Saving Smarter: A Complete Overview of Income Tax Deductions for FY 2023–24 (AY 2024–25)

Tax planning is a crucial aspect of personal finance, and one of the most effective ways to reduce your overall tax liability is by taking advantage of income tax deductions. As the financial year 2023-24 approaches, it’s important to familiarize yourself with the various deductions available to you for the assessment year 2024-25. In this blog post, we’ll provide a comprehensive overview of income tax deductions for the upcoming financial year, equipping you with the knowledge to save smarter.

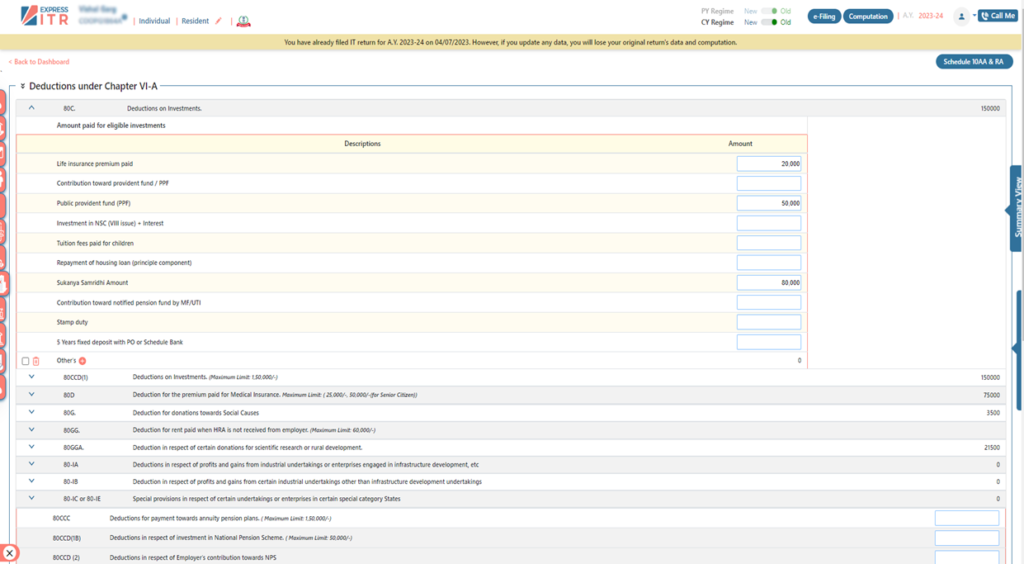

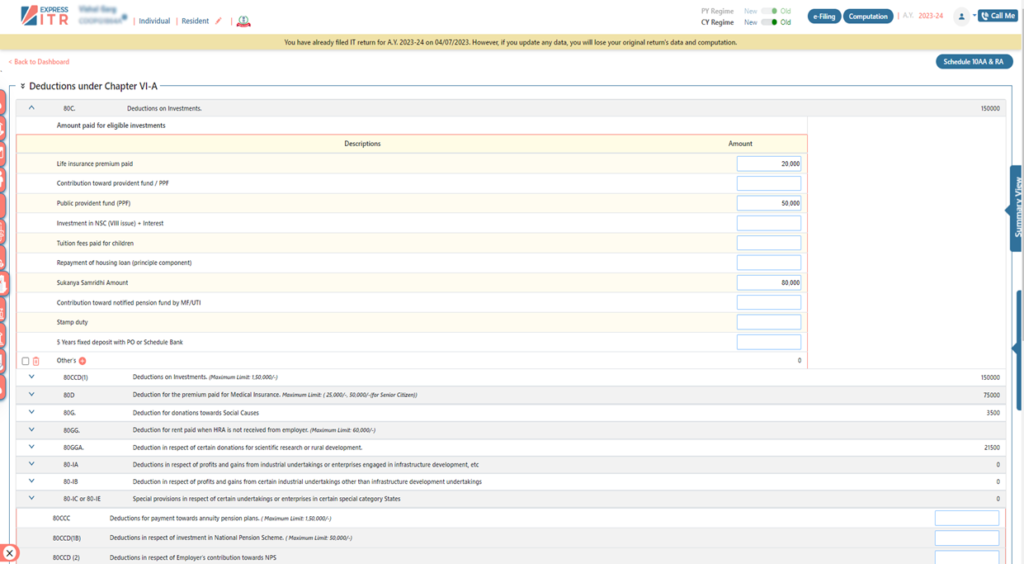

80C

Deductions on Investments

- Section 80C provides deductions for particular investments and expenses, helping taxpayers reduce their taxable income.

- The maximum deduction allowed under Section 80C is Rs. 1.5 lakh for the financial year.

- Both individuals and Hindu Undivided Families (HUFs) can claim deductions under Section 80C.

- Various investments and expenses qualify for deduction under Section 80C, including:

- Life Insurance Premium Paid

- Contribution Toward provident fund/PPF

- Public provident fund (PPF)

- Investment in NSC (VIII issue) + Interest

