Maximize Input Tax Credit and do complete GST Compliance with Reconciliation

What is Reconciliation?

In general terms, reconciliation refers to the matching of two sets of data to evaluate differences. Also, reconciliation helps keep a tab on manual errors.

Under taxation, reconciliation holds importance because it can give rise to tax short paid or not paid or excess paid as well.

GST reconciliation involves matching data of purchase and sales between different returns with purchase and sales registers.

Reconciliation under GST although seems to be a simple process, however it still consumes a lot of time and resources. One such example is that taxpayers are required to continuously communicate with vendors for making amendments in the returns filed by them or even to track ITC claims.

Therefore, one must reconcile the returns data on a regular basis under GST.

Listed below are different types of GST reconciliation that need to be done: GSTR1 vs Books, GSTR 2B vs Books, GSTR 2A vs 2B, GSTR-1 vs 3B, and so on.

GSTR1 Annual Reco with Books:

GSTR1 Reco is the regular comparison of the data of our GSTR1 return (uploaded data on portal) and the books of account (sales register) to verify that our books of accounts are in sync with our return. GSTR 1 reconciliation is the process of matching two sets of data; data available in the GSTR-1 form and data available in your books of accounts. In an ideal situation, the two sets of data must match exactly; however, in the real world, for plenty of reasons, differences can occur.

Importance of GSTR1 reco to clients in terms of Express GST:

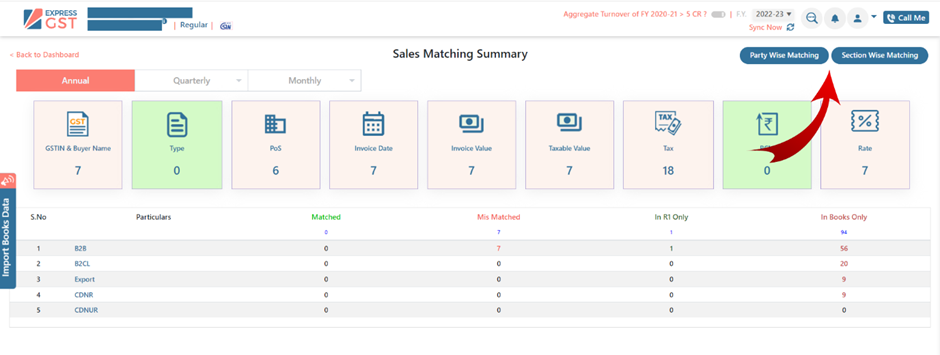

ExpressGST provides an Annual/ Monthly/ Quarterly comparison option available for GSTR1 and books to check on match and mismatch invoices and invoices available in R1 but not in books and vice versa.

It also includes:

- Party wise matching and Section wise matching

- Different cards available to indicate the mismatch fields such as, GST and buyer mismatch, POS, Rate, Type, Date, Values (Invoice /Taxable), Tax, RCM

- Identification of E invoices/ E Waybill transactions

The manual process is time-consuming as one needs to go through every transaction, calculate, and then rectify when mismatches occur between the two sets of data. ExpressGST thus provides a GSTR1 reco tool to perform the process in automation thus benefiting the user. As GSTR-1 reconciliation is a regular process, using software to perform this task is a smart way of ensuring zero errors while filing returns.

How it helps USERS?

- ExpressGST helps users in an automatic way of performing GSTR1 reconciliation as the ExpressGST gets all data without any click.

- On import of books data, ExpressGST compares it with portal GSTR1 data.

- ExpressGST highlights the mismatches, thereby saving hours of time and effort.

- Through this reconciliation of GSTR1 with books it becomes easier for users’ clients to identify mismatches as per their books and portal and if required user can correct his books at the earliest to avoid any discrepancy in future while preparing his annual returns and audit of books of accounts

- Users also gets knowledge on the number of E Invoices/ E-Waybill generated on the portal and actual sales invoices yet to be generated via E invoicing or to be uploaded on GST portal.

Process of reconciling GSTR1 with Books in Express GST

After login to ExpressGST software,

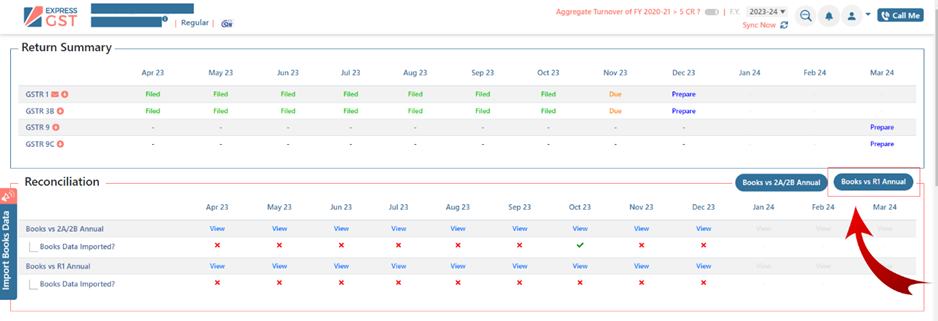

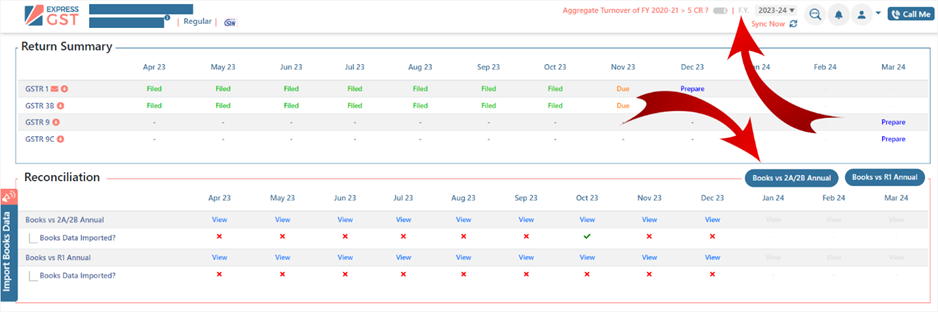

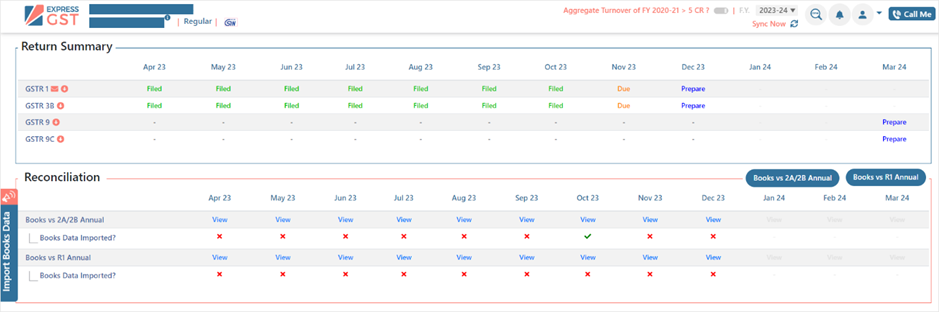

- Select the respective GSTIN (Company) and then the FY on the GSTIN Dashboard

- Under Reconciliation tab, click on Books vs R1 Annual

- The GSTR1 annual data will be auto fetched from GST portal.

