligibility criteria and avoid any reversal or denial of ITC.

- Detect and rectify any errors or omissions in the data entry or filing process.

- Comply with the GST law and rules and avoid any scrutiny or audit by the tax authorities.

- Prepare accurate and complete annual returns (GSTR-9) and audit reports (GSTR-9C).

- #EXPRESSGST automatically generates these reports on the basis of books imported in GSTR -1 module.

2. COMPARISON OF GSTR 9 V/S BOOK COMPLETE

Benefits of #EXPRESSGST: –

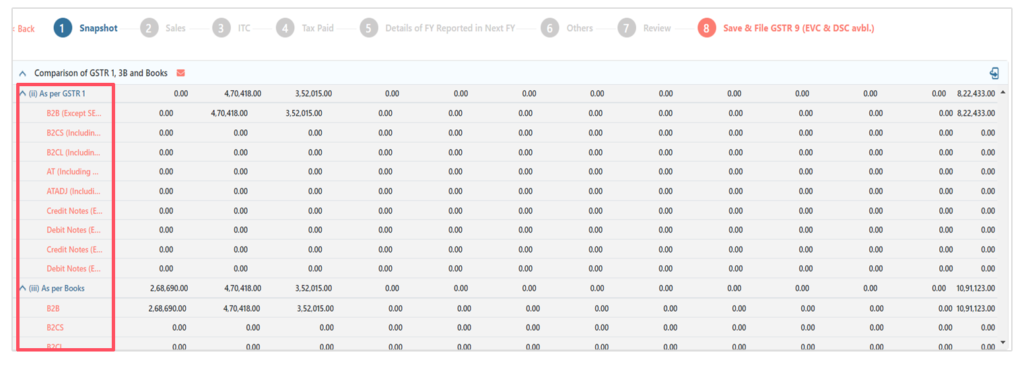

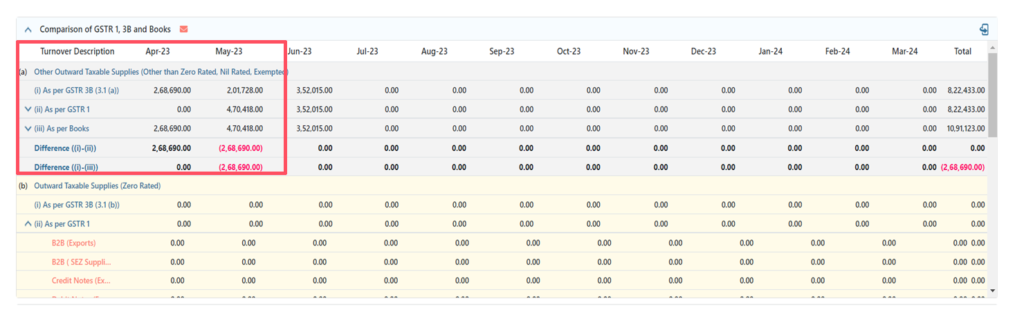

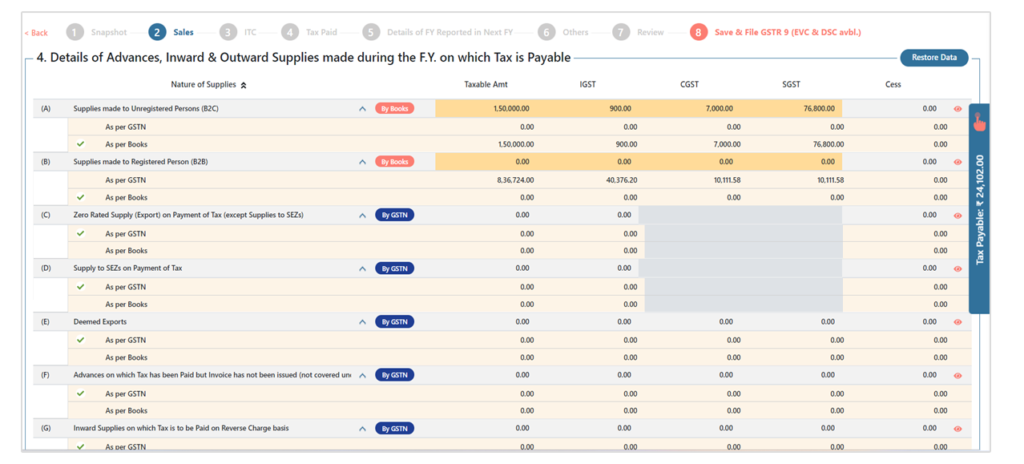

#EXPRESSGST provides us a very beautiful interface to prepare GSTR 9 along with multiple analysis reports. #EXPRESSGST imports the books data in a blink of eyes and provides the comparison of books data v/s GSTR 9 data on same page for easy identification of differences if any.

