Process to File 10 B Audit Report

Table of contents

- Step 1 : Open the Income Tax Auditor Software and Go to Master → Consultant information option given in the menu bar

- Step 2 : Go to Transactions → Auditor Information option given in menu bar

- Step 3 : Go to Form → Form 10B

- Step 4 : Similarly as per the selection, other details are also required to be punched and saved on every page.

- Step 5 : Finally, once all details are filled , click on “E-Filing” option and generate the XML file for form 10B

- Step 6: To upload form 10B Audit Report, click on “Submit” Button

In the case of charitable or religious trusts or institutions, the 10B Audit report under section 12A(b) of the Income-tax Act,1961 is filed. To Prepare Form 10B,

Please follow the steps provided below:-

- Add Consultant detail – The person, who signs the audit report, shall indicate reference of his membership number/ certificate of practice number/ authority under which he is entitled to sign this report

- Select Auditor detail.

- Generate XML form 10B

- Upload XML form 10B

Step 1 : Open the Income Tax Auditor Software and Go to Master → Consultant information option given in the menu bar

- Provide all the basic details:

- Membership Number,

- Enrolment date as CA,

- Name (Surname, First Name and middle name),

- Date of Birth,

- PAN

- E-mail ID

- Address

- Now click on “save” button

Step 2 : Go to Transactions → Auditor Information option given in menu bar

- Select “Other Audit Report Detail”

- Enter Auditor Information.

- Name of the Auditor Firm (Individual/ Firm as the case may be).

- Date of Audit Report.

- Name, and Membership Number of the Auditor.

Step 3 : Go to Form → Form 10B

- Click on Next and Save option, after filling in the required fields.

If yes is selected, in any of the below line items, then the user is required to further click on browse button and enter the data relevant to the section mentioned in that particular line item, in the window that appears next. It is to be noted that the data should be entered in the relevant section only. The section would then be automatically fetched from the input made and be visible in the field next to the yes option selection.

Step 4 : Similarly as per the selection, other details are also required to be punched and saved on every page.

Step 5 : Finally, once all details are filled , click on “E-Filing” option and generate the XML file for form 10B

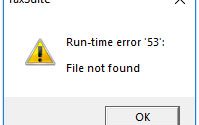

- After successfully generating the return, click on Upload XML option.

- Select Auditor firm detail from the drop down list and fill in the login id and password.

- To Generate Signature File for Digitally signed XML file, Click on DSC Management Utility

- Select signature and click on generate signature file option

Step 6: To upload form 10B Audit Report, click on “Submit” Button

Software will upload the XML file and digital signature file on incometaxindiaefiling.gov.in and confirmation will be received after Form 10B is filed successfully.