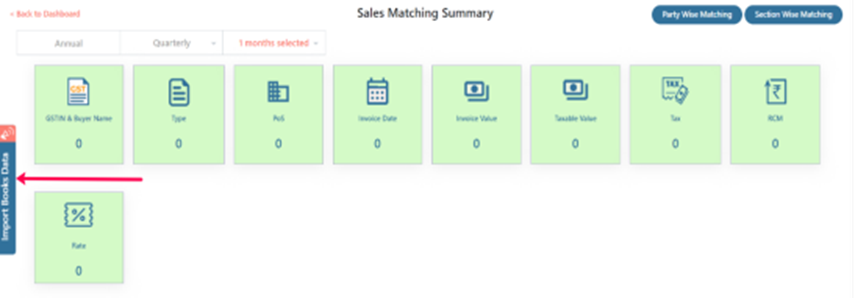

- Under Sales matching summary, import books data from the Import Books Data tab on the left-hand side panel, data can be monthly, quarterly, and annually depending on the reco method.

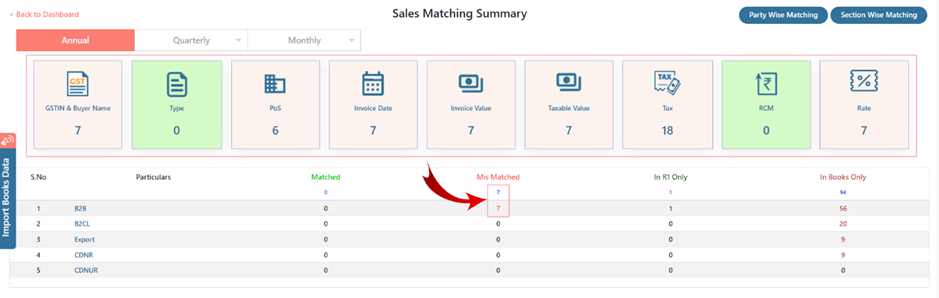

- Auto reco is done after importing of books data giving 4 different status of invoices- Matched, Mis matched, In R1 only and In Books only with section wise records of B2B, B2CL, Export, CDNR and CDNUR.

- Any type of Mismatches identified are indicated with respective cards on the same window giving the description of the mismatches which can be based on GSTIN and buyer name, Type, PoS, Invoice date, Invoice value, Taxable value, Tax, RCM and Rate.

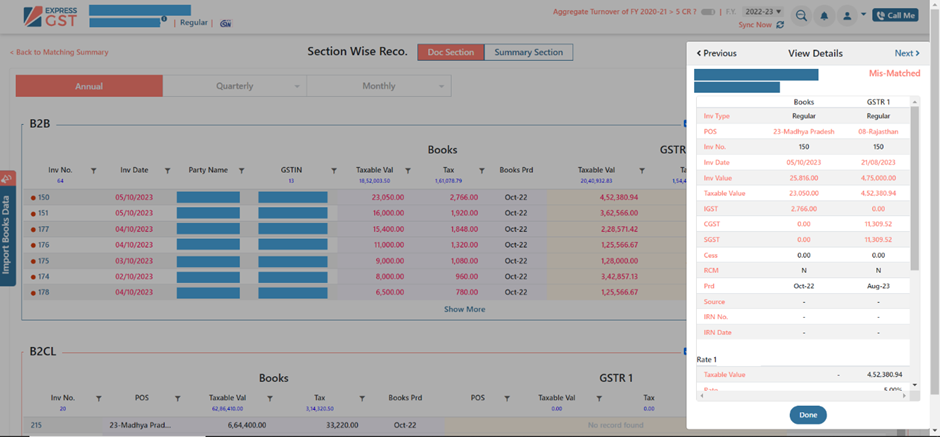

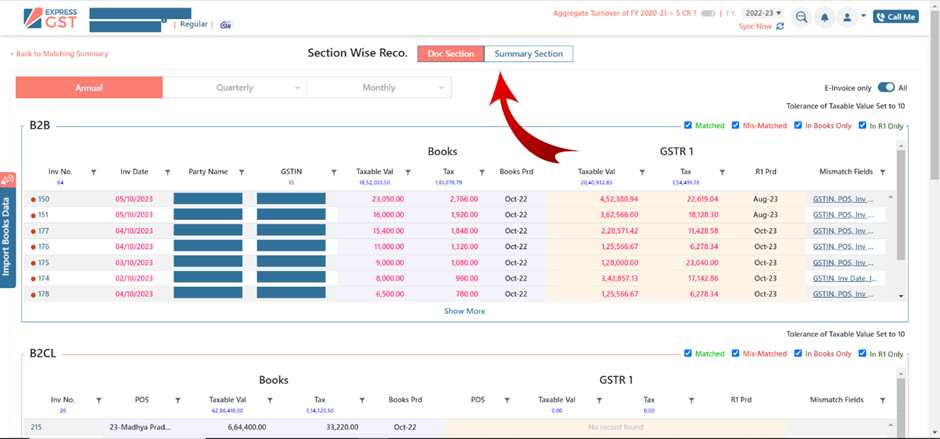

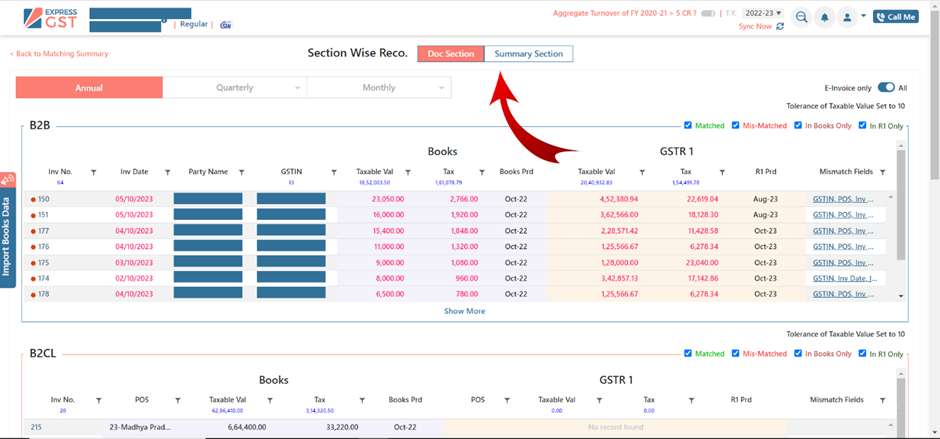

As in the above example, imported books data has given 7 mismatched records under the B2B section. The mismatch are of various types as highlighted in the cards. The above mismatch is in GST of buyer, POS, invoice date, invoice value, taxable value, IGST which is not matching with that of uploaded GSTR1 data. All the highlighted red data are mismatches identified with that of GSTR1 as described below:

| POS | Date | Invoice Value | Taxable Value | IGST | CGST | SGST | |

| Books | Madhya Pradesh | 05/10/2023 | 25816.00 | 23050.00 | 2766.00 | ||

| GSTR1 | Rajasthan | 21/08/2023 | 475000.00 | 452380.94 | 11309.52 | 11309.52 |

It also provides Party wise matching and Section wise matching.