- Get auto-calculated Data from GSTR 1, 2Q/2B and 3B.

- Easy and clear comparison of books v/s Portal data

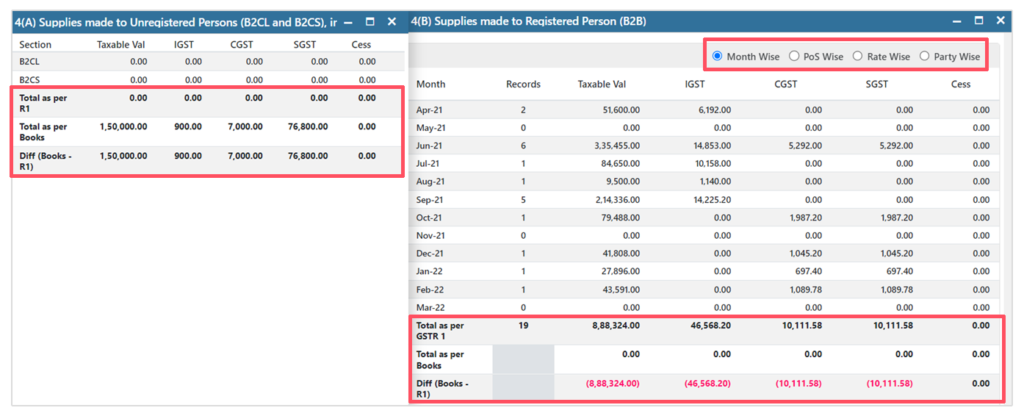

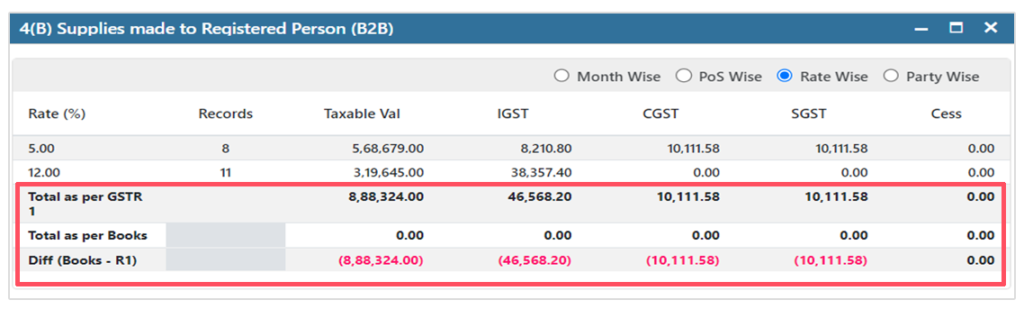

- Section wise multiple reports to figure out differences in books and portal data.

- Multiple reports can be views together with the help of Easy drag and drop, maximise, or minimize reports as per requirement of taxpayer.

