Process to File 10BB using ZEN IT Auditor

Table of contents

What is form 10BB?

Form 10BB is an audit report under section 10(23C) of the Income-Tax Act, 1961, in the case of any fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) of section 10(23C).

How to file Form 10BB using ZEN IT Auditor?

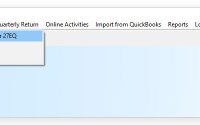

- Open Income Tax Auditor , Go to → Forms → Form 10BB

- The selection of sub-clause of section 10(23C) under which trust or any institute is seeking exemption, would appear in the drop down list by following the below mentioned path –

“Transaction →General Information → page 5 → point 24 →sub section, clause, sub clause”.

Then go to Transaction → General Information → page 5 → point 24 → sub section, clause, sub clause. Select the sub-clause as 10(23C).

Note:- The details will be active only when the square box is check marked.

Once these details are entered, the drop down list would appear for selection of the sub-clause.

- Once the Section 10 (23C) is available under the drop down list, select the section and click on Add button.

Note: The “Date of Report”, can be fetched by following this path- Transactions→ Auditor information → Other Audit Report Details. In case there is any change made in the Date of report for the above said path, the Update Date option available on Form 10BB would update the same with an updated date.

- To Proceed filing Form 10BB , all the general details will get auto populated from the client Master. Once the details are confirmed as per the requirement , Click on Next and proceed to the next page.

- Feed the required data from Point (7) to point (19) and Save the details.

Note: The Report for Form 10BB can be generated by using the Report option and the same can be printed in Word or PDF format

- The XML file can be generated by using E- Filing option. Once the XML file is generated successfully, upload the XMLto upload the file online.

Select the Auditor’s detail and generate the Signature file from “DSC Management utility”. Upload the form by clicking on Submit button.

NOTE: Auditor’s details can be listed from “Master”→ “Consultant Information“