- Party wise matching gives a party wise report indicating the total differences in Taxable value and tax as per GSTR1 and Books including no. of records in each status.

- Section wise matching gives 2 sections as Doc section and summary section

Doc section gives B2B, B2CL, Export, CDNR and CDNUR details while Summary section gives B2CS, Advance Received, Advance adjusted and HSN.

- User can also check all E invoices generated on GST portal with its IRN no. on the Doc section and comparison can be done with the actual books data

2A & 2B Reconciliation with Purchase Register

- GSTR2A/ 2B reconciliation is a specific type of reconciliation that occurs whereby the generated GSTR 2A/ 2B of a tax period is compared with the data in your purchase register. It is important to find whether some invoice data is missing from the statement because the suppliers did not file it timely.

- Reconciliation is done to prepare GSTR 3B return and for that it is necessary to ensure that the ITC claimed by the taxpayer matches with the ITC available on the portal as declared by their suppliers in their GSTR1 returns. In simple words, users will only be able to claim ITC if the concerned invoice is present in GSTR-2A/GSTR 2B.

Here are a few reasons why GSTR 2A/2B reconciliation is important

- Loss of ITC

- Claiming excess credit or incorrect values

- Notice from GST department.

- Avoid duplicate or ineligible ITC.

- Identify habitual default suppliers.

Express GST provides the following features in Reconciliation of ITC :

- Actionable emails to all suppliers with default: Users can send actionable mails to all default suppliers indicating them to file their GSTR1 as soon as possible so that he can claim his input credits on time, if already uploaded then supplier can check if any mismatch in the amount uploaded as result of which user fails to claim correct ITC. This e-mail consists of 6 reports:

- Invoices not found in 2A/2B statement.

- Invoices with mismatch in taxable and tax amount

- Invoices in 2A but not in 2B

- ITC eligibility conflict

- RCM Conflict

- POS conflict

- 2A/2B reconciled report provides the return filing status of all suppliersof all months for GSTR1 and GSTR 3B. User gets to know the filling frequency and also, he gets detailed status of each invoice uploaded by his supplier and he can claim ITC accordingly.

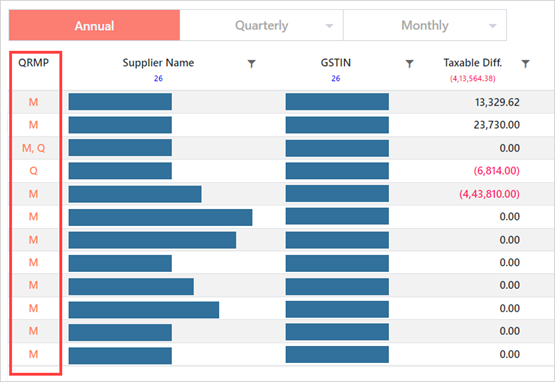

- Option to show QRMP (Filing Frequency) details for the FY.

Process of reconciling 2B/2A data with books in express GST

STEP 1

- Login to www.expressGST.com

- Add Company from add option, you can also add companies using bulk import option.

- Select Company for which Reco is to be done.

- Company’s GSTIN Dashboard will appear.

STEP 2

- On GSTIN Dashboard

- click on F.Y. & Select Year

- click on Books vs 2A/2B annual.

STEP 3

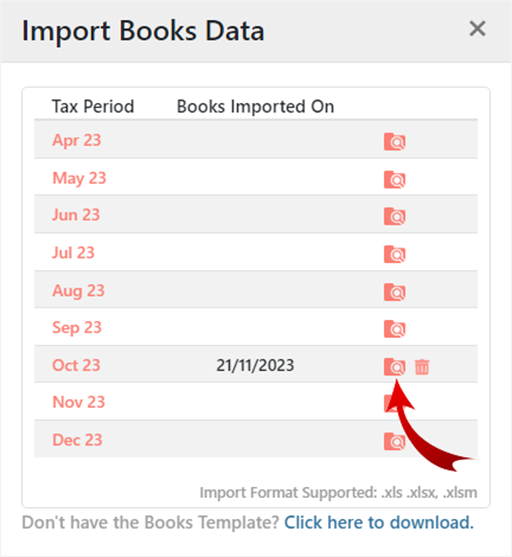

- Import Books Data

- At this step, your data is already synced with portal; you just need to import books data by the Import books data button from the left side of screen.

- Click on Import Books Data

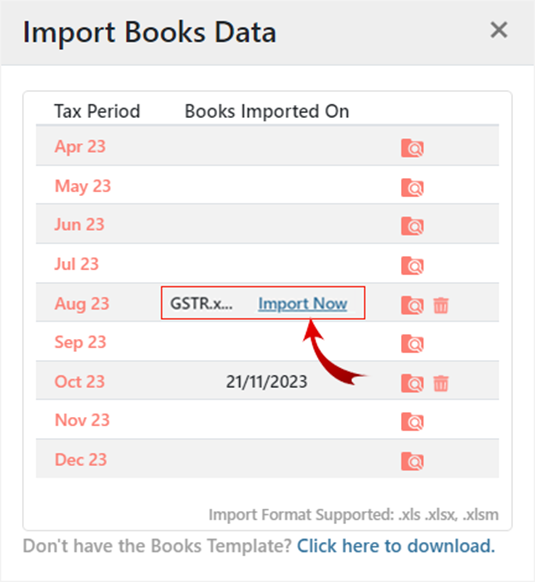

- Select Month

- Browse the data file

- Click on Import Now. Here in you can import one month data or you can also import all month’s data.

- Select the month/quarter/or Annual option for which you would like to do 2A/2B reconciliation.

Note:

- If you want to import Annual data, then import the data in the month of March.

- If you do not have any accounting software, then you can use standard template.

