How can I link my Aadhaar card with PAN card?

Introduced as a mandatory provision in 2017, the Aadhar-PAN linkage is now familiar law. Extended several times, the last date for ensuring linkage currently stands at June 30, 2021, whereafter any unlinked PAN card will lose its validity. Further, penal provisions exist for the use of an inoperative PAN card as it is unlawful.

But all is not lost. The Government has made provisions to revive the PAN card as soon as the linking between the two is done.

Here are the various convenient ways to get the linkage done. Choose what works best for you.

Before proceeding NOTE the following:

1. Please keep the following handy– Aadhar Card, PAN card, Mobile.

2. Be very careful in data entry and input exactly as per the information in the two cards (including spellings).

3. In case you see a mismatch between the information in the two cards, it is advisable to get the corrections done before the linkage.

4. For an online method, ensure that the site is authentic. Many fake websites with small variations in spelling are on the internet.

I.ONLINE (A)

Step 1:

Register on the Income Tax site at www.incometaxindiaefiling.gov.in. NOTE: As OTPs will come on the registered mobile, please ensure the same mobile is readily available with you while registering

Step 2:

Login using registered credentials. PAN is the user ID, fill in the password created by you, provide the date of birth and the CAPTCHA.

Step 3:

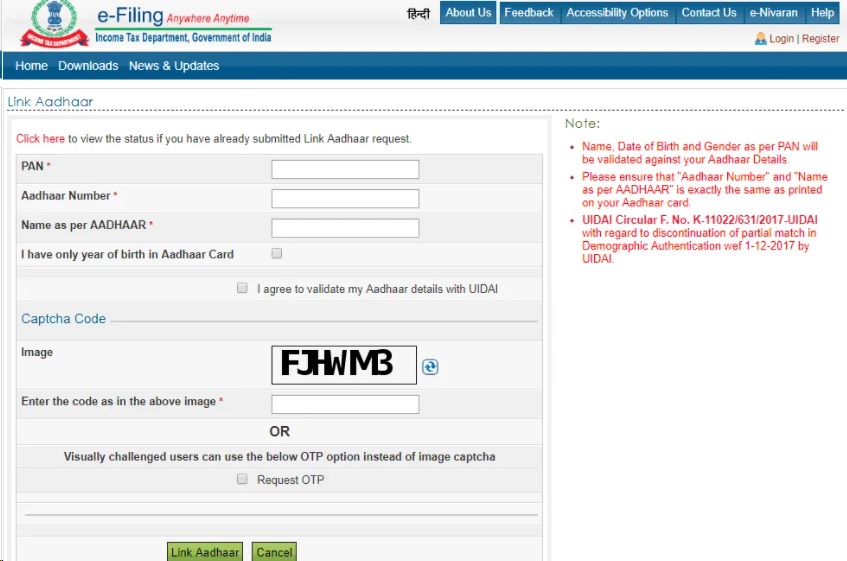

Go to the ‘Profile Settings’ tab, and click on the ‘Link Aadhar’ option thereunder. On the form that appears on the screen, fill in the requisite details i.e., Name, date of birth, gender.

NOTE:.details must be as per PAN records

Input Aadhar number to be linked to the PAN, CAPTCHA, and Submit.

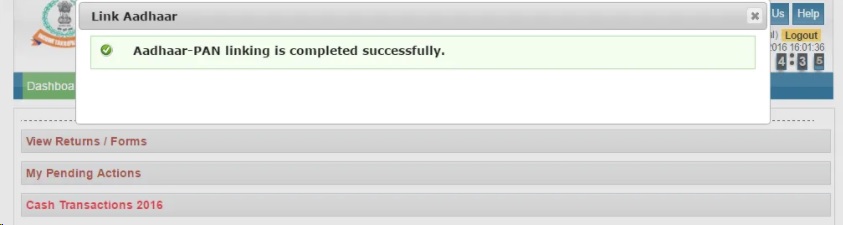

If all is in order, you will receive a Success message on the screen.

The linking is done in just three steps.

II.ONLINE (B)

There exists a segment of the population that has both Aadhar and PAN but does not file returns e.g., students, minors, unorganized sector workers with incomes below specified income brackets, etc. They, too, are expected to comply with the IT provisions. These categories can proceed without registration.

Such persons may visit the IT e-filing portal and look for the ‘Link Aadhar’ under ‘Services’ on the homepage. Click this and fill in the form that appears on the screen with PAN, Aadhar number, and Name as per Aadhar. Check whether your Aadhar Card has your full date of birth or only year of birth. If the only year, then tick the box in the form otherwise, leave blank. Enter CAPTCHA and Submit. The success message confirms that the linking is done.

III. OFFLINE

1. Link via SMS

Send SMS to 567678 from your Aadhar/PAN registered mobile in the following format–

UIDPAN<space><12 digit Aadhaar Number><space><10 digit PAN>

Example — UIDPAN 123456789012 ABPPD1234E

The linking will be done after due verification. Unlike the above online methods, this may not be instantaneous.

2. Link via physical visit

Visit an authorized PAN Service provider, NSDL-UTIITSL PAN Service Centre (Google the same for a location near you). Manually fill in form Annexure 1, provide the documents for verification, and the service provider will get the needful done. This is a paid service.

The above multiple options are convenient and easy to use. However, if you still need assistance, help from KDKSoftware.com, a preferred tax solutions provider, is just a call away.