- Tuition fees are paid for children.

- Repayment of housing loan (Principal component)

- Sukanya Samriddhi Account

- Contribution toward notified pension fund by MF/UTI

- Stamp duty

- 5 Years Fixed deposit with PO or Schedule Bank

- Senior Citizen Saving Scheme (SCSS)

Express ITR helps you in providing facility for auto calculation to claim deduction as per Income tax Act rules. If the entered amount is more than the applicable limit, ExpressITR will not accept the value and will guide the user.

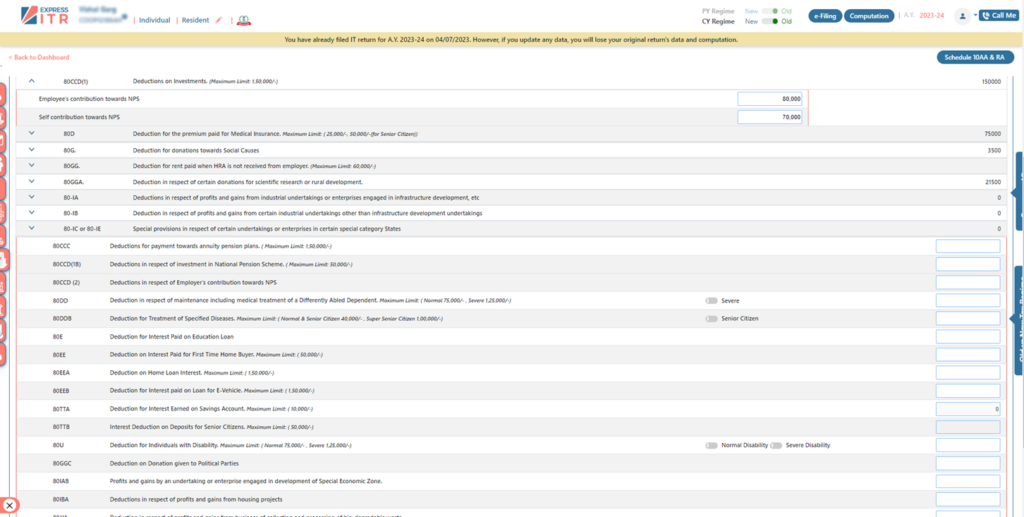

80CCD

Deduction of Investments

- Section 80CCD (1) primarily deals with deductions related to the employee’s contribution to the NPS. Both salaried and self-employed individuals can claim this deduction.

- The maximum deduction allowed under Section 80CCD (1) is 10% of the individual’s salary (for salaried individuals) or 10% of the individual’s gross total income (for self-employed individuals).

- The deduction under Section 80CCD (1) is over and above the limit of Rs.1.5 lakh provided under Section 80C. This means that an individual can claim deductions under both Section 80CCD (1) and Section 80C.

- The deduction under Section 80CCD (1) is only for the contribution made by the individual employee.