- Now Browse the file and Click on Import Now

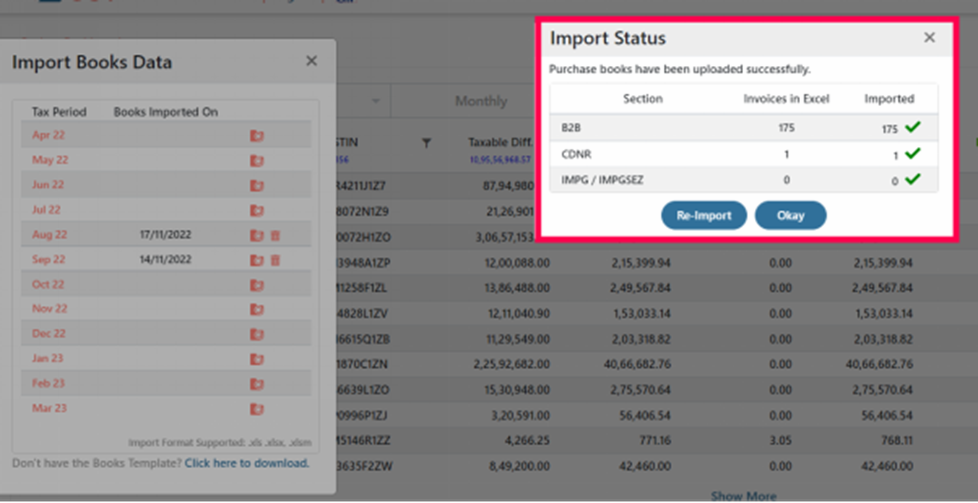

- After Import, it will show the count of Invoices successfully Imported under the import status.

- You can re-import if you want to, otherwise you can click on Okay.

STEP 4

After the books data gets imported, 3 ways reco is done.

- Supplier Wise

- Invoice Wise

- Month Wise

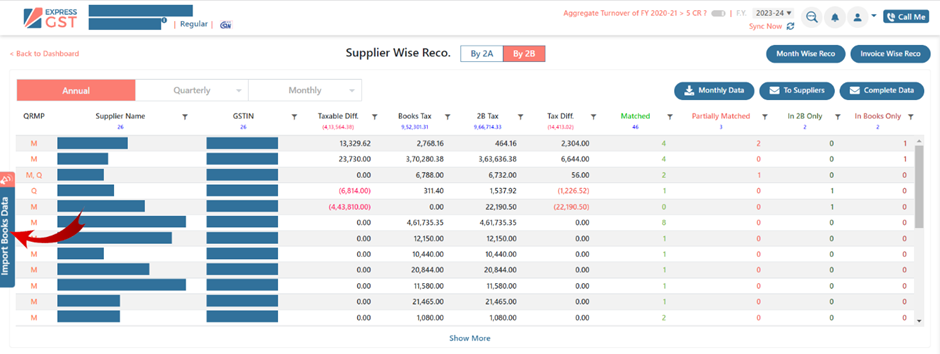

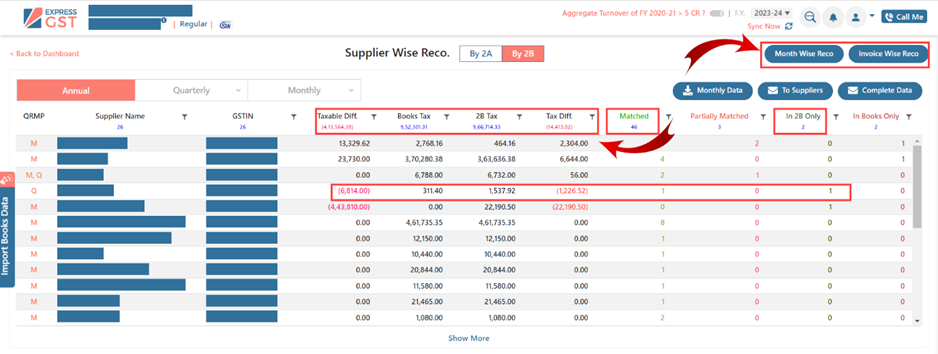

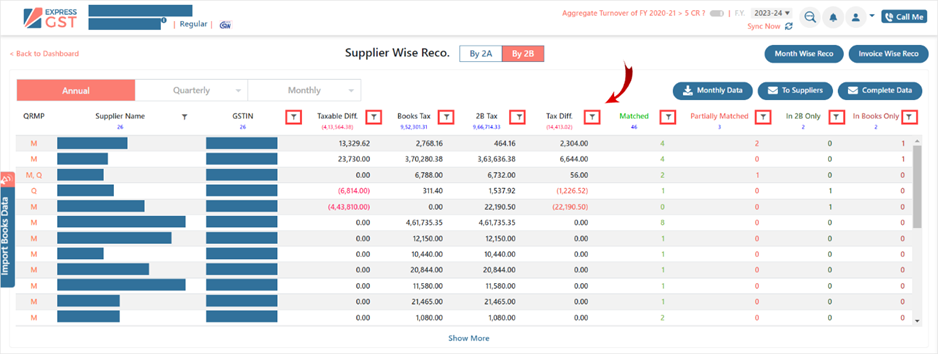

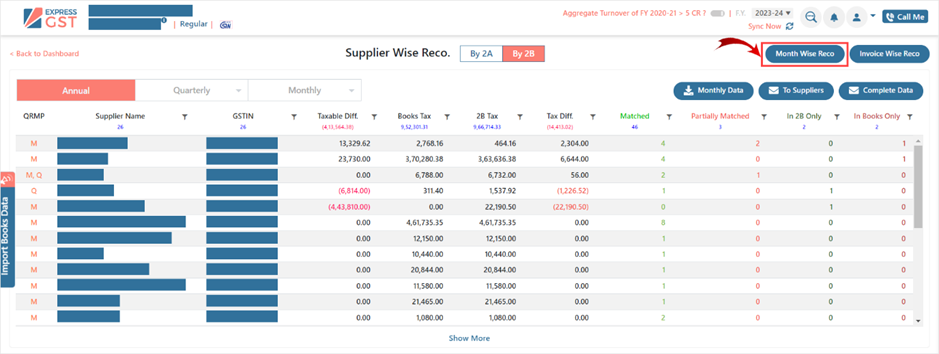

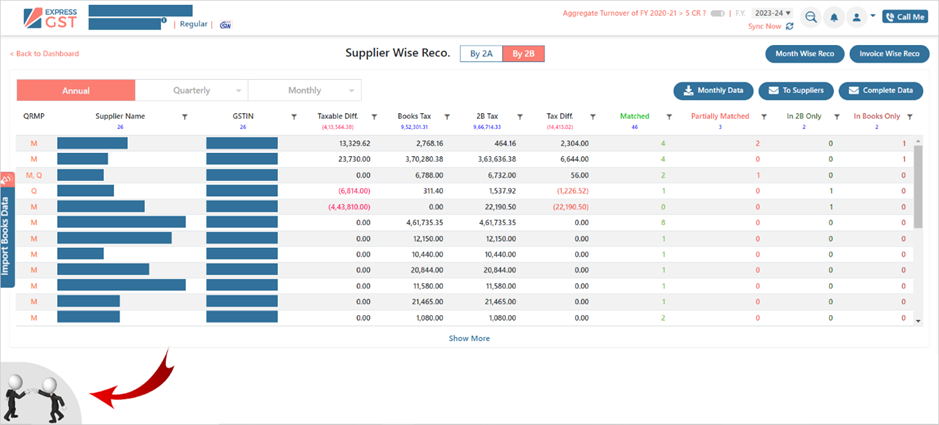

Supplier Wise Reco

This Type of reco is useful when you want to check the Supplier wise Difference in Tax or taxable value.

