Are you Ready to file your Return this Quarter?

As the due dates of TDS/TCS filing is fast approaching let’s discuss the filing procedure for all those who are new to the business or are recently joined executives. For all those people, who are running a small business or a startup; Jan 15 is the due date to file the quarterly TDS.

What is TDS Return?

Tax deducted at source (TDS), as the very name infers aims at collection of revenue at the very source of income. It is fundamentally a secondary method of collecting tax which combines the concepts of “pay as you earn” and “collect as it is being earned.” To the tax payer, it distributes the incidence of tax and provides for a simple and appropriate mode of payment.

Who are responsible to file the return?

The following people are required to file the e-TDS return every quarter

>Company

>Persons whose accounts are audited

>Government Employees

It is compulsory to file TDS within the given time period otherwise they are liable to pay penalty for non- submitting of return.

TDS Return Forms

| QTRs. | Due Dates |

| 1st Quarter | 15th July |

| 2nd Quarter | 15th October |

| 3rd Quarter | 15th January |

| 4th Quarter | 15 the May |

Process of filing e-TDS

Filing an e-TDS requires to generate a FVU (File Validation Utility) which is submitted for filing the return.

With KDK’s Zen TDS, the File Validation Utility is created, generated and validated at the same time. The Final generated FVU can be downloaded at the end of the process.

The FVU which is downloaded is then uploaded on the NSDL website for return filing.

To know the list of authorized TDS filing software click here.

What does Zen TDS provide?

Zen TDS provides you with the following features:

>Preparation and Validation of e TDS return file

>User can Generate Forms 24Q, 27EQ, 16, 16A, 16AA, 27A, 27B, 27D, ITR1 by giving Single Input (with correction statement)

>List of All India Bank Branches Codes Available

>Salary Calculation taking care of chapter VIA Deductions and Tax there on

>Facility to calculate amount of Monthly TDS to be deducted

>Text file / FVU file viewer

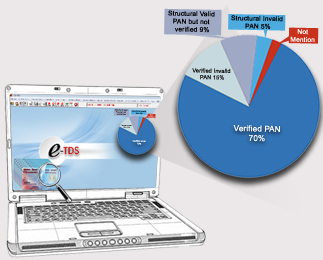

>Online TAN & PAN verification (To Know More about PAN Verification, Click here)

The return filing can also be done with our I-tds software which is cloud based and can be accessed anytime anywhere 24*7.

The software will save you from the errors and time required.

To know more about the software, request a Demo on info@kdksoftware.com

Great and Summarized Info related to TDS Retrun