Express ITR Software provides automatic calculation to users and as per income tax rules, the maximum and minimum eligibility limit is already given in ExpressITR

80D

Deduction for the premium Paid for Medical Insurance

- Section 80D provides deductions for premiums paid towards health insurance policies.

- Both individuals and Hindu Undivided Families (HUFs) can claim deductions under Section 80D.

- The maximum deduction allowed under Section 80D depends on the type of health insurance and the individuals covered.

- For the Normal person, Maximum amount of limit is Rs. 25,000/- and For the Senior citizen, the limit is Rs. 50,000/-

- An additional deduction of up to Rs. 5,000/- is allowed for expenses on health checkups for the taxpayer, family, and parents.

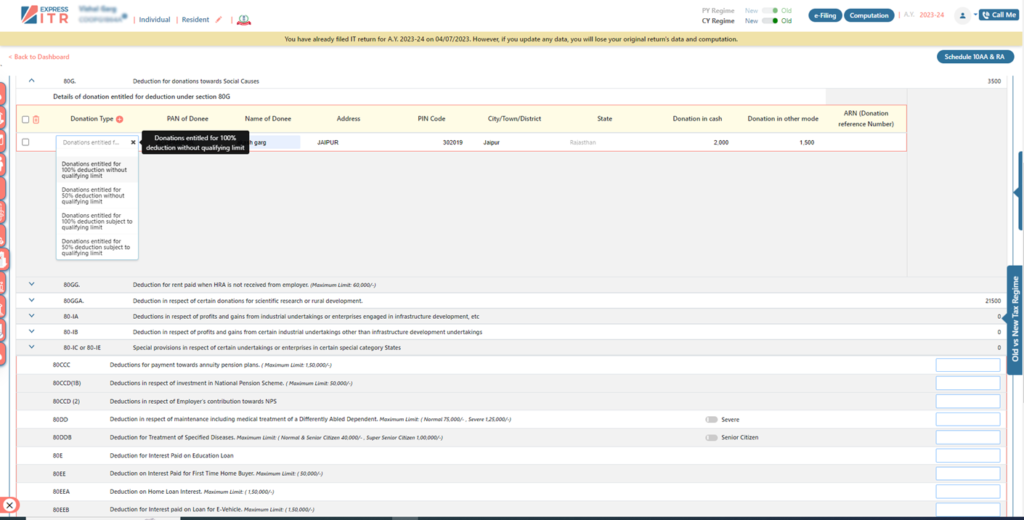

80G

Deduction for donations towards Social Causes

- Section 80G provides deductions for donations made to specified charitable institutions and funds.

- Deductions under Section 80G are available for donations made to specified funds and charitable institutions.

- The deduction contains, to a limit, 10% of the taxpayer’s adjusted gross total income.