It is done by sorting Invoices by supplier’s name and checking if the Invoices of particular Supplier present in 2A/2B and in Books. Matching of Invoices is categorised into 4 types of status as explained below:

- Matched: Invoices found in books as well as on the portal and amount is matched.

- Partially matched: Invoices found in books as well as on the portal but there is a difference in invoice value.

- In 2B only: Invoices found on the portal in 2B only.

- In Books Only: Invoices found in books only, no corresponding invoices found on portal.

In the above example, it can be understood that 1 Invoice of Supplier is matched and1 is in 2B only. Also it can be seen that there is Tax diff of ₹1226.52 as per books and as per 2B which could be due to 1 invoice that was missed to be accounted in books and is appearing 2B only.

For details, you should click on supplier name and you will get the details of bill to bill reconciliation of supplier

You can sort the reco with excel like filter & sorting options given at the column heads.

You can sort supplier name alphabetically in increasing or decreasing order by clicking on supplier name column.

GSTIN number can be searched by using a Filter like button and similarly other columns can be filtered also.

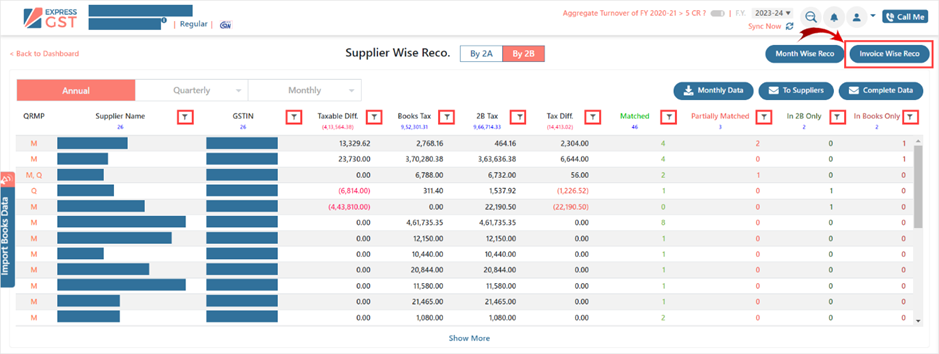

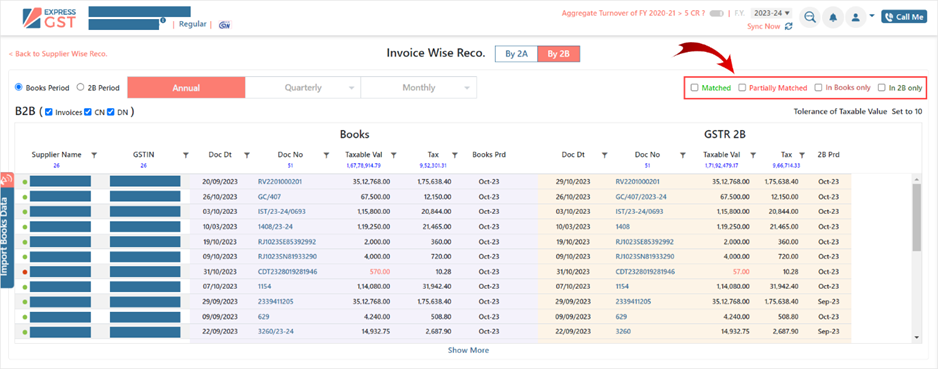

Invoice wise Reco

Click on Invoice-wise Reco to view invoice wise data reconciliation.

Here you can do reconciliation by selecting any of the Status vis-à-vis Matched, Partially Matched, in 2B only, in books only.

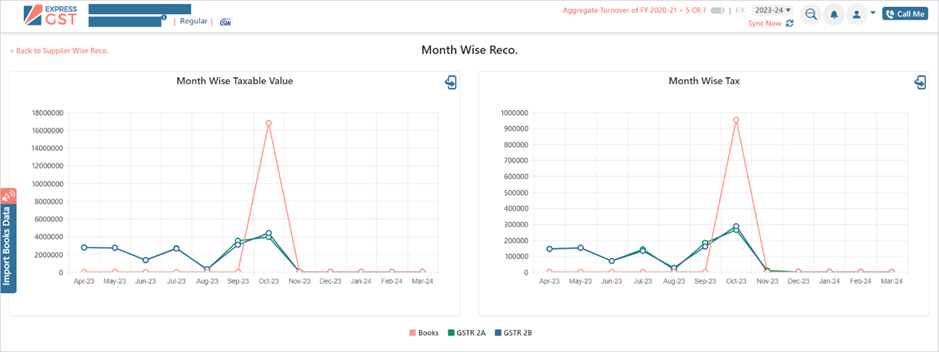

Month Wise Reco

Click on Month Wise Reconciliation to get the reconciliation done by month wise.

You will get the graphical view. You can get the taxable and tax figures if you click on Flip Button here.

As shown below are the comparison of GSTR 2A/GSTR 2B and books data for a month and also annual

For Example, in the month of Oct, Taxable value as per 2A is 39,35,555.00 Taxable value as per 2B is 43,87,488.05 and as per books is 1,67,78,914.79.

In the same way, in the month of Oct, Input tax as per 2A is 2,63,148.08 as per 2B is 2,86,546.34 and as per books is 2,86,546.34

This is the Month wise Reco where you get to reconcile data by 2A, 2B and Books.

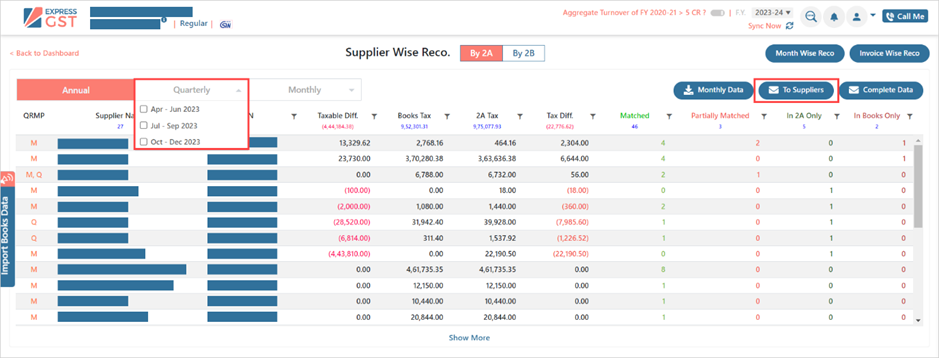

STEP 5

How do I view Annual, Quarterly or Monthly Reco?