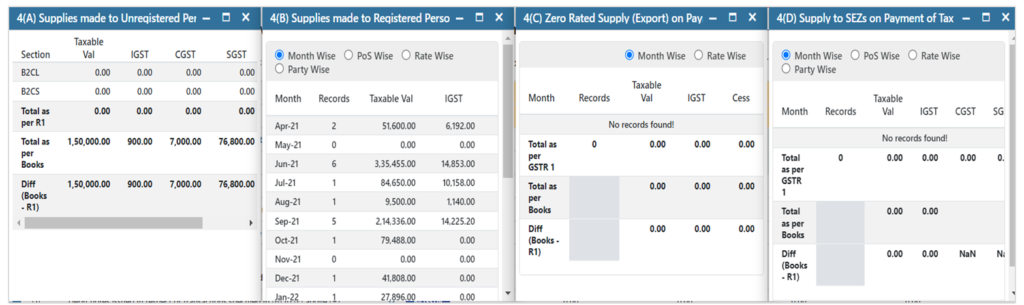

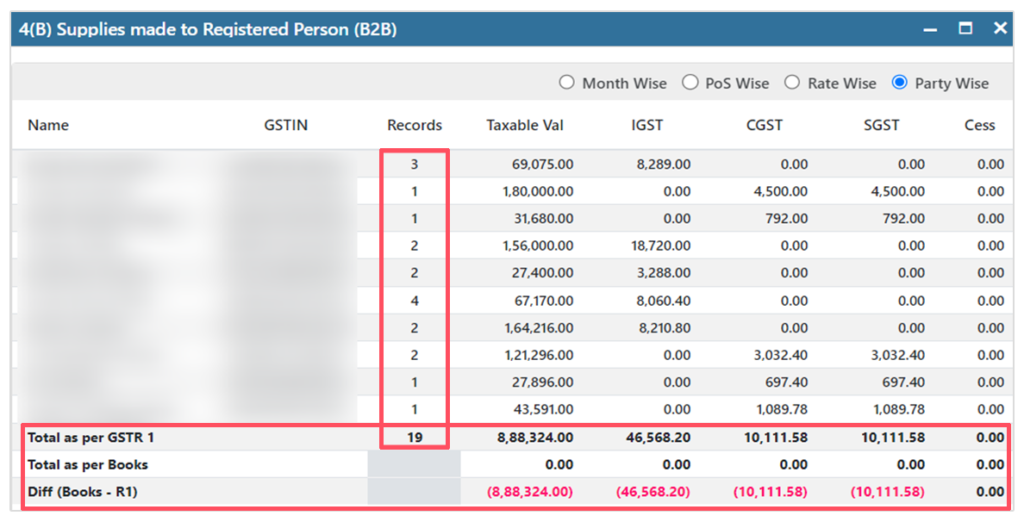

| These are some reports where EXPRESSGST provides the comparative summary of section wise data with books imported along with monthly view, pos view, rate wise report and partwise data also. |

Benefits for #ExpressGST User

#ExpressGST user get summarised POS, Rate wise as well as Party Wise report. Such report helps in easy identification of any error, omission or discrepancy. Party-wise report specify the total no. of transaction recorded and total tax liability against the supplier. This helps taxpayer to identify the transaction against the individual supplier which further helps to do easy reconciliation of R1 v/s Books data for professional.

Once Books data is imported in #ExpressGST, there is no need to bifurcate the input transaction in inputs goods, capital goods or input services. #ExpressGST automatically feeds the data as per books.

#EXPRESSGST allows taxpayer to fetch all HSN summary from GSTR 1 to GSTR 9 return, which helps to avoid unnecessary error and rectification of data.

To prepare GSTR-9 return almost all applicable section has summary reports as per GST portal against books data.

Except for a few exceptions, all registered taxpayers under GST are required to submit GSTR-9 each year. It includes a summary of the taxpayer’s outgoing and incoming supply, tax due, and input tax credit (ITC) claims for a given financial year. The records of all transactions and events pertaining to the taxpayer’s business are kept in the books of accounts.

It is crucial to check the GSTR-9 against the books of accounts to make sure the information stated in the GST returns is accurate and consistent with the information listed there. This comparison can assist taxpayers in claiming the appropriate amount of ITC in accordance with qualifying requirements, avoiding any penalties or interest for under-reporting or over-reporting of tax due or ITC.

#EXPRESSGST auto calculates all information as per books imported and Portal fetched information and also provides computation of tax liability if any and allows to file DRC -03 directly from the software.