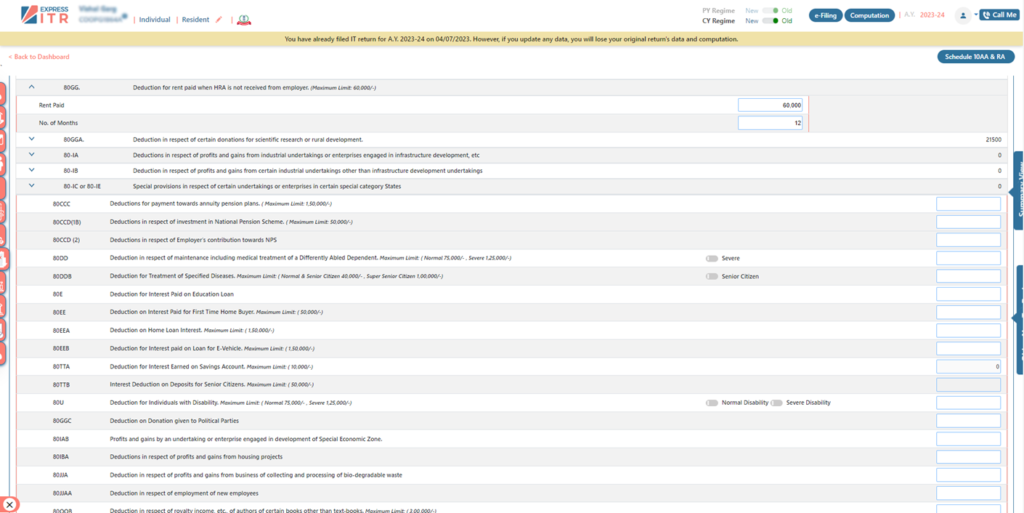

80GG

Deduction for rent paid when HRA is not received from employer

- Section 80GG provides deductions for individuals who do not receive House Rent Allowance (HRA) and pay rent for their residential accommodation.

- Individuals who do not receive HRA as part of their salary or do not own a residential property in the location where they work or reside are eligible for deductions under Section 80GG.

- The deduction allowed under Section 80GG is the least of the following three amounts:

- Rent paid -10% of total income.

- 25% of total income.

- Rs. 5,000 per month.

- To claim the deduction, the taxpayer needs to submit a declaration in Form 10BA along with their income tax return.

- If the taxpayer’s spouse owns a residential property at the place of employment or residence, the taxpayer is not eligible for the deduction under Section 80GG.

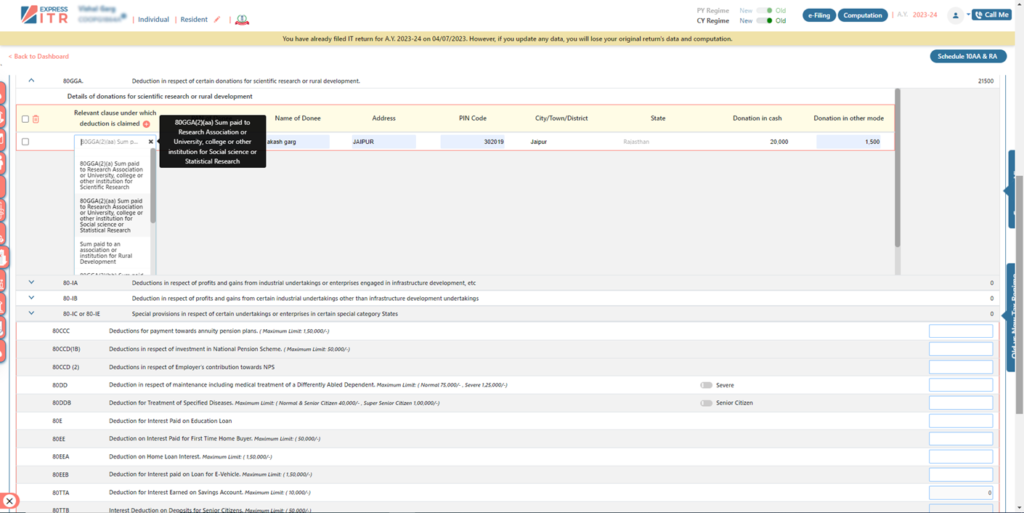

80GGA

Deduction in respect of certain donations for scientific research or rural development

- Section 80GGA provides deductions for donations made to specified scientific research or rural development projects.

- Deductions under Section 80GGA are available for donations made by taxpayers (including individuals, HUFs, and non-corporate taxpayers) to specified entities engaged in scientific research or rural development.

- The total amount of the donation made to eligible entities under Section 80GGA qualifies for deduction. In other sections where there may be a limit expressed as a percentage of the donated amount, Section 80GGA allows the full amount of the donation to be deducted from the taxable income.

- To claim the deduction under Section 80GGA, the taxpayer is required to submit a Form 58 along with the income tax return.

