Letter Head Master: An Introduction

The Income Tax Auditor Software allows the user to use predefined templates for Letter Head along with an option for manual input.

There are almost 13 templates the software provides. User can also create a template of his own choice. Logo’s such as CA logo, Advocate Logo can also be inserted.

Use of Letter Head:

The user can use the letterhead templates for reporting purpose. The selected template for a particular report can be assigned. As per the selection is done, the details of Auditor/Client appears on the letterhead as per the set format.

If CA Firm templates are used, the auditor details would appear in the reports.

If Company templates are used, the selected company or assessee details would appear in the reports.

Procedure:

Step 1

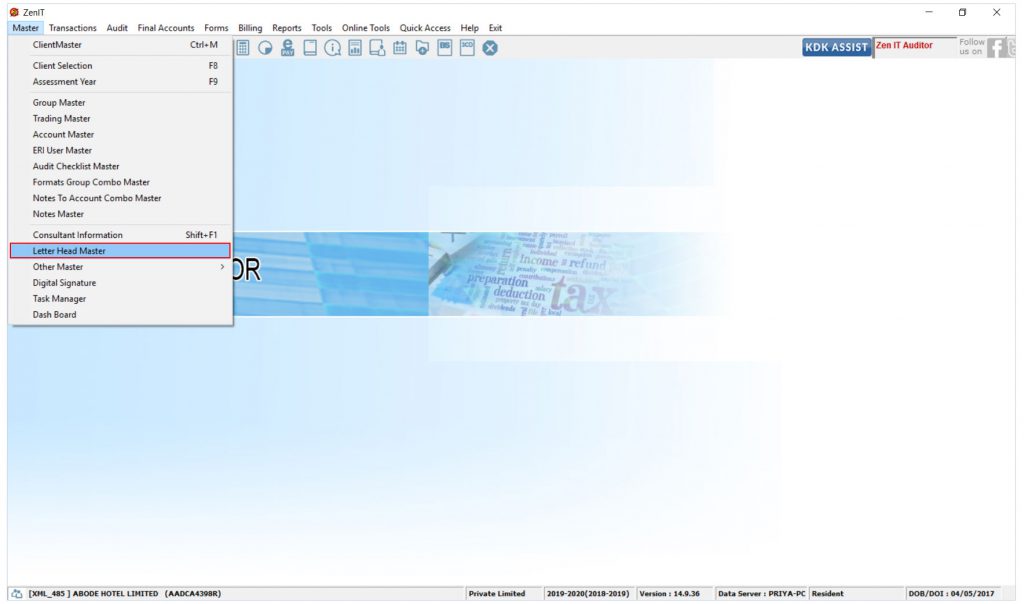

Open Income Tax Auditor Software, Go to Master → Letter Head Master

If the user wants to enter the details of the Auditor manually, it can be done as follows.

- Mention the firm name

- Mention the phone number/ mobile number /e-mail ID

- Mention address

Step 2

The user can add or customise the logo and insert additional data field in the template

Step 3

The Set Default option allows the user to fix the template for every assessee available in the IT Auditor.

The Option “This Client” allows the user to set the required templates for the selected assessee in the similar fashion as that of Set Default.

The auditor Information such as Auditor Name, Address, Mobile Number, Mail ID, etc, can be fetched from Consultant Information.

Go to Master → Consultant Information

How to set letterhead template on Income tax reports, Computation ?

Go to Transaction → Income Tax Options → Set letter Head Template

Now, check the Report

For Tax Audit case or Company Case, the details for the Auditor would appear on selection of Auditor under Auditor Information.

Go to Transactions → Auditor Information.

The report would then generate as shown below.