3. SUMMARY OF GSTR-1 WITH DETAILED ANAYSIS

Benefit of #EXPRESSGST: –

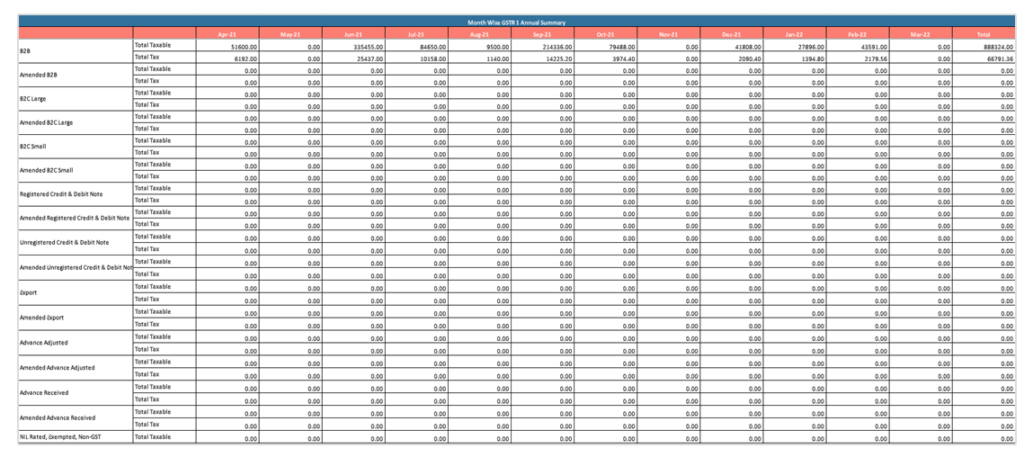

#EXPRESSGST can help you to view and verify the summary of GSTR-1 data for a given period, such as monthly, quarterly, or yearly. You can also use these report to compare GSTR-1 summary report with GSTR-9 data and identify and resolve any mismatches or variances.

#EXPRESSGST has section wise monthly based summary for all sections viz, B2B , B2C, EXPORT IMPORT, DEBIT NOTE CREDIT NOTEtheir amendments along with detailed HSN and Doc summary reported in GSTR 1 filing during the year.

#ExpressGST User

Taxpayers need to submit the details of b2b sales, b2c sales total debit or credit note transaction during the year along with all necessary amendment, HSN summary and DOC Summary that is reported during the financial year

Increase or decrease in taxable supplies due to amendments need to report in table no. 10 and 11

Its is complex to get all such report from individual monthly data. Here #EXPRESSGST gives all this in 1 single consolidated GSTR -1 summary which gives transaction wise detailed report for complete financial year. No Manual reporting work or calculation is needed in this regards. In-fact, these reports are available and auto generated right from the beginning of GST registration year till date.

This also helps to identify the issues and prepare data against demand or notices that taxpayer might have received for old financial years.

This reports not only automates the calculation but also helps taxpayer to prepare bulky GSTR 9 Audit report with out any hassle and saves the time and maintain the efficiency of taxpayer as well.

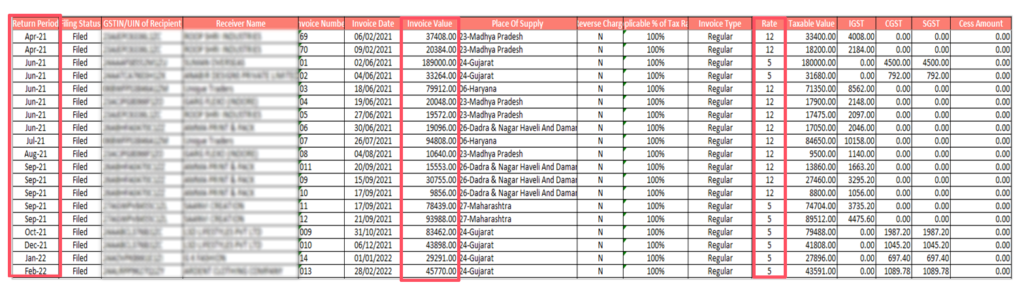

Detailed invoice wise analysis is given in #EXPRESSGST along with Rate wise report and period of filing and actual date of invoice. Difference in between output tax of specific month can easily identify if invoice is filed in next preceding month.

Report clearly shows the actual invoice data and period of GSTR 1 filed.

This also help the user to identify the discrepancy caused due to incorrect tax rate and prepare the GSTR 9 more accurately.

#EXPRESSGST provides rate wise consolidated report against GSTR -1 filed for all specific sections. GSTR 9C requires to disclosed rate wise report for tax liability paid and due for financial year.

Conclusion : –

As discussed in this article, #EXPRESSGST provides multiple reports for quick and easy analysis of filed data v/s Books data.

#EXPRESSGST provides all auto calculated reports right from the beginning of GST Registration till date, which helps taxpayer to prepare their data against Scrutiny orders or notice as well. With the help of easy reporting taxpayer can identify the error, omission or discrepancy and saves themselves against notices, order, and scrutiny due to mismatches, excess ITC or tax liability generated cause of errored data.