- You can simply click on Annual Tag or Quarterly Tag or Monthly tag to view the required type of reco. You can select Multi-Month, Multi –Quarter in this Page.

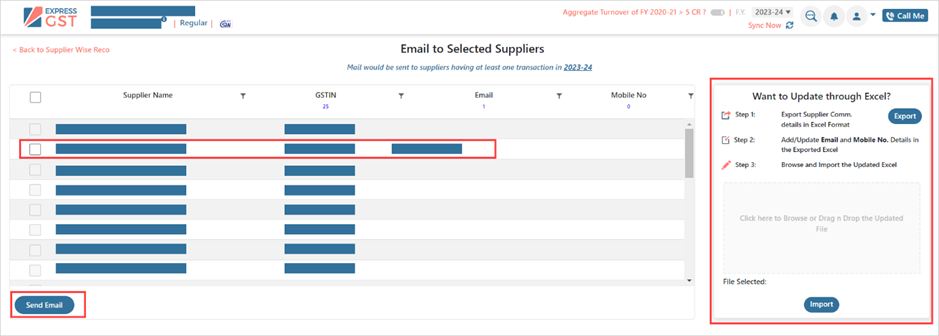

STEP 6

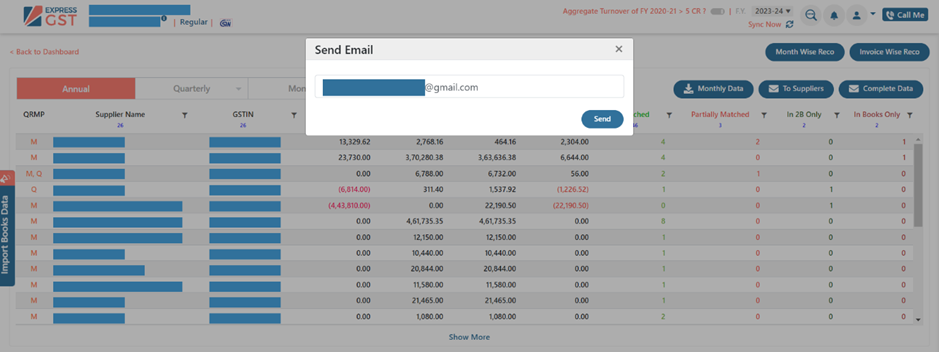

How to email the Default suppliers?

- Click on To Supplier Email

- Enter the email of all or multiple suppliers.

- Excel import facility is available to add bulk Email ID of all suppliers.

- Click on Send Email

In the above example, you can share email to a single supplier in case of default or you can share email to multiple suppliers also by selecting bulk option on left hand side.

As Baxy limited had 1 invoice in Books Only that means 1 invoice was not uploaded by Baxy limited in his GSTR-1 as a result of which it was reflected in our 2B statement. In this scenario, actionable mail is to be sent to the default supplier for not uploading his invoice as a result of which the respective company is not eligible to claim its input credit in the relevant month.

STEP 7

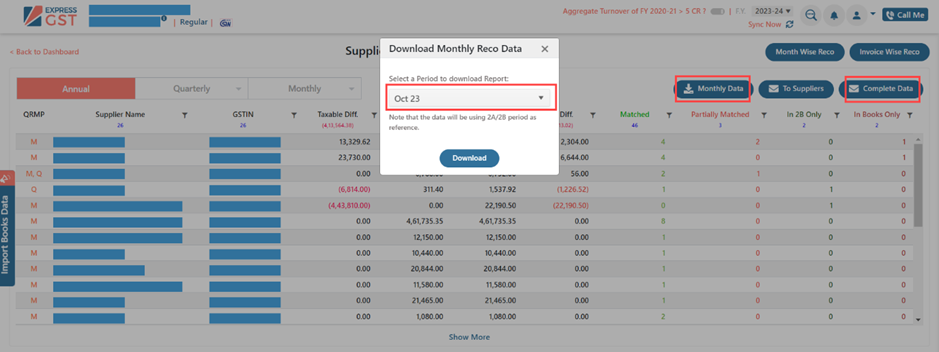

Email of annual report and downloading monthly data

You can also email the complete Reconciliation report containing Supplier wise 2A-2B Reco and Invoice wise 2A-2B Reconciliation. You can Click on Email Complete Data Button on the right side of Page and enter the required email id and get the complete (Annual)reco report on the email within few seconds.

In other cases you can download monthly data into the system for any particular month into excel.

The Exported Reco report also gives details of all suppliers GSTR1 and GSTR3B filling dates for complete Year with their filling frequency as Monthly/Quarterly under QRMP option as shown below.

