March 9, 2022

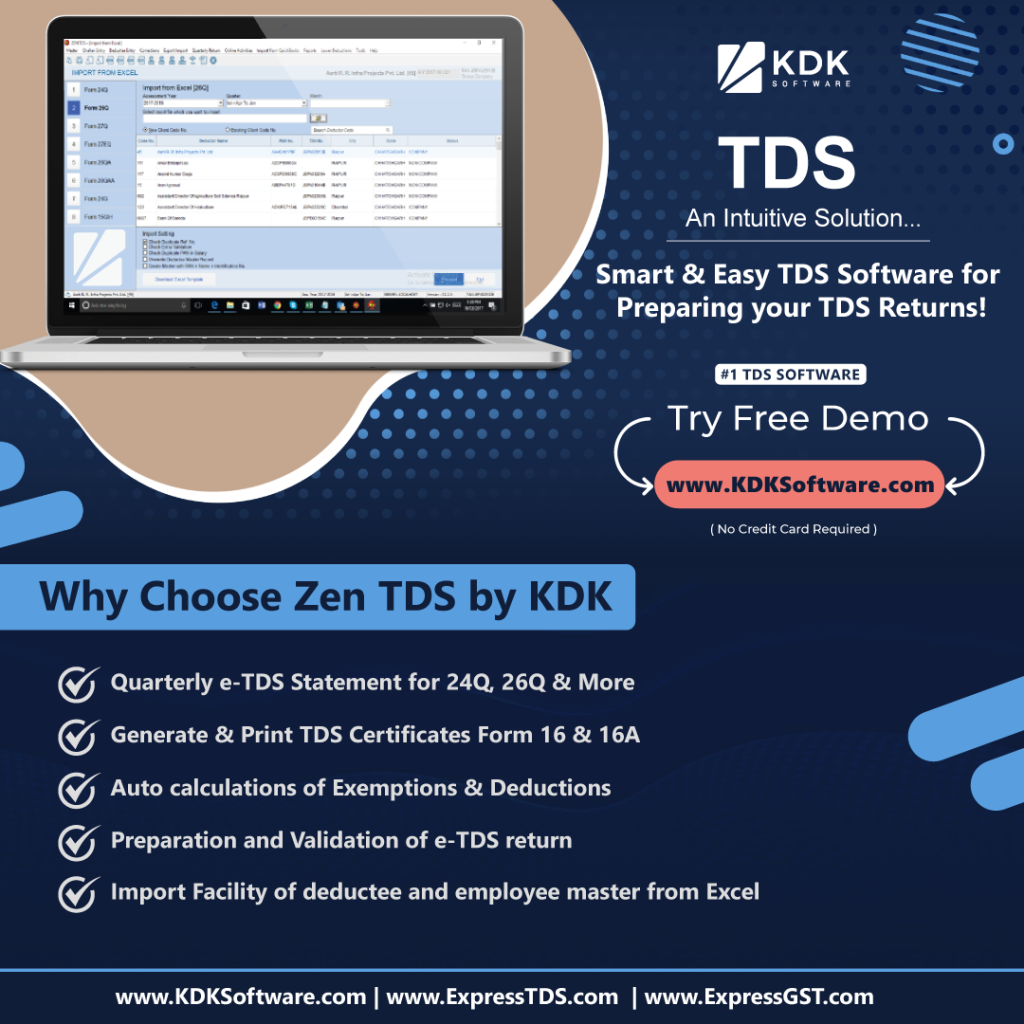

Smart & Easy TDS Software for Preparing your TDS Returns!

KDK TDS is the #1 TDS Software for All TDS-related compliance. KDK TDS Software is used widely by Tax Professionals, Tax Practitioners, SMEs & Corporates and is considered the best software for TDS Filing. Zen TDS by KDK covers all TDS compliance work.

Zen Corporate TDS Features

Features

- Preparation and Validation of e-TDS return file.

- Users can Generate Forms 24G, 24Q, 26Q, 26QA, 26QAA, 27A, 27B, 27Q, 27EQ, 15G/H, 16, 16A, 27D, 49B by giving Single Input (with correction statement).

- Facilitates record keeping and error tracking of returns through the preparation of multiple correction statements.

- Identification of the wrong PAN – This helps to identify a wrong PAN report and correct it accordingly.

- File Viewer Facility to view FVU files as per the format prescribed by the NSDL.

- Import Challan from Govt Portal (OLTAS & Traces)

- Online Payment option available

- Salary display computation of total income and tax calculation thereon.

- Challans wise Details, Certificate Issue Register, List of Clients not having PAN and address.

- Salary Summary Annual Gross (Display the Gross Amount and Exempted Amount separately), Annual Net (Display the Final Taxable Amount), and Monthly Salary Summary (Display the Monthly Salary Paid)

- Online TAN Registration.

- e-Filing of Return (Auto downloads of CSI File from the NSDL Site, Error Locator – e-file error locator redirects you to the point of initiation of error, Auto Generation of Form No. 27A with control report.

- List of All India Bank Branches Codes Available.

- Facility to calculate the amount of Monthly TDS to be deducted.

- Real-Time Validation Facility – A tripwire in the software to identify errors and notify the user during the e-Filing process.

- Challan Verification – This facility verifies the authenticity and correctness of the challan from the CSI File.

- Option to file NIL Declaration return.

- Bulk Mail of e-TDS Certificates.

- Merge, Email and Download Form 16 Part A & Part B.

- Request and download / from 16/16A/27D/ Conso file/ justification report.

Import/Export Facility

- Import Facility – Zen TDS facilitates importing data of deductee and employee master and deductee entries from Excel Sheets / FVU / NSDL-TDS File.

- Facilitates importing deductee entries from Text files generated by all major banking software e.g. Finacle etc.

- Export Facility – Zen TDS facilitates exporting of data and grids into Excel templates.

MIS Reports

- Various Master Reports – Deductor Master / Deductee Master / Employee Master Reports.

- Salary Report – Reports on Monthly TDS Deducted, Monthly TDS to be Deducted, Gross Salary Summary, and Net Salary Summary.

- Challan Report – Reports on Challan Status, Deductee wise Challan report.

- Return Status Report – The user is facilitated by the status report of Filed and Pending Returns.

- Statement Analysis Report – Identification of all the possible defaults on an excel sheet for a particular quarter with a single click.

- 3CD Annexure Reports

Online Features

- New Deductor Registration on Income Tax Website.

- Facility to upload TDS statements.

- Online TAN/AIN Registration – Information is automatically filled up in the online registration form on the Traces website using the software’s master database.

- Online Verification Single / Multiple Challan – This facility checks the correctness of the challan from the NSDL Website.

- Online Bulk PAN Verification – This facility checks the correctness of the PAN from the Traces Website.

Express TDS Software for CA Firms & Enterprises

Cloud TDS :Prepares TDS Returns 2X Faster