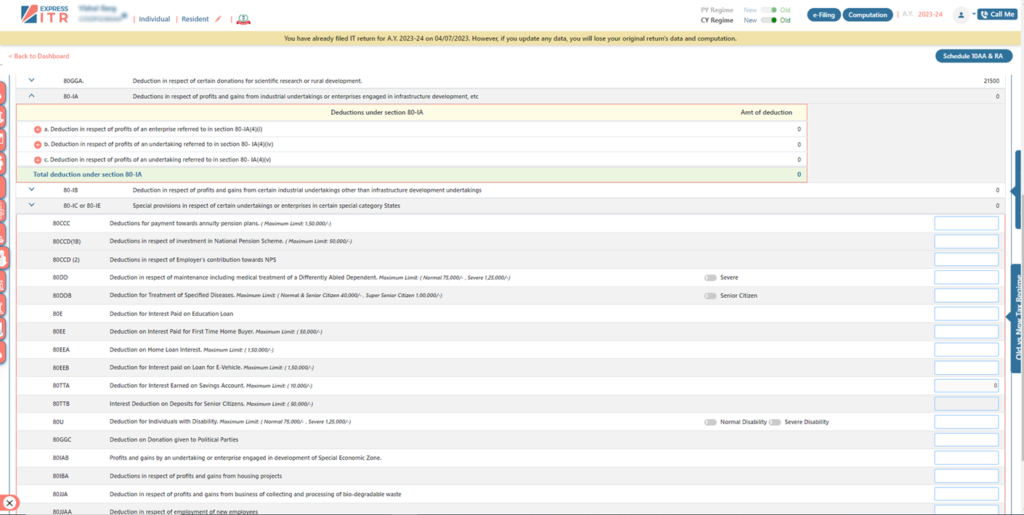

80-IA

Deduction in respect of profits and gains from industrial undertakings or enterprises engaged in infrastructure development, etc.

- Section 80-IA provides deductions for profits derived from eligible businesses which are related to infrastructure and industrial activities.

- Section 80-IA provides deductions for profits and gains derived by an undertaking or an enterprise engaged in certain eligible businesses.

- The deduction under Section 80-IA is granted as a percentage of the profits and gains from the eligible business. The deduction aims to encourage and promote investment in certain sectors for economic development.

- To claim the deduction, the taxpayer should fulfil certain conditions, including compliance with statutory requirements and specific criteria for each eligible business.

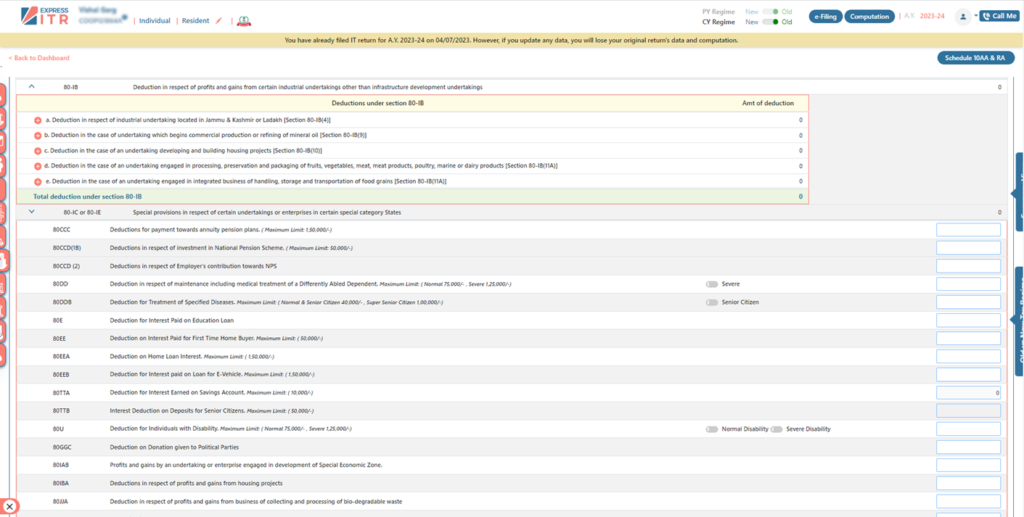

80IB

Deduction in respect of profits and gains from certain industrial undertakings other than infrastructure development undertakings

- Section 80-IB provides deductions for profits from certain businesses, mainly focused on industrial and housing development.