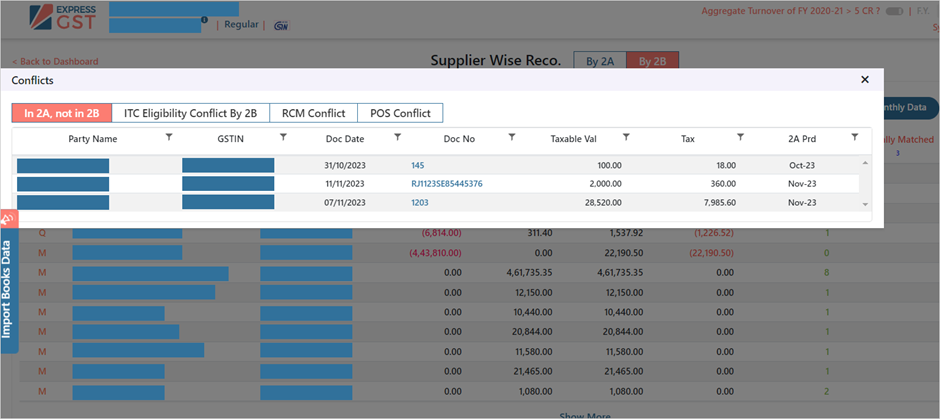

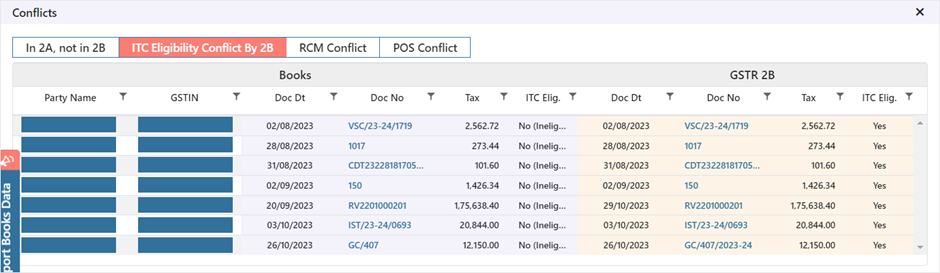

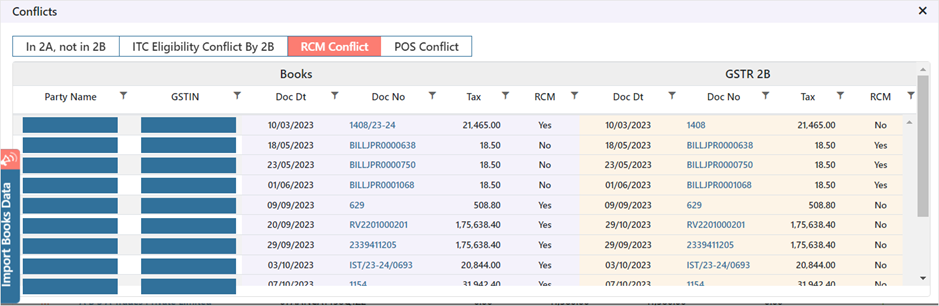

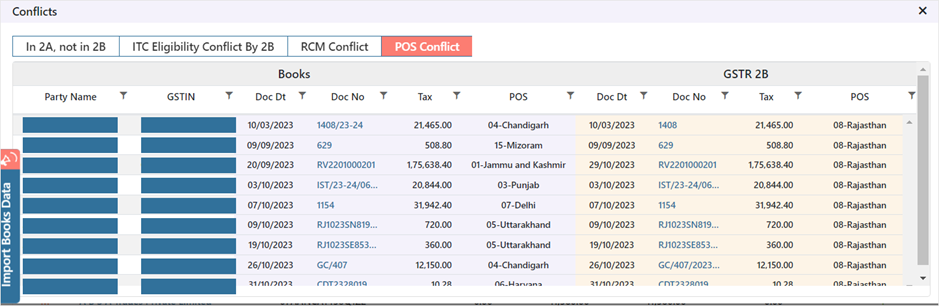

Additional Conflict report gives the following details as shown below

- Invoices in 2A but not in 2B

- ITC eligibility conflict

- RCM Conflict

- POS conflict

In the below example,

In 2A not in 2B, reflects 3 suppliers whose data in not in 2b but available in 2A that means supplier has either not filed his GSTR1 or he has not considered the above invoices his return or may be supplier has delayed in filing as a result of the invoice is not reflecting in current month 2B.

ITC Eligibility conflict by 2B, the above 7 suppliers having ITC ineligibility because those invoices have been marked as ineligible ITC in the books of the company

RCM Conflict, the above suppliers identify a difference in their RCM selection when compared with RCM of supplier

POS conflict, the above suppliers having a mismatch in POS when compared to supplier POS which may result to ITC ineligibility

ITC Tracker

Express GST ensures that your GSTR-2B data is fetched without manual intervention. Our advanced reconciliation engine matches data between books and GSTR-2B to identify gaps, with the option to define custom matching logic and claim 100% ITC in GSTR 3B.

Express GST also allows users to annually reconcile ITC across financial years for accurate preparation of GSTR-9 and GSTR-9C.

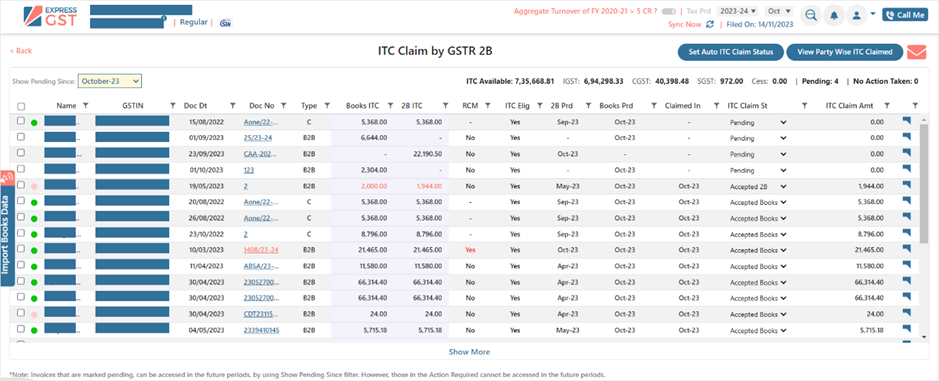

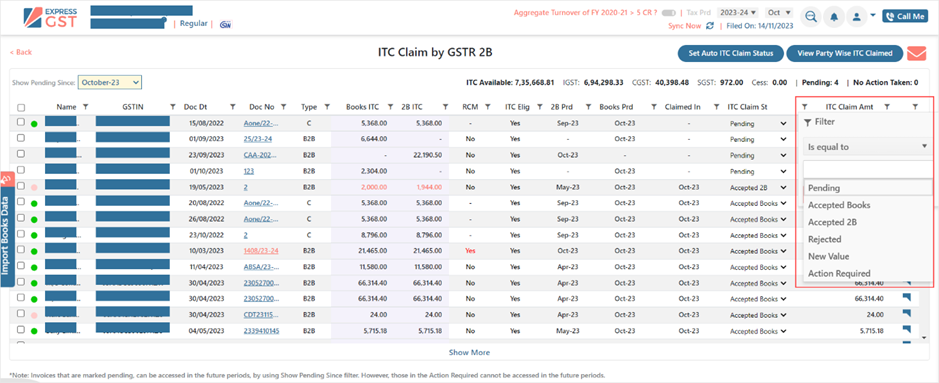

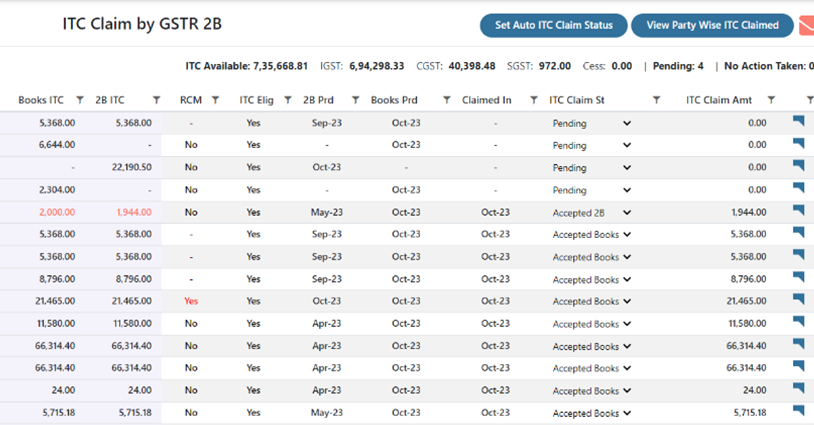

In respect to above, GSTR 3B Enterprise plan provides ITC tracker to keep a track on all such ITC. ITC tracker is an end-to-end enterprise solution for maximising the claims of the input tax credit. ITC tracker has exclusive features to improve your input tax credit claims with value additions as it provides,

