The rumors and myths regarding the extension of GST implementation schedule do not hold good at this stage as the government is all set to roll out the new indirect tax regime from 1-July-2017. The 17th GST Council Meeting that concluded on 18-June-2017 came out with a number of major decisions. A welcome decision taken at the meeting was regarding the relaxation in the requirements to file return for the first two months. Let’s understand the importance of this relaxation:

What is the new GSTR-3B?

As per the rules made in respect of returns under GST, Rule 3(5) provides for the filing of an alternate return Form GSTR-3B in lieu of Form GSTR-3, if the time limit for filing Form GSTR-1 and Form GSTR-2 is extended and the circumstances so warrant.

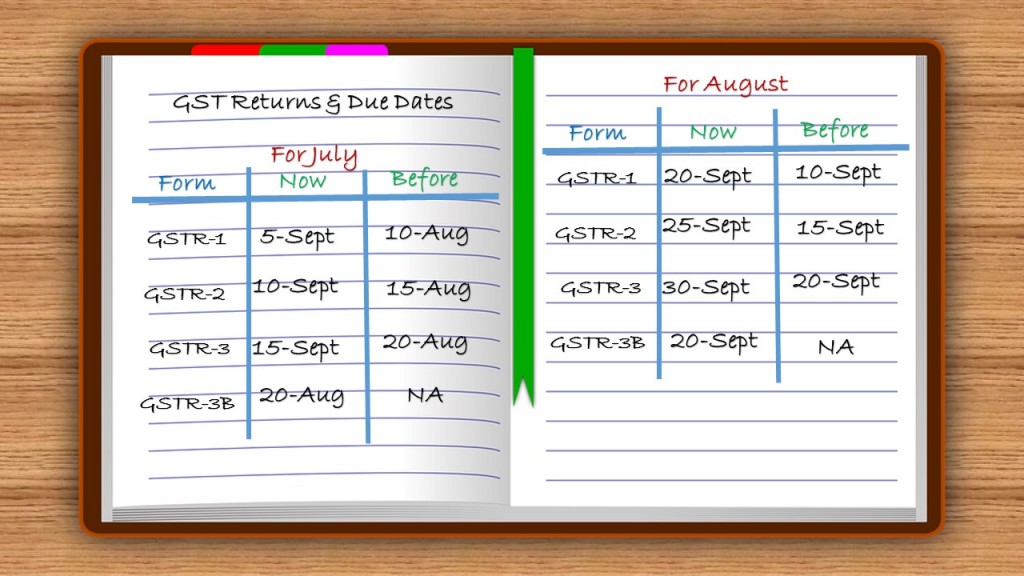

For smooth and swift working out of the law, the government has extended the dates for filing of returns for the first two months, viz. July and August 2017.

Therefore, in place of the required returns to be filed earlier, now a summary return is to be filed in Form GSTR-3B. It contains a summary of outward and inward supplies based on which, the assessee will pay tax for the first two months on a self-assessment basis. The due date of filing the same is 20th of the succeeding month.

In addition, there will be no late fee or penalty for the first two months.

Do I still need to file GSTR-1, GSTR-2, etc.?

Yes. There is relaxation only in the due dates for filing the above returns and that too for the first two months. From September onwards, the regular return filing dates will be applicable (as per presently available updates).

The comparative chart shows the extension in the return filing dates:

What will happen after filing GSTR-1, GSTR-2, etc.?

After assessee files GSTR-1, in the month of September, GSTR-2 and GSTR-3 will be auto-generated from GSTR-1. Then, GSTR-3 will be matched against GSTR-3B for the month of July and August. Any balance amount of tax, if in excess will be refunded, or if there is a short deposit of tax, the same has to be deposited. However, there will be no penalty or late fees as already discussed.

What next, to get prepared?

Business should not take these extensions as a honeymoon period. This is a crucial time and one should not only focus on a summary of records that are required under Form GSTR-3B. As the other returns are also to be filed on a later date, a proper record containing complete details should be maintained from day one itself. This shall be done in order to avoid any hustle at the last moment in the month of September. The wise men always say, “Prevention is better than cure!” This is the time to fasten your seat belts for GST. Good luck!