- Section 80-IB provides deductions for profits and gains derived from specified businesses, including industrial undertakings and housing projects. The objective is to encourage investment and development in these sectors.

- The deduction under Section 80-IB is allowed as a percentage of the profits and gains derived from eligible businesses. The intention is to promote industrialization and housing development.

80CCC

Deduction of payments towards annuity pension Plans

- Section 80CCC allows deductions for contributions made to pension plans of life insurance companies. These contributions are towards annuity policies that provide a regular income after retirement.

- The deduction under Section 80CCC is part of the overall limit of Rs.1.5 lakh available under Section 80C. This means that the total deduction allowed for contributions to Section 80C, 80CCC, and 80CCD (combined) cannot exceed Rs.1.5 lakh in a financial year.

- To claim the deduction under Section 80CCC, the taxpayer needs to declare the amount contributed to the pension plan in the income tax return form. It is important to keep records of premium payment receipts and policy details for verification purposes.

80CCD (1B)

Deduction in respect of investment in the National pension Scheme

- Section 80CCD (1B) provides deductions for contributions made to the National Pension System (NPS).

- Section 80CCD(1B) allows an individual taxpayer to claim an additional deduction on contributions made to the National Pension System (NPS) over and above the limits specified under Section 80C and Section 80CCD(1).

- The maximum additional deduction allowed under Section 80CCD(1B) is Rs. 50,000. This means that a taxpayer can claim an additional deduction of up to Rs. 50,000 over and above the deductions available under Section 80C and Section 80CCD(1).

- To claim the additional deduction under Section 80CCD(1B), taxpayers need to declare the amount contributed to the NPS in the income tax return form.

80CCD (2)

Deduction in respect of Employer’s contribution towards NPS

- Section 80CCD(2) provides deductions for contributions made by the employer to an employee’s National Pension System (NPS) account.

- The maximum deduction allowed under Section 80CCD(2) is 10% of the individual’s salary (basic salary + dearness allowance) or 20% of gross total income in the case of self-employed individuals. This is over and above the deduction limit of Rs. 1.5 lakh available under Section 80C and Section 80CCD(1).

- The employee’s own contribution (which is Restricted at 10% of salary), there is no upper limit on the employer’s contribution to the NPS account. However, the deduction is limited to the prescribed percentage of the salary.

- To claim this deduction, the individual should ensure that the employer contributes to the NPS on their behalf.

80DD

Deduction in respect of maintenance including medical treatment of a Differently abled dependent

- Section 80DD provides a deduction to individuals who incur expenses for the maintenance and medical treatment of a dependent person with a disability. The dependent may be a spouse, children, and parents.

- To claim the deduction under 80DD, the taxpayer must furnish a medical certificate issued by an approved medical authority.

- The maximum deduction allowed under Section 80DD is Rs. 75,000/- for the Normal. If the disability is severe (80% or more), the maximum deduction is higher, restricted at Rs. 1,25,000/-. This deduction is available for each dependent with a disability.

- The deduction covers expenses incurred on medical treatment, nursing, training, and any other expenditure directly related to the care of the dependent with a disability.

- To claim this deduction, the taxpayer needs to submit the medical certificate along with the income tax return. The certificate should be renewed periodically, usually every year.

80DDB

Deduction for treatment of specified Diseases

- Section 80DDB provides a deduction to individuals for expenses incurred on the treatment of specified critical illnesses for themselves or their dependents.

- The deduction is available for specified diseases like neurological diseases, malignant cancers, AIDS, chronic renal failure, and hematological disorders.

- As per the Express Gst Software the maximum deduction allowed under Section 80DDB is Rs. 40,000/- for individuals below 60 years of age. For senior citizens (aged 60 years or above), the limit is Rs. 1,00,000/-.