- Set auto ITC button to set the actual ITC available from Books and 2B on invoice level 6

- status: Accepted books, Accepted 2B, Pending, Rejected, New value and Action required

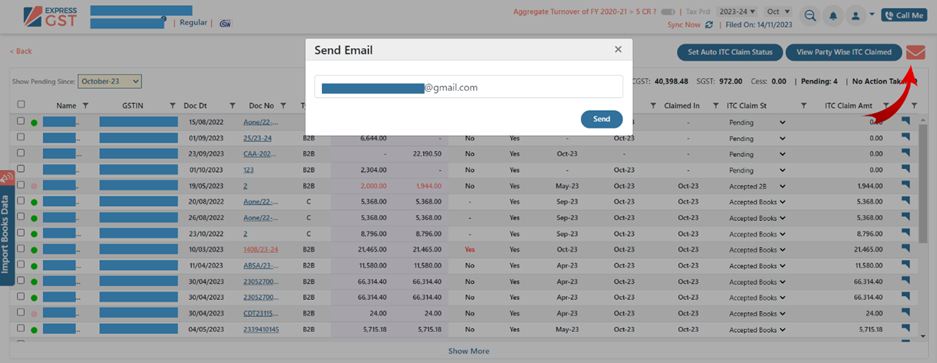

- Email functionality to download the ITC claimed report in excel

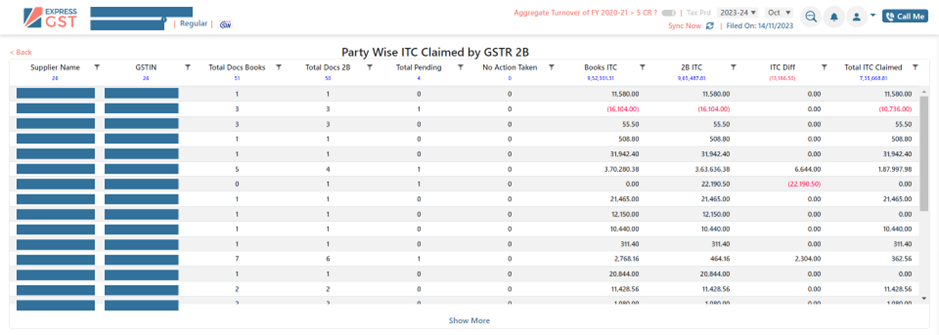

- Party wise ITC claimed as well.

The ITC tracker tool in ExpressGST helps clients to claim correct and actual ITC rather than claiming maximum and incorrect ITC. Client can decide whether he needs to claim the entire ITC available as per his 2B statement or to check with his books and then claim such ITC which is relevant and pertaining to his business only.

The ITC Tracker gives different checkpoints to client helping him in his 3B ITC claim amount

- Steps to check any ITC which is ineligible due to delay in filing GSTR1 or incorrect POS mentioned in returns by suppliers

- RCM whether available or not can also be checked

- Acceptance of any ITC related to PY years and also attaching valuable remarks for future reference

- Rejecting ITC at the initial stage to avoid any duplicacy

Process of claiming/calculating correct ITC under ITC tracker module of 3B

Step 1

From the GSTIN Dashboard under Return summary section, select the 3B return for the month where Reco with 2B was done as shown below:

Step 2

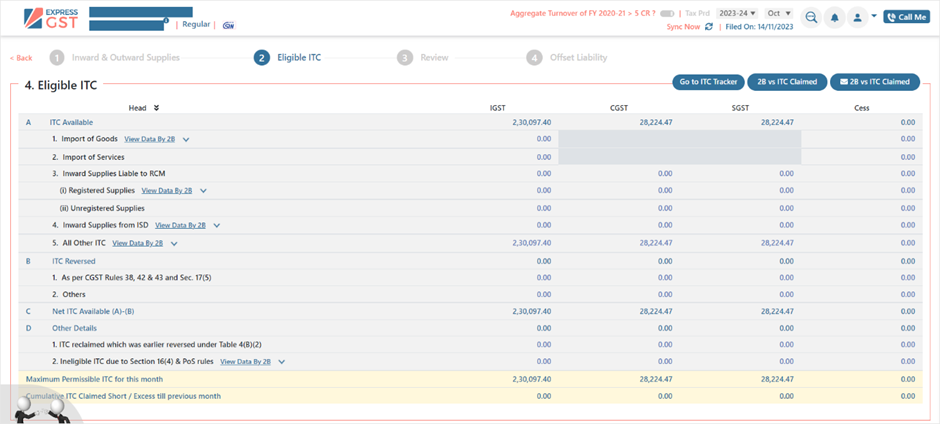

- Under 3B return window

- Select Eligible ITC

- Go to ITC tracker.

Step 3

Click on Set Auto ITC Claim Status which divides all invoices from books and 2B under 6 status: Accepted books, Accepted 2B, Pending, Action Require, Rejected and New Value

- The reconciled data from GSTR 2B reconciliation giving Matched and partially matched status gets auto accepted giving status as Accepted Books/ Accepted 2B

- Those invoices not getting reconciled showing status as In books only and In 2B only gets marked under Action required and Pending status respectively

- Some invoices get marked under Rejected status where

- POS wrongly entered by supplier in his GSTR1

- Return filed after cutoff date

- In books data ITC selected as ineligible

- Other than the above status, you can split ITC a per its eligibility by using New Value option which accepts only that part of ITC whose value has been newly added.

Step 4

Apart from Invoice wise ITC claim, you can also check View party Wise ITC claimed showing Total books document, Total 2B documents, Total pending and No Action taken and also gives the ITC difference as per Books and 2B and Total ITC claimed.

Step 5

This ITC tracker report can be downloaded into excel using the Email Icon on the right-hand side window which gives complete supplier wise and invoice wise 2b Reco report with ITC claimed status on each invoice with the remarks already added in the remarks flag on left hand side of the window.

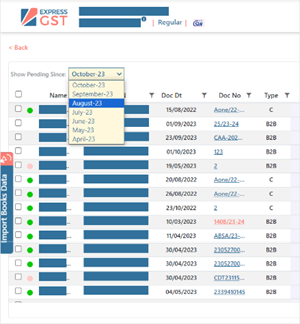

Note: Invoices that are marked pending, can be accessed in the future periods, by using Show Pending Since filter. However, those in the Action Required cannot be accessed in the future periods.

Note: Invoices that are marked pending, can be accessed in the future periods, by using Show Pending Since filter. However, those in the Action Required cannot be accessed in the future periods.