- To claim this deduction, the taxpayer needs to obtain a medical certificate from a specialist doctor working in a government hospital.

80E

Deduction on Interest paid on Education Loan

- Section 80E provides a deduction for the interest paid on loans taken for higher education. This deduction is available to individuals who have taken loans for themselves, their spouse, or their children’s education.

- The deduction is applicable to loans taken from any financial institution or approved charitable institution for the purpose of pursuing higher education in India or abroad.

- The deduction is available for a maximum of eight assessment years, starting from the year in which the individual starts repaying the loan or until the interest on the loan is fully repaid.

- The entire interest paid on the education loan during the applicable period is eligible for deduction under Section 80E. There is no upper limit on the amount of interest that can be claimed as a deduction.

- To claim this deduction, the taxpayer needs to obtain a certificate from the financial institution or bank providing the loan.

80EE

Deduction on Interest paid for First time home Buyer

- Section 80EE provides a deduction on interest paid on loans taken for the purchase of a residential property. This deduction is available to first-time homebuyers.

- To claim the deduction under Section 80EE, the individual must be a first-time homebuyer, and the loan must be sanctioned by a financial institution or a housing finance company. Additionally, the loan amount should not exceed Rs. 35 lakhs, and the value of the residential property should not exceed Rs. 50 lakhs.

- The maximum deduction allowed under Section 80EE is Rs. 50,000/- per financial year.

- The deduction is available for interest payments made during the financial year in which the loan is sanctioned.

80EEA

Deduction on Home Loan Interest

- Section 80 EEA promotes affordable housing by providing tax benefits to first-time homebuyers.

- To avail of this deduction, the taxpayer must be a first-time homebuyer, and the loan should be sanctioned between April 1, 2019, and March 31, 2022.

- The maximum deduction allowed under 80 EEA is Rs. 1.5 lakh per financial year.

- The home loan amount for which the deduction is claimed should not exceed Rs. 45 lakh, and the value of the residential house should not exceed Rs. 50 lakh.

80EEB

Deduction For interest paid on Loan for E-Vehicle

- Section 80 EEB provides a deduction on interest paid on loans taken for the purchase of electric vehicles (EV) to promote the adoption of eco-friendly transportation.

- The maximum deduction allowed under 80 EEB is Rs. 1.5 lakh per financial year.

- The loan taken for the purchase of the electric vehicle should not exceed Rs. 1.5 lakh, and the value of the electric vehicle should not exceed Rs. 45 lakh.

80TTA

Deduction for interest Earned on Savings Account

- Section 80TTA provides a deduction on interest income earned from savings accounts.

- The maximum deduction allowed under 80TTA is Rs. 10,000/-per financial year. This deduction is applicable to the interest earned on savings accounts with banks, cooperative banks, and post offices.

- The deduction is applicable to interest earned on savings accounts, but not on fixed deposits, recurring deposits, or any other time deposits.

80TTB

Interest deduction on deposits for Senior Citizens

- Section 80 TTB provides a deduction on interest income for senior citizens (aged 60 years and above) to reduce the burden on the interest earnings.

- The maximum deduction allowed under 80 TTB is Rs. 50,000/-per financial year. This deduction is applicable to interest income earned from deposits with banks, cooperative banks, and post offices.

- The deduction is available to individual senior citizens, including resident and non-resident senior citizens.

80U

Deduction for Individuals with disability

- Section 80U provides a deduction to individuals with disabilities to ease their financial burden.

- To be eligible, the individual must be certified as a person with a disability under the Persons with Disabilities.

- The deduction under 80U is a fixed amount. In January 2022, the deduction is Rs. 75,000/- for a disability and Rs. 1,25,000/- for severe disability.

- To claim the deduction, the individual must have a disability certificate from a medical authority.

80GGC

Deduction of Donation given to political parties

- Section 80GGC provides a deduction for contributions made to political parties to encourage transparency and financial support to political organisations.

- The entire amount contributed to a political party is eligible for deduction under Section 80GGC. There is no specific limit on the deduction.

- The contribution can be made in any form, including cash, cheque, draft, or other modes.

80IAB

Profits and gains by an undertaking or enterprises engaged in development of special Economic Zone

- Section 80IAB provides a deduction for profits and gains derived by an undertaking or enterprise engaged in the business of developing, maintaining, and operating an Infrastructure Facility.

- The deduction is available to an undertaking that operates and maintains a specified infrastructure facility, which includes roads, highways, bridges, airports, ports, railways, or any other public facility.

- The deduction is 100% of the profits and gains from the eligible infrastructure facility for the starting five years. For the remaining five years the deduction is 30% of the profits and gains.

80IBA

Deductions in respect of profits and gains from housing projects

- Section 80IBA provides a deduction for profits and gains derived by a taxpayer engaged in the development and construction of housing projects.

- The deduction is 100% of the profits and gains derived from the affordable housing project.

- The housing project must be approved by the competent authority before a certain date. The approval is generally approved based on the fulfilment of specified conditions related to the size, cost, and location of the residential units.

80JJA

Deductions in respect of profits and gains from business and collecting and processing of biodegradable waste

- Section 80JJA provides a deduction for profits and gains derived by a taxpayer engaged in the business of collecting and processing of biodegradable waste.

- The deduction is available to a person carrying on the business of biodegradable waste collect and processing. This includes businesses involved in composting or generating power or electricity from biodegradable waste.

- The deduction is 100% of the profits and gains derived from the specified business. However, it is available for a specified period, usually five consecutive assessment years.

80JJAA

Deduction in respect of employment of new employees

- The deduction is available to Indian companies, resident Indian partnerships, or sole proprietorships employing persons with disabilities. The disability of the employee should be at least 40%.

- The deduction is 30% of the additional employee cost incurred by the employer, which includes the salary and wages paid to the new employee with a disability.

- To claim the deduction, the employer must employ the person with a disability for a minimum period of 240 days during the previous year.

80QQB

Deduction in respect of royalty income, etc., of authors of certain books other than text-books

- The deduction is available to resident individual authors, including co-authors, who receive royalty income from the sale of their books.

- The deduction is available on the gross income derived from the royalty of books. In January 2022, the deduction is allowed for 50% of the gross royalty income.

- To claim the deduction, the total royalty income should not exceed Rs. 3 Lakh in the previous year.

- The income must be disclosed under the head “Income from Other Sources” in the income tax return.

80RRB

Deduction in respect of royalty on patients

- The deduction is available to resident individuals who are the registered owners of a patent granted under the Patents Act, 1970, the taxpayer must receive a royalty for a patent registered under the Patent Act after 31st march 2003.

- In January 2022, the deduction is available for a sum equal to the whole of the income received by the taxpayer in the previous year for the patented invention.

- To claim the deduction, the total royalty income should not exceed Rs. 3 Lakh in the previous year.

- The deduction is available for a maximum of five assessment years beginning from the year in which the patent is registered.

80ID

Deduction in respect of profits and gains from business of hotels and convention centres in specified area

- The deduction is available to the developer of an industrial park that has been approved by the Board or a government authority.

- The deduction is 100% of the profits and gains derived from the industrial park for a specified period. The deduction is generally available for ten assessment years.

- The conditions specified under Section 80ID, including the size, location, and facilities provided by the industrial park.

80CCH

Deduction in respect of contribution to Agnipath Scheme

- The Ministry of Defense has introduced the Agnipath Scheme, 14, June, 2022 for Agniveers in Indian Armed Forces.

- Individuals aged between 17.5 years to 21 years will be eligible to apply for it.

- A sum Receivable after completing their 4 year job tenure. Individuals must contribute 30% of their monthly earnings to the Agniveer corpus Fund.

- As per the Income Tax Department, the deduction will be equal to the contributions made to the Agniveer Corpus Fund.